Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) An investor is considering starting a new business. The company would require $500,000 of assets, and it would be financed entirely with common

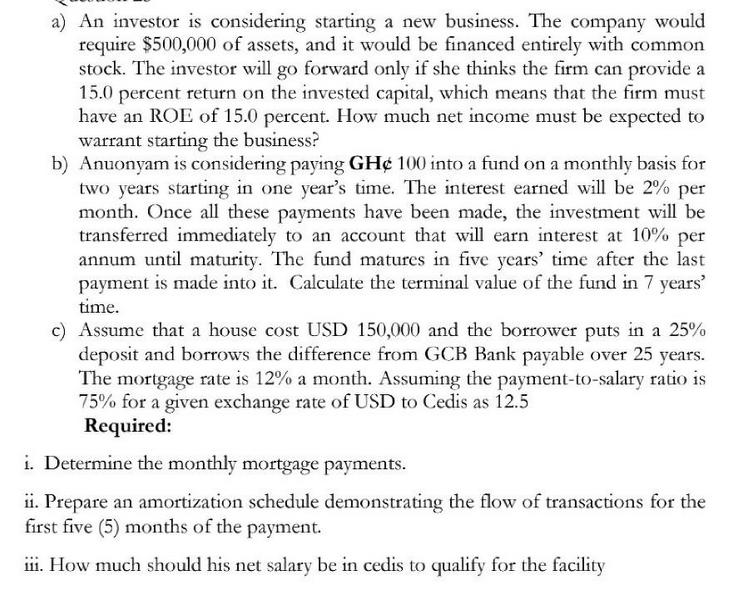

a) An investor is considering starting a new business. The company would require $500,000 of assets, and it would be financed entirely with common stock. The investor will go forward only if she thinks the firm can provide a 15.0 percent return on the invested capital, which means that the firm must have an ROE of 15.0 percent. How much net income must be expected to warrant starting the business? b) Anuonyam is considering paying GH 100 into a fund on a monthly basis for two years starting in one year's time. The interest earned will be 2% per month. Once all these payments have been made, the investment will be transferred immediately to an account that will earn interest at 10% per annum until maturity. The fund matures in five years' time after the last payment is made into it. Calculate the terminal value of the fund in 7 years' time. c) Assume that a house cost USD 150,000 and the borrower puts in a 25% deposit and borrows the difference from GCB Bank payable over 25 years. The mortgage rate is 12% a month. Assuming the payment-to-salary ratio is 75% for a given exchange rate of USD to Cedis as 12.5 Required: i. Determine the monthly mortgage payments. ii. Prepare an amortization schedule demonstrating the flow of transactions for the first five (5) months of the payment. iii. How much should his net salary be in cedis to qualify for the facility

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started