Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a and c. Bonita Limited has been experiencing increased customer demand for its specialty food products. To meet this demand, the company has bought additional

a and c.

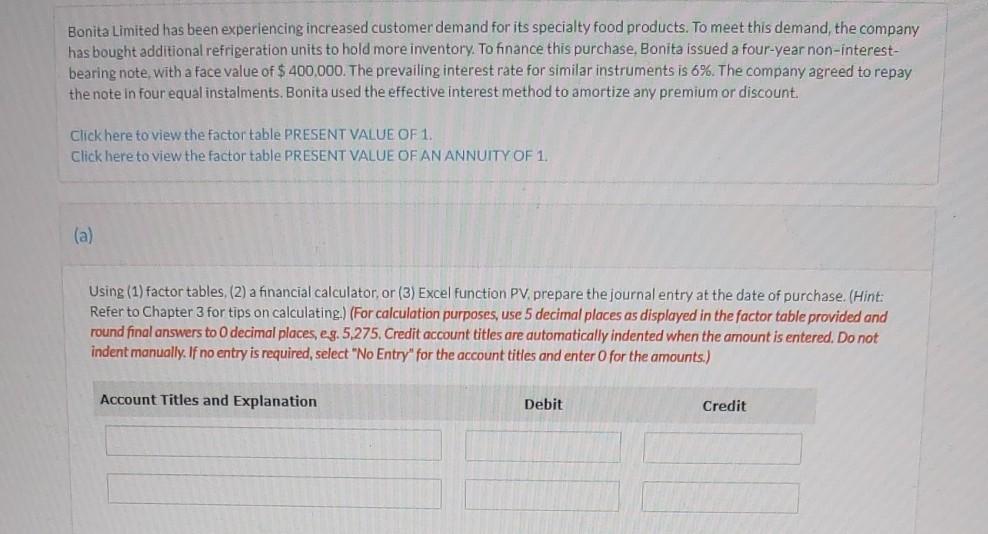

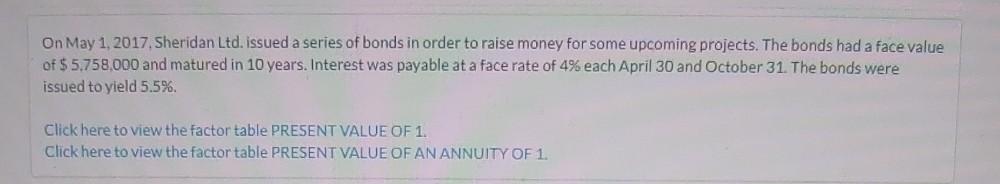

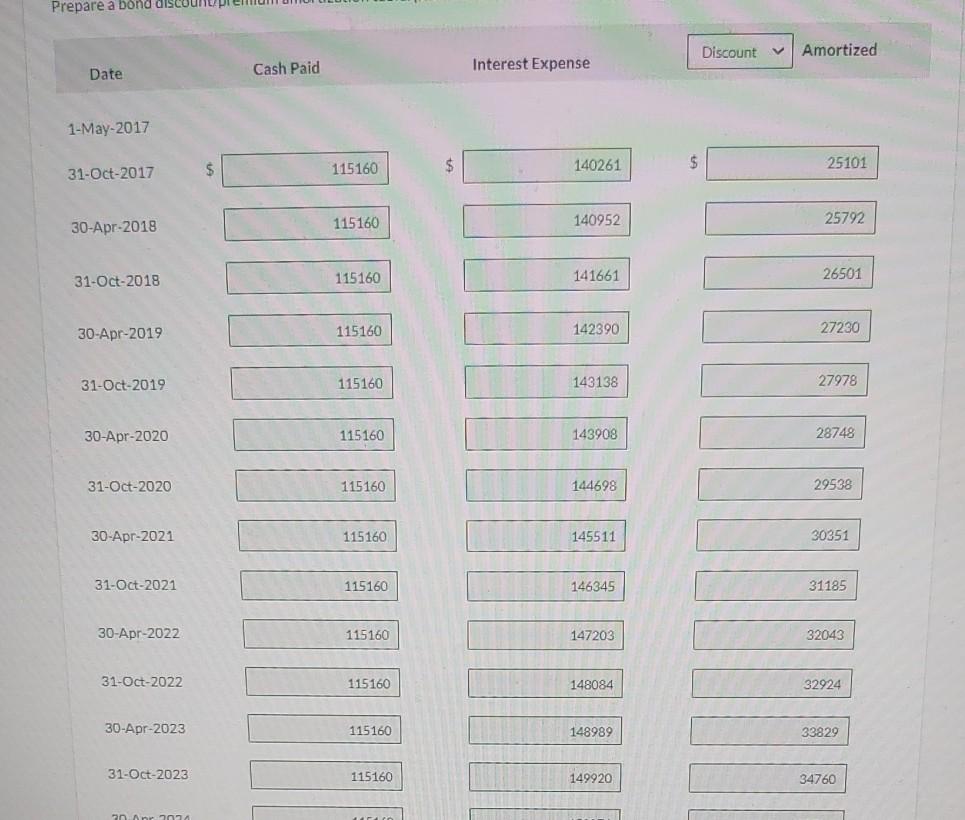

Bonita Limited has been experiencing increased customer demand for its specialty food products. To meet this demand, the company has bought additional refrigeration units to hold more inventory. To finance this purchase. Bonita issued a four-year non-interest- bearing note with a face value of $ 400.000. The prevailing interest rate for similar instruments is 6%. The company agreed to repay the note in four equal instalments. Bonita used the effective interest method to amortize any premium or discount. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a) Using (1) factor tables, (2) a financial calculator, or (3) Excel function PV prepare the journal entry at the date of purchase. (Hint: Refer to Chapter 3 for tips on calculating.) (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit On May 1, 2017, Sheridan Ltd. issued a series of bonds in order to raise money for some upcoming projects. The bonds had a face value of $ 5.758,000 and matured in 10 years. Interest was payable at a face rate of 4% each April 30 and October 31. The bonds were issued to yield 5.5%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare a bond disco Discount v Amortized Date Cash Paid Interest Expense 1-May-2017 $ $ 31-Oct-2017 $ 115160 140261 25101 115160 140952 30-Apr-2018 25792 31-Oct-2018 115160 141661 26501 30-Apr-2019 115160 142390 27230 31-Oct-2019 115160 143138 27978 30-Apr-2020 115160 143908 28748 31-Oct-2020 115160 144698 29538 30-Apr-2021 115160 145511 30351 31-Oct-2021 115160 146345 31185 30-Apr-2022 115160 147203 32043 31-Oct-2022 115160 148084 32924 30-Apr-2023 115160 148989 33829 31-Oct-2023 115160 149920 34760 20 nr 707 Discount v Amortized ash Paid Interest Expense Carrying Amount $ 5100408 $ 115160 140261 $ 25101 5125509 115160 140952 25792 5151301 115160 141661 26501 5177802 115160 142390 27230 5205032 115160 143138 27978 5233010 115160 143908 28748 5261758 115160 144698 29538 5291296 115160 145511 30351 5321647 115160 146345 31185 5352832 115160 147203 32043 5384875 115160 148084 32924 5417799 115160 148989 33829 5451628 115160 149920 34760 5486388 115160 150876 35716 5522104 115160 143908 28748 5261758 115160 144698 29538 5291296 115160 145511 30351 5321647 115160 146345 31185 5352832 115160 147203 32043 5384875 115160 148084 32924 5417799 115160 148989 33829 5451628 115160 149920 34760 5486388 115160 150876 35716 5522104 115160 151858 36698 5558802 115160 152867 37707 5596509 115160 153904 38744 5635263 115160 154969 39809 5675062 115160 156064 40904 5715966 115160 157194 42034 5758000 2303200 S 2960792 657592 Your answer is partially correct. In the years that followed, Sheridan encountered a number of highly profitable years, resulting in a surplus of cash On August 1, 2022, the company repurchased and retired the entire bond issue at 111, plus accrued interest. Calculate the amount of the gain or loss on early redemption of the bonds. (Round answer to 0 decimal places, e.g 5,275.) Loss on early redemption of bonds: $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started