Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Amrita has been employed by Pax Ltd for many years. She received the following remuneration package in 2020/21: A salary of 18,000 (gross).

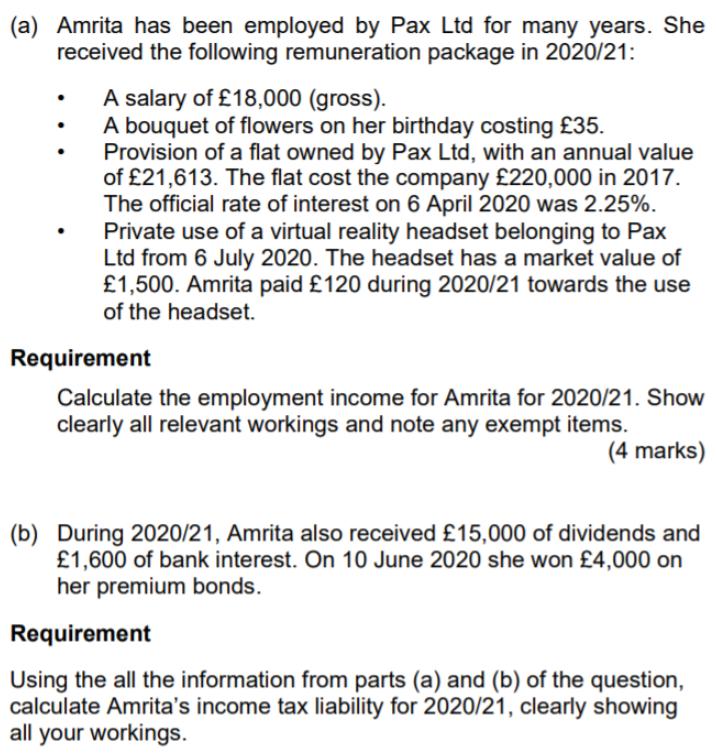

(a) Amrita has been employed by Pax Ltd for many years. She received the following remuneration package in 2020/21: A salary of 18,000 (gross). A bouquet of flowers on her birthday costing 35. Provision of a flat owned by Pax Ltd, with an annual value of 21,613. The flat cost the company 220,000 in 2017. The official rate of interest on 6 April 2020 was 2.25%. Private use of a virtual reality headset belonging to Pax Ltd from 6 July 2020. The headset has a market value of 1,500. Amrita paid 120 during 2020/21 towards the use of the headset. Requirement Calculate the employment income for Amrita for 2020/21. Show clearly all relevant workings and note any exempt items. (4 marks) (b) During 2020/21, Amrita also received 15,000 of dividends and 1,600 of bank interest. On 10 June 2020 she won 4,000 on her premium bonds. Requirement Using the all the information from parts (a) and (b) of the question, calculate Amrita's income tax liability for 2020/21, clearly showing all your workings.

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Date Page No Calculate the ermployment Intome f Ami ta Fur ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started