Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. After taking into account for *all relevant* expenses, calculate cash flow from the assets (CFFA) for every year. (3 points) b. Find UberZs capital

a. After taking into account for *all relevant* expenses, calculate cash flow from the assets (CFFA) for every year. (3 points)

b. Find UberZs capital structure weights. (4 points)

c. Find UberZs cost of equity using the capital asset pricing model (CAPM). (4 points)

d. Find UberZs cost of equity using the dividend growth model (DGM). (4 points)

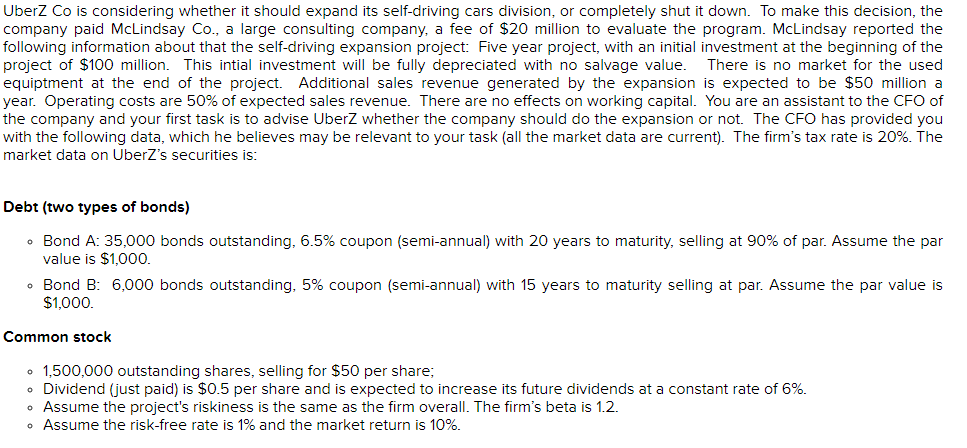

UberZ Co is considering whether it should expand its self-driving cars division, or completely shut it down. To make this decision, the company paid McLindsay Co., a large consulting company, a fee of $20 million to evaluate the program. McLindsay reported the following information about that the self-driving expansion project: Five year project, with an initial investment at the beginning of the project of $100 million. This intial investment will be fully depreciated with no salvage value. There is no market for the used equiptment at the end of the project. Additional sales revenue generated by the expansion is expected to be $50 million a year. Operating costs are 50% of expected sales revenue. There are no effects on working capital. You are an assistant to the CFO of the company and your first task is to advise UberZ whether the company should do the expansion or not. The CFO has provided you with the following data, which he believes may be relevant to your task (all the market data are current). The firm's tax rate is 20%. The market data on UberZ's securities is: Debt (two types of bonds) Bond A: 35,000 bonds outstanding, 6.5% coupon (semi-annual) with 20 years to maturity, selling at 90% of par. Assume the par value is $1,000. Bond B: 6,000 bonds outstanding, 5% coupon (semi-annual) with 15 years to maturity selling at par. Assume the par value is $1,000. Common stock . 1,500,000 outstanding shares, selling for $50 per share; Dividend (just paid) is $0.5 per share and is expected to increase its future dividends at a constant rate of 6%. Assume the project's riskiness is the same as the firm overall. The firm's beta is 1.2. . Assume the risk-free rate is 1% and the market return is 10%. UberZ Co is considering whether it should expand its self-driving cars division, or completely shut it down. To make this decision, the company paid McLindsay Co., a large consulting company, a fee of $20 million to evaluate the program. McLindsay reported the following information about that the self-driving expansion project: Five year project, with an initial investment at the beginning of the project of $100 million. This intial investment will be fully depreciated with no salvage value. There is no market for the used equiptment at the end of the project. Additional sales revenue generated by the expansion is expected to be $50 million a year. Operating costs are 50% of expected sales revenue. There are no effects on working capital. You are an assistant to the CFO of the company and your first task is to advise UberZ whether the company should do the expansion or not. The CFO has provided you with the following data, which he believes may be relevant to your task (all the market data are current). The firm's tax rate is 20%. The market data on UberZ's securities is: Debt (two types of bonds) Bond A: 35,000 bonds outstanding, 6.5% coupon (semi-annual) with 20 years to maturity, selling at 90% of par. Assume the par value is $1,000. Bond B: 6,000 bonds outstanding, 5% coupon (semi-annual) with 15 years to maturity selling at par. Assume the par value is $1,000. Common stock . 1,500,000 outstanding shares, selling for $50 per share; Dividend (just paid) is $0.5 per share and is expected to increase its future dividends at a constant rate of 6%. Assume the project's riskiness is the same as the firm overall. The firm's beta is 1.2. . Assume the risk-free rate is 1% and the market return is 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started