Answered step by step

Verified Expert Solution

Question

1 Approved Answer

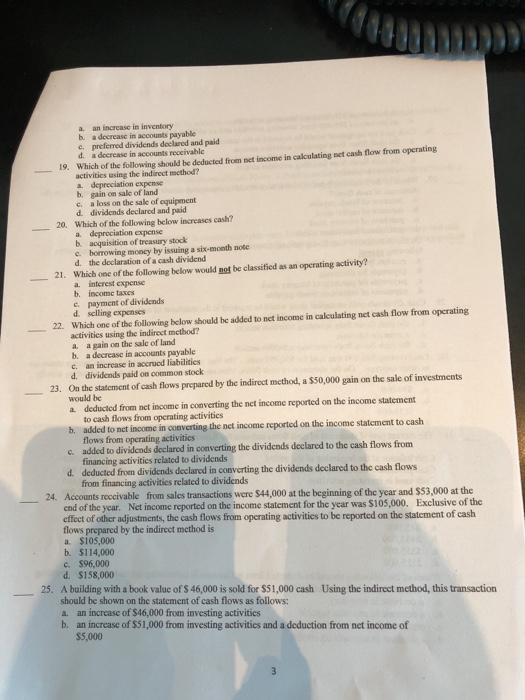

a. an increase in inventory b. a decrease in accounts payable c preferred dividends declared and paid d a decrease in accounts receivable 19. Which

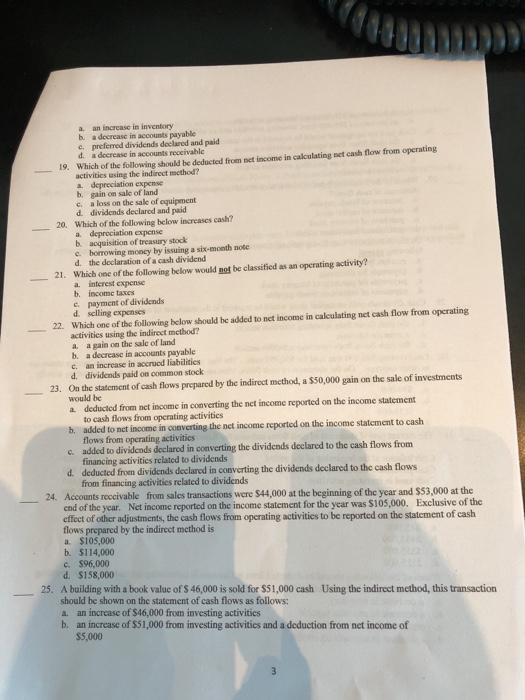

a. an increase in inventory b. a decrease in accounts payable c preferred dividends declared and paid d a decrease in accounts receivable 19. Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method? a depreciation expense b. gain on sale of land c a loss on the sale of equipment d dividends declared and paid 20. Which of the following below increases cash? a depreciation expense b. acquisition of treasury stock c. borrowing money by issuing a six-month note d. the declaration of a cash dividend 21. Which one of the following below would not be classified as an operating activity? a interest expense b. income taxes c. payment of dividends d selling expenses 22. Which one of the following below should be added to net income in calculating net cash flow from operating activities using the indirect method? a. again on the sale of land b. a decrease in accounts payable c. an increase in accrued liabilities d. dividends paid on common stock 23. On the statement of cash flows prepared by the indirect mcthod, a $50,000 gain on the sale of investments would be a deducted from nct income in converting the net income reported on the income statement to cash flows from operating activities b. added to net income in converting the net income reported on the income statement to cash flows from operating activities c added to dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends d. deducted from dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends 24. Accounts receivable from sales transactions were $44,000 at the beginning of the year and $53,000 at the end of the year. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method is a. S105,000 b. $114,000 c. 596,000 d. $158,000 A building with a book value of $ 46,000 is sold for $51,000 cash Using the indirect method, this transaction should be shown on the statement of cash flows as follows: a. an increase of $46,000 from investing activities b. an increase of $51,000 from investing activities and a deduction from net income of $5,000

a. an increase in inventory b. a decrease in accounts payable c preferred dividends declared and paid d a decrease in accounts receivable 19. Which of the following should be deducted from net income in calculating net cash flow from operating activities using the indirect method? a depreciation expense b. gain on sale of land c a loss on the sale of equipment d dividends declared and paid 20. Which of the following below increases cash? a depreciation expense b. acquisition of treasury stock c. borrowing money by issuing a six-month note d. the declaration of a cash dividend 21. Which one of the following below would not be classified as an operating activity? a interest expense b. income taxes c. payment of dividends d selling expenses 22. Which one of the following below should be added to net income in calculating net cash flow from operating activities using the indirect method? a. again on the sale of land b. a decrease in accounts payable c. an increase in accrued liabilities d. dividends paid on common stock 23. On the statement of cash flows prepared by the indirect mcthod, a $50,000 gain on the sale of investments would be a deducted from nct income in converting the net income reported on the income statement to cash flows from operating activities b. added to net income in converting the net income reported on the income statement to cash flows from operating activities c added to dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends d. deducted from dividends declared in converting the dividends declared to the cash flows from financing activities related to dividends 24. Accounts receivable from sales transactions were $44,000 at the beginning of the year and $53,000 at the end of the year. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method is a. S105,000 b. $114,000 c. 596,000 d. $158,000 A building with a book value of $ 46,000 is sold for $51,000 cash Using the indirect method, this transaction should be shown on the statement of cash flows as follows: a. an increase of $46,000 from investing activities b. an increase of $51,000 from investing activities and a deduction from net income of $5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started