Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Advise Sue Tenner how best to treat the $100,000 contribution to the Tenner Superfund to maximise her tax deduction. b) Calculate the taxable income

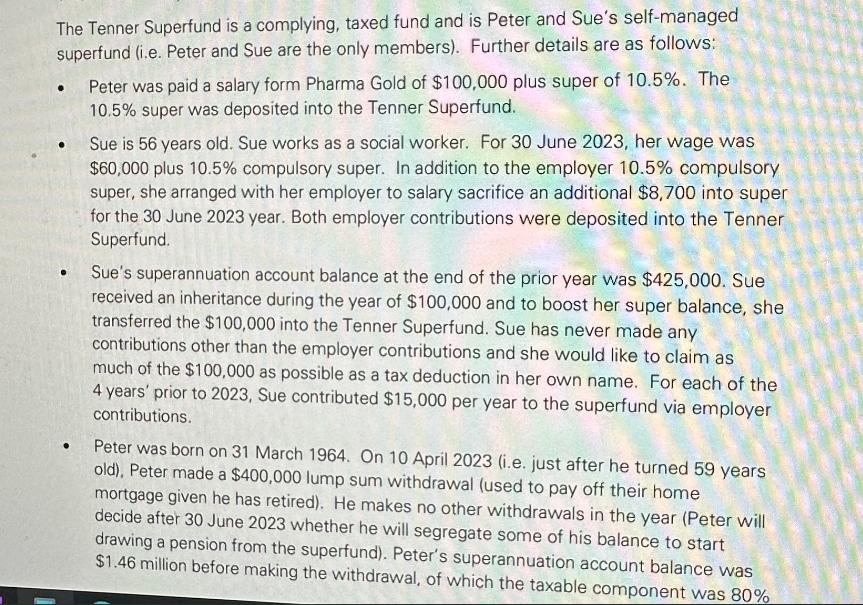

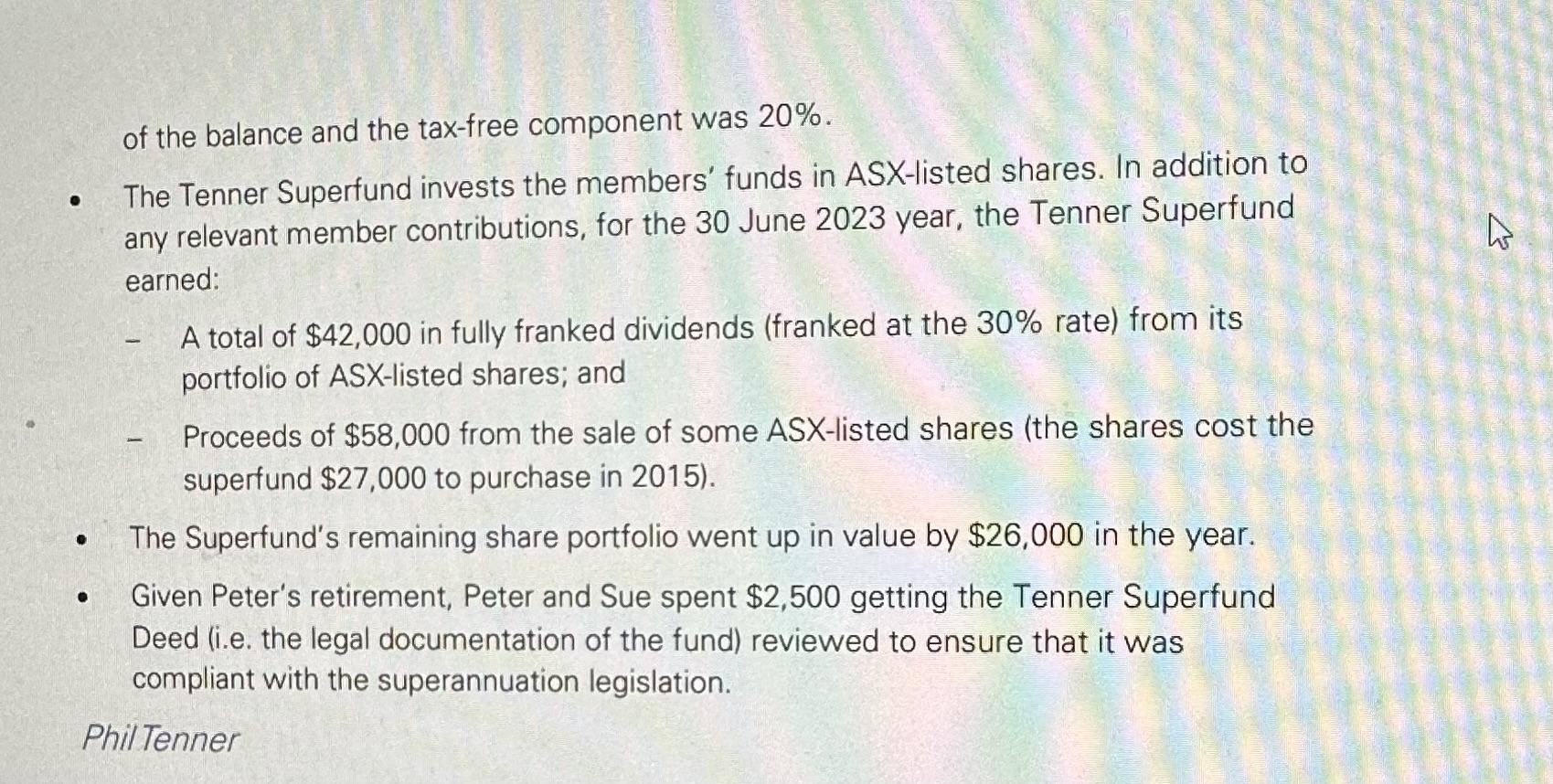

The Tenner Superfund is a complying, taxed fund and is Peter and Sue's self-managed superfund (i.e. Peter and Sue are the only members). Further details are as follows: Peter was paid a salary form Pharma Gold of $100,000 plus super of 10.5%. The 10.5% super was deposited into the Tenner Superfund. Sue is 56 years old. Sue works as a social worker. For 30 June 2023, her wage was $60,000 plus 10.5% compulsory super. In addition to the employer 10.5% compulsory super, she arranged with her employer to salary sacrifice an additional $8,700 into super for the 30 June 2023 year. Both employer contributions were deposited into the Tenner Superfund. Sue's superannuation account balance at the end of the prior year was $425,000. Sue received an inheritance during the year of $100,000 and to boost her super balance, she transferred the $100,000 into the Tenner Superfund. Sue has never made any contributions other than the employer contributions and she would like to claim as much of the $100,000 as possible as a tax deduction in her own name. For each of the 4 years' prior to 2023, Sue contributed $15,000 per year to the superfund via employer contributions. Peter was born on 31 March 1964. On 10 April 2023 (i.e. just after he turned 59 years old), Peter made a $400,000 lump sum withdrawal (used to pay off their home mortgage given he has retired). He makes no other withdrawals in the year (Peter will decide after 30 June 2023 whether he will segregate some of his balance to start drawing a pension from the superfund). Peter's superannuation account balance was $1.46 million before making the withdrawal, of which the taxable component was 80%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Advice for Sue Tenner To maximize Sues tax deduction for the 100000 contribution to the Tenner Superfund she should consider the following steps 1 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started