Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) An investor is considering investing in a corporate bond, but the risk of default is not known. The following information is available to the

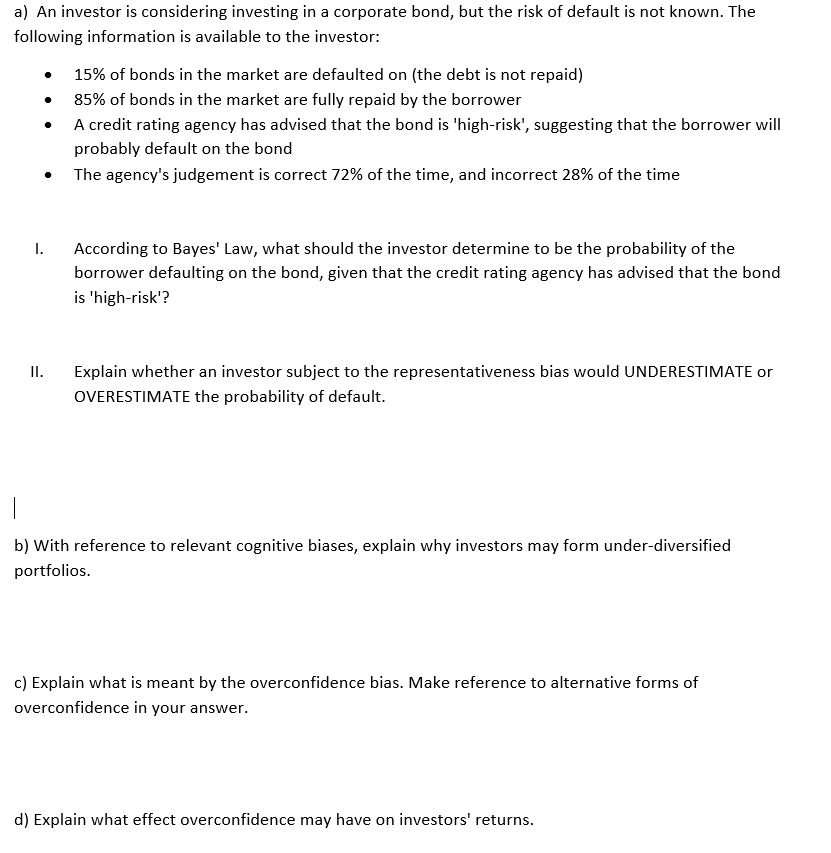

a) An investor is considering investing in a corporate bond, but the risk of default is not known. The following information is available to the investor: - 15% of bonds in the market are defaulted on (the debt is not repaid) - 85% of bonds in the market are fully repaid by the borrower - A credit rating agency has advised that the bond is 'high-risk', suggesting that the borrower will probably default on the bond - The agency's judgement is correct 72% of the time, and incorrect 28% of the time I. According to Bayes' Law, what should the investor determine to be the probability of the borrower defaulting on the bond, given that the credit rating agency has advised that the bond is 'high-risk'? II. Explain whether an investor subject to the representativeness bias would UNDERESTIMATE or OVERESTIMATE the probability of default. b) With reference to relevant cognitive biases, explain why investors may form under-diversified portfolios. c) Explain what is meant by the overconfidence bias. Make reference to alternative forms of overconfidence in your answer. d) Explain what effect overconfidence may have on investors' returns

a) An investor is considering investing in a corporate bond, but the risk of default is not known. The following information is available to the investor: - 15% of bonds in the market are defaulted on (the debt is not repaid) - 85% of bonds in the market are fully repaid by the borrower - A credit rating agency has advised that the bond is 'high-risk', suggesting that the borrower will probably default on the bond - The agency's judgement is correct 72% of the time, and incorrect 28% of the time I. According to Bayes' Law, what should the investor determine to be the probability of the borrower defaulting on the bond, given that the credit rating agency has advised that the bond is 'high-risk'? II. Explain whether an investor subject to the representativeness bias would UNDERESTIMATE or OVERESTIMATE the probability of default. b) With reference to relevant cognitive biases, explain why investors may form under-diversified portfolios. c) Explain what is meant by the overconfidence bias. Make reference to alternative forms of overconfidence in your answer. d) Explain what effect overconfidence may have on investors' returns Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started