Answered step by step

Verified Expert Solution

Question

1 Approved Answer

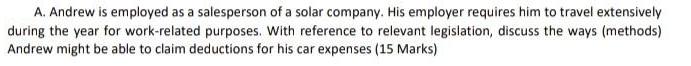

A. Andrew is employed as a salesperson of a solar company. His employer requires him to travel extensively during the year for work-related purposes.

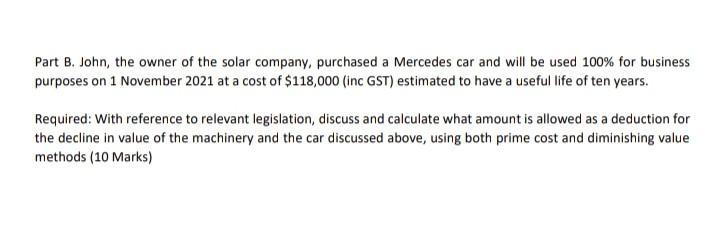

A. Andrew is employed as a salesperson of a solar company. His employer requires him to travel extensively during the year for work-related purposes. With reference to relevant legislation, discuss the ways (methods) Andrew might be able to claim deductions for his car expenses (15 Marks) Part B. John, the owner of the solar company, purchased a Mercedes car and will be used 100% for business purposes on 1 November 2021 at a cost of $118,000 (inc GST) estimated to have a useful life of ten years. Required: With reference to relevant legislation, discuss and calculate what amount is allowed as a deduction for the decline in value of the machinery and the car discussed above, using both prime cost and diminishing value methods (10 Marks)

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer A If the car owned by the employer and that is u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started