Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Active Auto Inc. manufactures electronic components in the Vietnam. Active Auto Inc. sells 300 of Z-model electronic devices to a company in Malaysia.

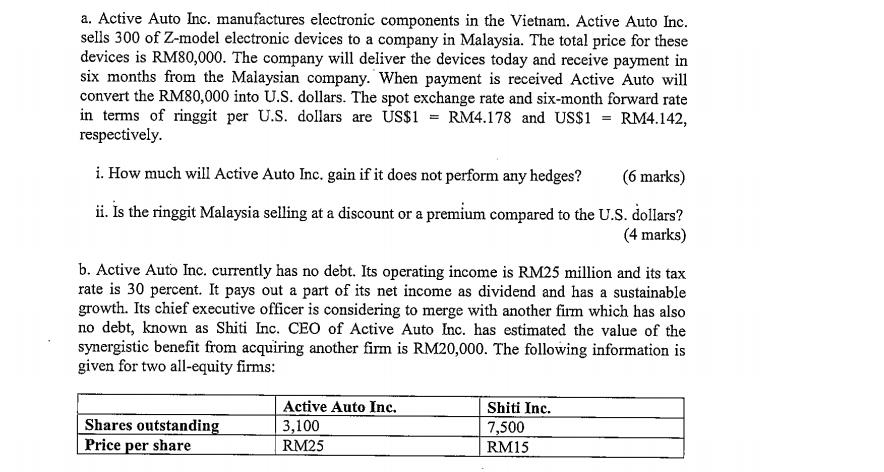

a. Active Auto Inc. manufactures electronic components in the Vietnam. Active Auto Inc. sells 300 of Z-model electronic devices to a company in Malaysia. The total price for these devices is RM80,000. The company will deliver the devices today and receive payment in six months from the Malaysian company. When payment is received Active Auto will convert the RM80,000 into U.S. dollars. The spot exchange rate and six-month forward rate in terms of ringgit per U.S. dollars are US$1 = RM4.178 and US$1 RM4.142, respectively. i. How much will Active Auto Inc. gain if it does not perform any hedges? (6 marks) ii. Is the ringgit Malaysia selling at a discount or a premium compared to the U.S. dollars? (4 marks) b. Active Auto Inc. currently has no debt. Its operating income is RM25 million and its tax rate is 30 percent. It pays out a part of its net income as dividend and has a sustainable growth. Its chief executive officer is considering to merge with another firm which has also no debt, known as Shiti Inc. CEO of Active Auto Inc. has estimated the value of the synergistic benefit from acquiring another firm is RM20,000. The following information is given for two all-equity firms: Shares outstanding Price per share Active Auto Inc. 3,100 RM25 Shiti Inc. 7,500 RM15 Shiti Inc. has given a condition that it would accept cash purchase offer at RM20 per share. i. Given the above scenario, should Active Auto Inc. proceed with the merger? (5 marks) c. In the coming top management committee meeting, Active Auto Inc.'s financial manager is asked to discuss the following: i. Explain briefly 'hazard risks', 'financial risks', 'operational risks' and 'strategic risks'. (8 marks) ii. What does beta indicate if its value less than 1 and greater than 1. (2 marks) (Total: 25 marks)

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Active Auto Inc Case Analysis a Currency Exchange and Hedging i Gain without Hedging 6 marks We cannot definitively determine the gain without hedging ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started