Question

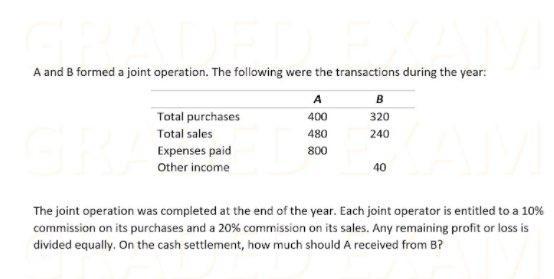

A and B formed a joint operation. The following were the transactions during the year: A B Total purchases 400 320 Total sales 480

A and B formed a joint operation. The following were the transactions during the year: A B Total purchases 400 320 Total sales 480 240 Expenses paid 800 Other income 40 The joint operation was completed at the end of the year. Each joint operator is entitled to a 10% commission on its purchases and a 20% commission on its sales. Any remaining profit or loss is divided equally. On the cash settlement, how much should A received from B?

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Calculation of joint profit Total sales 480240 720 Other inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett

9th edition

1118608224, 1118608227, 730323994, 9780730323990, 730319172, 9780730319177, 978-1118608227

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App