a.) Analyze the financial statement below and calculate;

1. the profitability ratios

2. the liquidity ratios

3. the debt ratios

b.) Using the ratios calculated, evaluate the performance of the company analyzed.

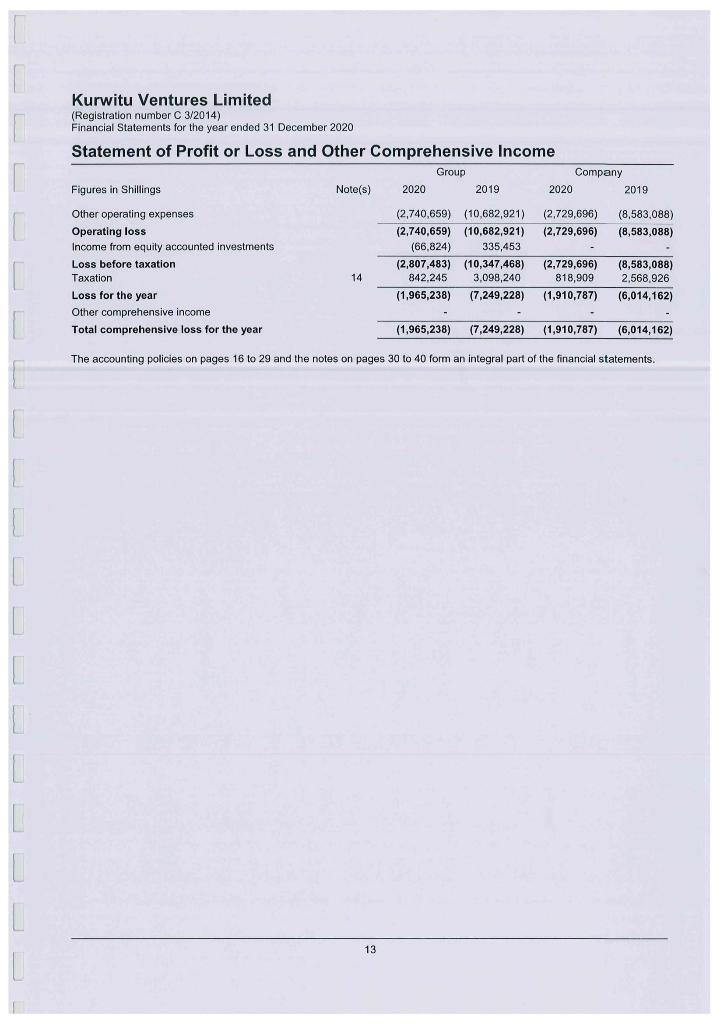

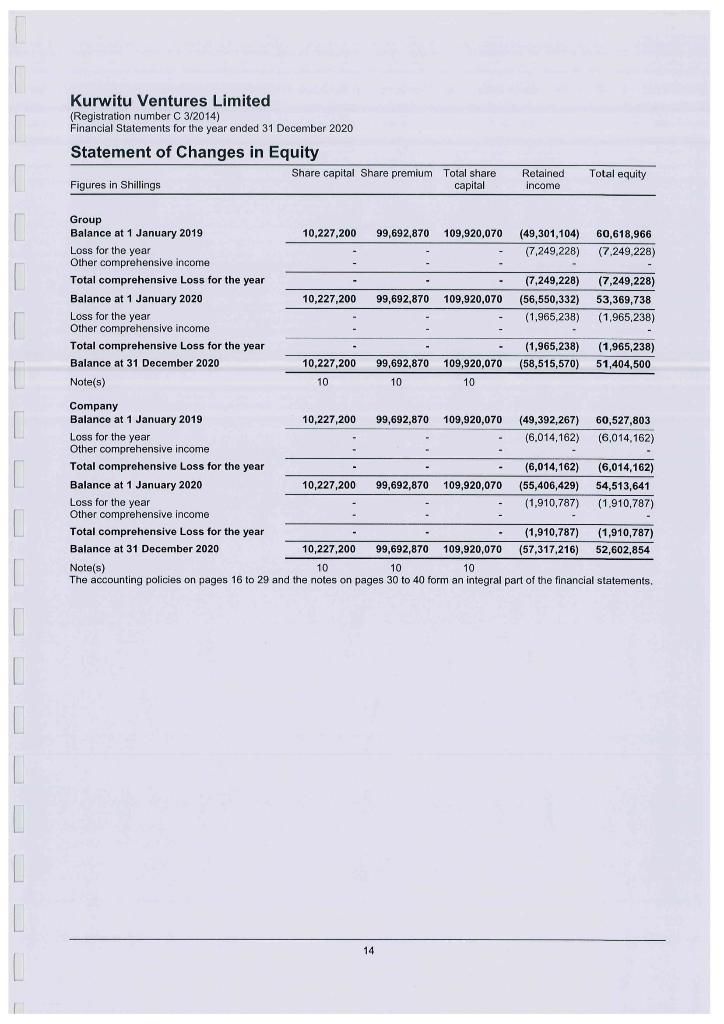

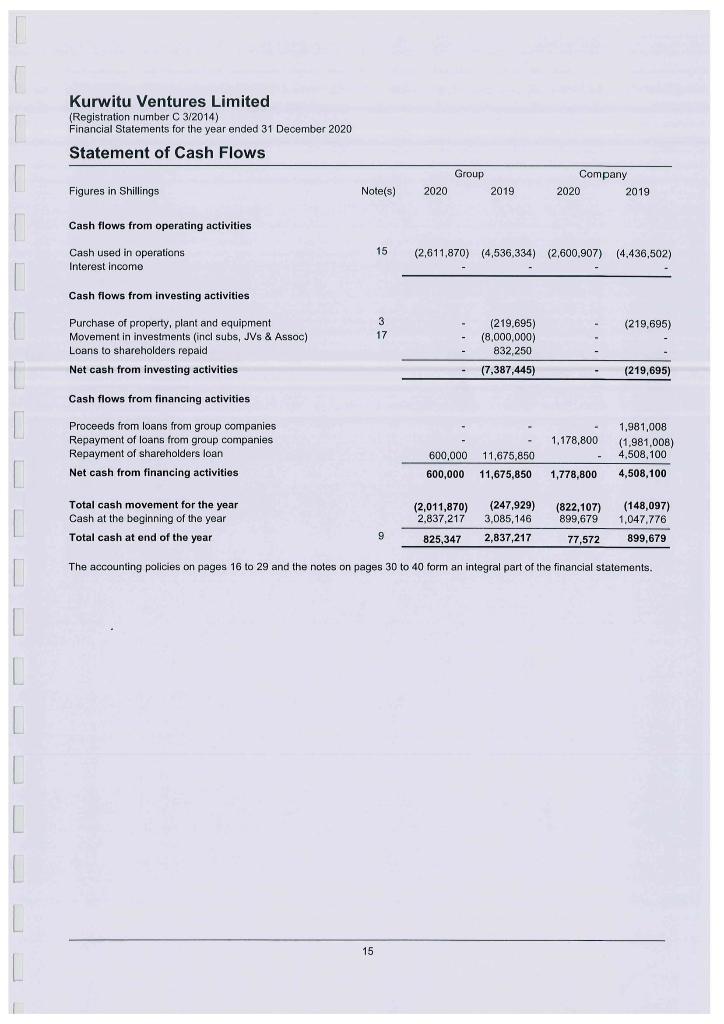

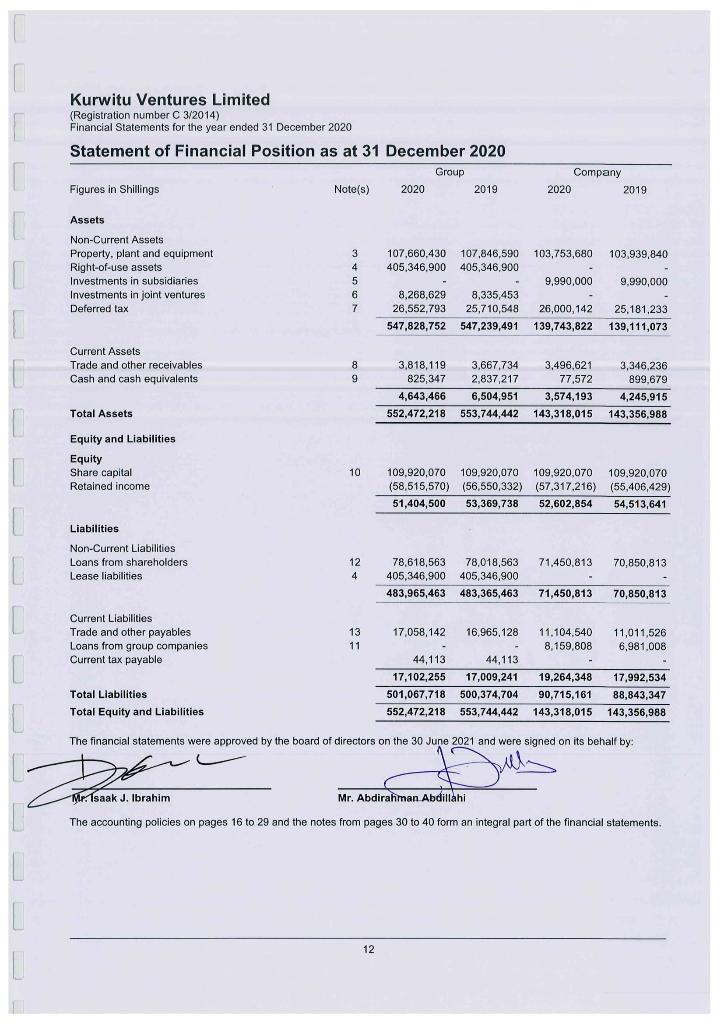

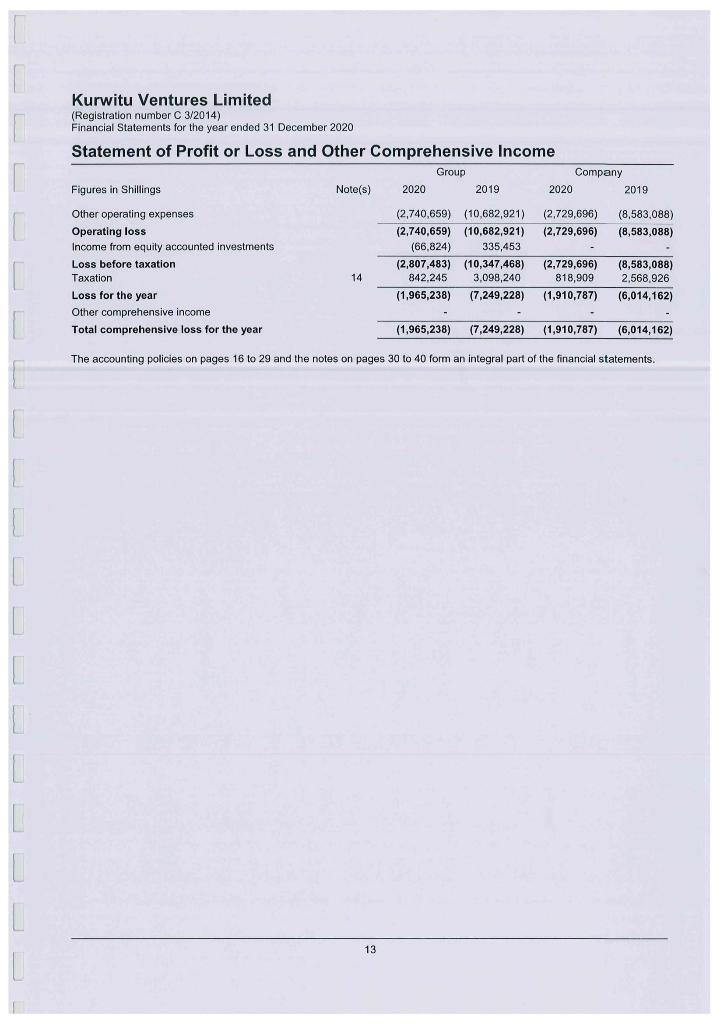

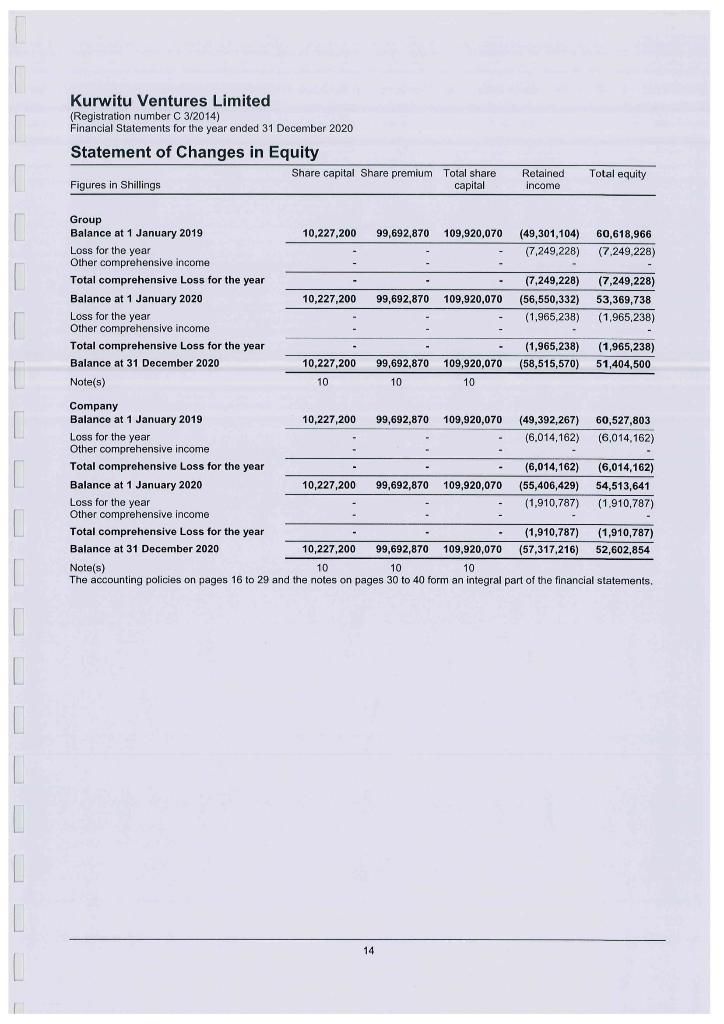

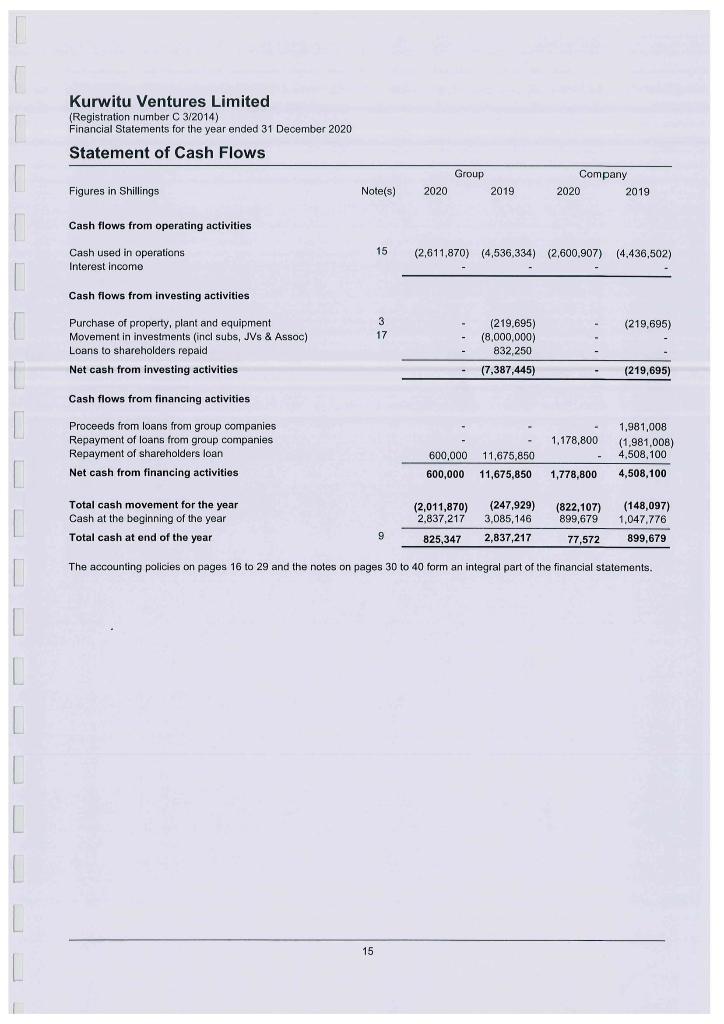

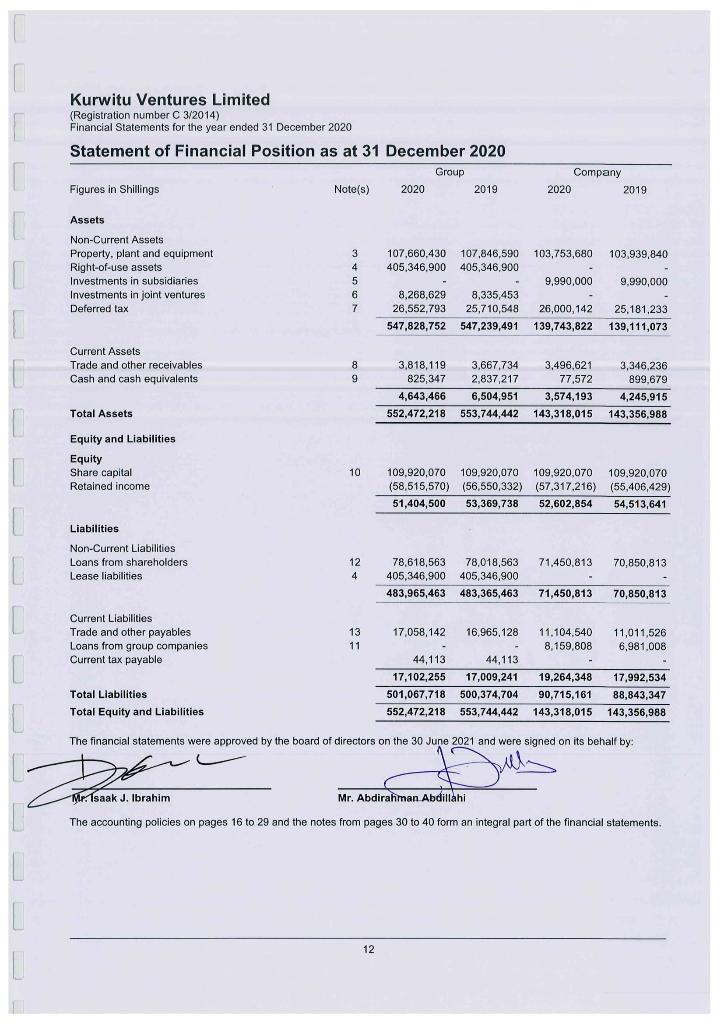

Kurwitu Ventures Limited (Registration number C 3/2014) Financial Statements for the year ended 31 December 2020 Statement of Profit or Loss and Other Comprehensive Income Group Company Figures in Shillings Note(s) 2020 2019 2020 2019 (2,729,696) (2,729,696) (8,583,088) (8,583,088) Other operating expenses Operating los Income from equity accounted investments Loss before taxation Taxation Loss for the year Other comprehensive income Total comprehensive loss for the year (2,740,659) (10,682,921) (2,740,659) (10.682,921) (66,824) 335,453 (2,807,483) (10,347,468) 842.245 3,098,240 (1,965,238) (7,249,228) 14 (2,729,696) 818,909 (1,910,787) (8,583,088) 2,568,926 (6,014,162) (1,965,238) (7,249,228) (1,910,787) (6,014,162) The accounting policies on pages 16 to 29 and the notes on pages 30 to 40 form an integral part of the financial statements. 13 Kurwitu Ventures Limited (Registration number C 3/2014) Financial Statements for the year ended 31 December 2020 Statement of Changes in Equity Share capital Share premium Total share Figures in Shillings capital Total equity Retained income 10,227,200 99,692,870 109,920,070 (49,301,104) (7,249,228) 60,618,966 (7,249,228) Group Balance at 1 January 2019 Loss for the year Other comprehensive income Total comprehensive Loss for the year Balance at 1 January 2020 Loss for the year Other comprehensive income Total comprehensive Loss for the year Balance at 31 December 2020 Note(s) 10,227,200 99,692,870 109,920,070 (7,249,228) (56,550,332) (1,965,238) (7,249,228) 53,369.738 (1,965,238) (1,965,238 (58,515,570) (1,965,238) 51,404,500 10,227,200 99,692,870 109,920,070 10 10 10 Company Balance at 1 January 2019 10,227,200 99,692,870 109,920,070 (49,392,267) 60,527,803 Loss for the year (6.014,162) (6,014.162) Other comprehensive income Total comprehensive Loss for the year (6,014,162) (6,014,162) Balance at 1 January 2020 10,227,200 99,692,870 109,920,070 (55,406,429) 54,513,641 Loss for the year (1,910,787) (1,910,787) Other comprehensive income Total comprehensive Loss for the year (1,910,787) (1,910,787) Balance at 31 December 2020 10,227,200 99,692,870 109,920,070 (57,317,216) 52,602,854 Note(s) 10 10 10 The accounting policies on pages 16 to 29 and the notes on pages 30 to 40 form an integral part of the financial statements, I 14 Kurwitu Ventures Limited (Registration number C 3/2014) Financial Statements for the year ended 31 December 2020 Statement of Cash Flows Group Company 2020 2019 Figures in Shillings Note(s) 2020 2019 Cash flows from operating activities 15 Cash used in operations Interest income ( (2,611,870) (4,536,334) (2,600,907) (4,436,502) Cash flows from investing activities 3 17 (219,695) Purchase of property, plant and equipment Movement in investments (incl subs, JVs & Assoc) Loans to shareholders repaid Net cash from investing activities (219,695) (8,000,000) 832,250 (7,387,445) (219,695) Cash flows from financing activities 1,178,800 Proceeds from loans from group companies Repayment of loans from group companies Repayment of shareholders loan Net cash from financing activities 600,000 11,675,850 11,675,850 1,981,008 (1,981,008) 4,508,100 4,508,100 600,000 1,778,800 (247,929) Total cash movement for the year Cash at the beginning of the year Total cash at end of the year (2,011,870) 2,837,217 3.085,146 (822,107) 899,679 77,572 (148,097) 1,047,776 899,679 9 825,347 2,837,217 The accounting policies on pages 16 to 29 and the notes on pages 30 to 40 form an integral part of the financial statements 15 Kurwitu Ventures Limited (Registration number C 3/2014) Financial Statements for the year ended 31 December 2020 Statement of Financial Position as at 31 December 2020 Group Figures in Shillings Note(s) 2020 2019 Company 2020 2019 Assets 103,753,680 103,939,840 107.660,430 405,346,900 107,846,590 405,346,900 Non-Current Assets Property, plant and equipment Right-of-use assets Investments in subsidiaries Investments in joint ventures Deferred tax 3 4 5 6 6 7 9,990,000 9,990,000 8,268,629 26,552,793 547.828,752 8,335,453 25,710,548 547,239,491 26,000,142 139,743,822 25,181,233 139,111,073 Current Assets Trade and other receivables Cash and cash equivalents 8 9 3,818,119 825,347 4,643,466 552,472,218 3,667,734 2,837,217 6,504,951 553,744,442 3,496,621 77,572 3,574,193 143,318,015 3,346,236 899,679 4,245,915 143,356,988 Total Assets Equity and Liabilities Equity Share capital Retained income 10 109,920,070 109.920,070 109,920,070 109.920,070 (58,515,570) (56,550,332) (57,317.216) (55,406,429) 51,404,500 53,369,738 52,602,854 54,513,641 Liabilities Non-Current Liabilities Loans from shareholders Lease liabilities 71.450.813 70,850,813 12 4 78,618,563 405,346,900 483,965,463 78,018,563 405,346,900 483,365,463 71,450,813 70,850,813 17,058,142 16,965,128 Current Liabilities Trade and other payables Loans from group companies Current tax payable 13 11 11,104,540 8,159,808 11,011,526 6,981,008 44,113 44,113 17,009,241 500,374,704 553,744,442 17.102,255 501,067,718 552,472,218 Total Liabilities Total Equity and Liabilities 19,264,348 90,715,161 143,318,015 17.992,534 88,843,347 143,356,988 The financial statements were approved by the board of directors on the 30 June 2021 and were signed on its behalf by: a Mr. Tsaak J. Ibrahim Mr. Abdirahman Abdillahi The accounting policies on pages 16 to 29 and the notes from pages 30 to 40 form an integral part of the financial statements. 12