Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marry owns all the stock of Gold, Inc., a C corporation for which his adjusted basis is $225,000. Marry founded Gold 12 years ago.

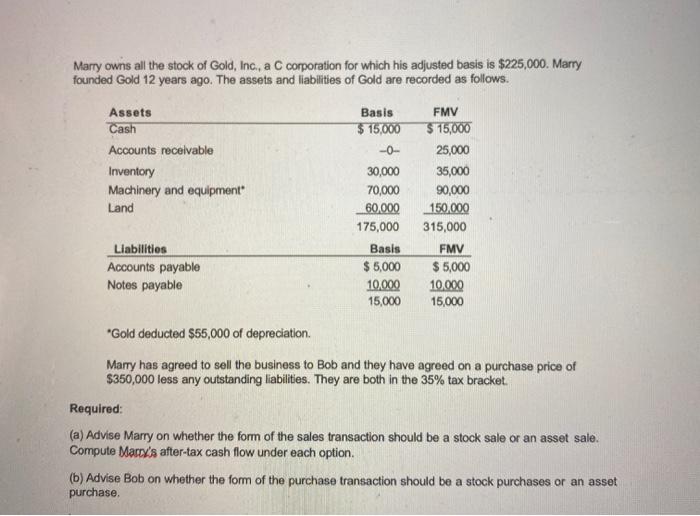

Marry owns all the stock of Gold, Inc., a C corporation for which his adjusted basis is $225,000. Marry founded Gold 12 years ago. The assets and liabilities of Gold are recorded as follows. Basis FMV Assets Cash $ 15,000 $ 15,000 Accounts receivable -0- 25,000 Inventory 30,000 35,000 Machinery and equipment" 70,000 90,000 Land 60,000 150,000 175,000 315,000 Liabilities Basis FMV Accounts payable $5,000 $ 5,000 Notes payable 10,000 10,000 15,000 15,000 *Gold deducted $55,000 of depreciation. Marry has agreed to sell the business to Bob and they have agreed on a purchase price of $350,000 less any outstanding liabilities. They are both in the 35% tax bracket. Required: (a) Advise Marry on whether the form of the sales transaction should be a stock sale or an asset sale. Compute Marry's after-tax cash flow under each option. (b) Advise Bob on whether the form of the purchase transaction should be a stock purchases or an asset purchase.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Stock Sale Marry would recognize a longterm capital gain of 125000 350000 225000 which would be ta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started