A and B are partners sharing profit and loss equally on January 1 2013 they agreed to liquidate their partnership firm, at the time

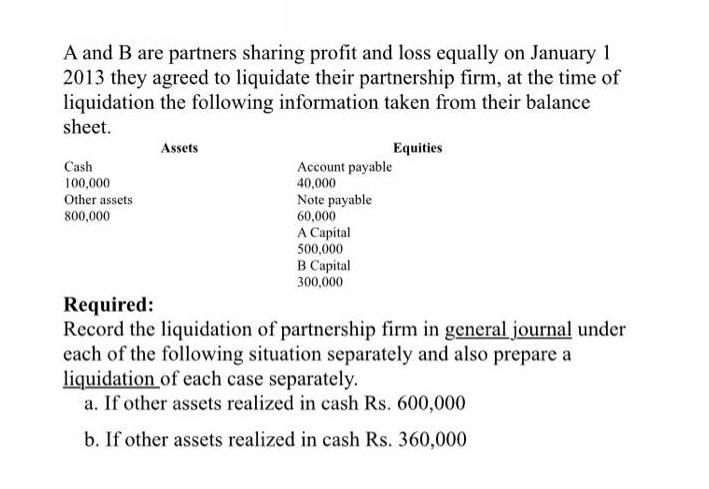

A and B are partners sharing profit and loss equally on January 1 2013 they agreed to liquidate their partnership firm, at the time of liquidation the following information taken from their balance sheet. Cash 100,000 Other assets 800,000 Assets Account payable 40,000 Note payable 60,000 Equities A Capital 500,000 B Capital 300,000 Required: Record the liquidation of partnership firm in general journal under each of the following situation separately and also prepare a liquidation of each case separately. a. If other assets realized in cash Rs. 600,000 b. If other assets realized in cash Rs. 360,000

Step by Step Solution

3.27 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a General Journal Debit Credit Cash 600000 Account Payable 40000 Note Payable 60000 A Capital ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started