Answered step by step

Verified Expert Solution

Question

1 Approved Answer

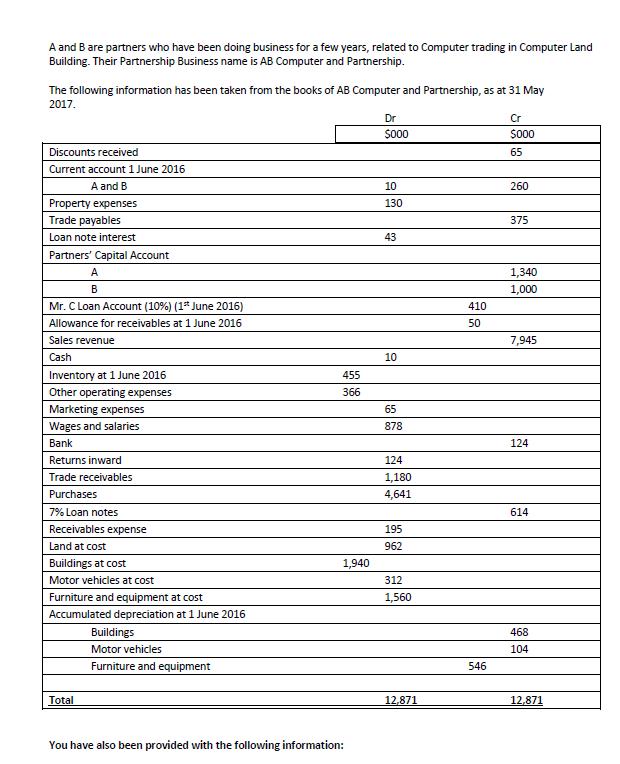

A and B are partners who have been doing business for a few years, related to Computer trading in Computer Land Building. Their Partnership

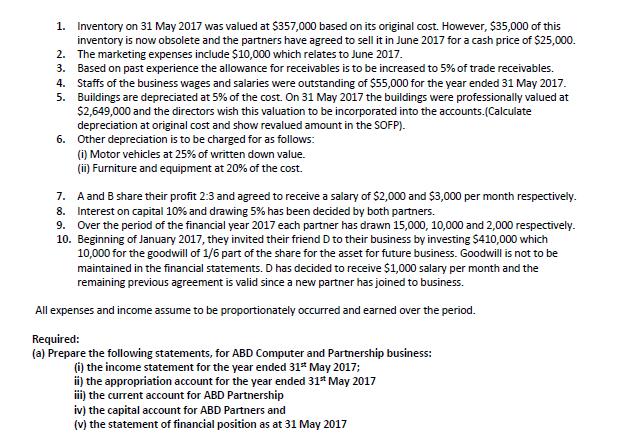

A and B are partners who have been doing business for a few years, related to Computer trading in Computer Land Building. Their Partnership Business name is AB Computer and Partnership. The following information has been taken from the books of AB Computer and Partnership, as at 31 May 2017. Dr Cr $000 $000 Discounts received 65 Current account 1 June 2016 A and B 10 260 Property expenses 130 Trade payables 375 Loan note interest 43 Partners' Capital Account A 1,340 B 1,000 Mr. C Loan Account (10%) (1 June 2016) Allowance for receivables at 1 June 2016 Sales revenue 7,945 Cash 10 Inventory at 1 June 2016 Other operating expenses Marketing expenses 65 Wages and salaries 878 Bank 124 Returns inward 124 Trade receivables 1,180 Purchases 4,641 7% Loan notes 614 Receivables expense 195 Land at cost 962 Buildings at cost Motor vehicles at cost 312 Furniture and equipment at cost 1,560 Accumulated depreciation at 1 June 2016 Buildings 468 104 Motor vehicles Furniture and equipment Total 12,871 12,871 You have also been provided with the following information: 455 366 1,940 410 50 546 1. Inventory on 31 May 2017 was valued at $357,000 based on its original cost. However, $35,000 of this inventory is now obsolete and the partners have agreed to sell it in June 2017 for a cash price of $25,000. 2. The marketing expenses include $10,000 which relates to June 2017. 3. Based on past experience the allowance for receivables is to be increased to 5% of trade receivables. 4. Staffs of the business wages and salaries were outstanding of $55,000 for the year ended 31 May 2017. Buildings are depreciated at 5% of the cost. On 31 May 2017 the buildings were professionally valued at $2,649,000 and the directors wish this valuation to be incorporated into the accounts.(Calculate depreciation at original cost and show revalued amount in the SOFP). 5. 6. Other depreciation is to be charged for as follows: (i) Motor vehicles at 25% of written down value. (ii) Furniture and equipment at 20% of the cost. 7. A and B share their profit 2:3 and agreed to receive a salary of $2,000 and $3,000 per month respectively. Interest on capital 10% and drawing 5% has been decided by both partners. 8. 9. Over the period of the financial year 2017 each partner has drawn 15,000, 10,000 and 2,000 respectively. 10. Beginning of January 2017, they invited their friend D to their business by investing $410,000 which 10,000 for the goodwill of 1/6 part of the share for the asset for future business. Goodwill is not to be maintained in the financial statements. D has decided to receive $1,000 salary per month and the remaining previous agreement is valid since a new partner has joined to business. All expenses and income assume to be proportionately occurred and earned over the period. Required: (a) Prepare the following statements, for ABD Computer and Partnership business: (i) the income statement for the year ended 31* May 2017; ii) the appropriation account for the year ended 31* May 2017 iii) the current account for ABD Partnership iv) the capital account for ABD Partners and (v) the statement of financial position as at 31 May 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

particulars To opening stock to wages and salaries 878 add outstanding expenses 55 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started