Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(A) Answer the provided problems. (B) Submit your answers through the google form. If you are not yet satisfied with your score, revisit the

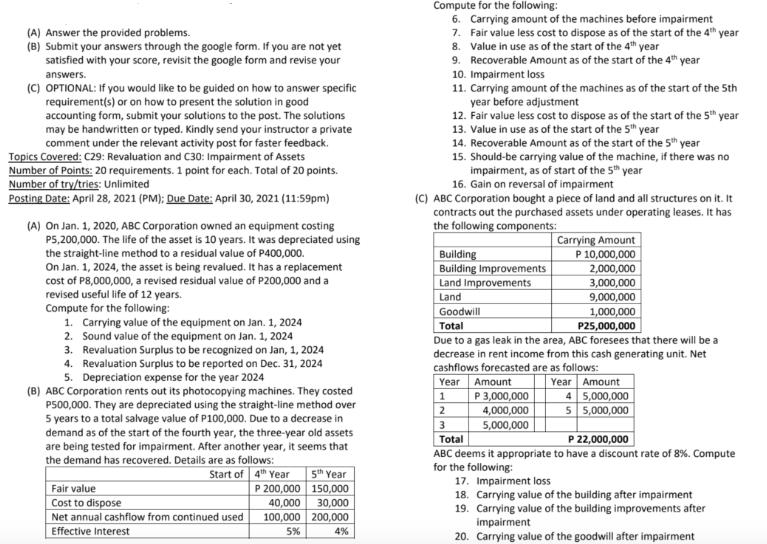

(A) Answer the provided problems. (B) Submit your answers through the google form. If you are not yet satisfied with your score, revisit the google form and revise your answers. (C) OPTIONAL: If you would like to be guided on how to answer specific requirement(s) or on how to present the solution in good accounting form, submit your solutions to the post. The solutions may be handwritten or typed. Kindly send your instructor a private comment under the relevant activity post for faster feedback. Topics Covered: C29: Revaluation and C30: Impairment of Assets Number of Points: 20 requirements. 1 point for each. Total of 20 points. Number of try/tries: Unlimited Posting Date: April 28, 2021 (PM); Due Date: April 30, 2021 (11:59pm) (A) On Jan. 1, 2020, ABC Corporation owned an equipment costing P5,200,000. The life of the asset is 10 years. It was depreciated using the straight-line method to a residual value of P400,000. On Jan. 1, 2024, the asset is being revalued. It has a replacement cost of P8,000,000, a revised residual value of P200,000 and a revised useful life of 12 years. Compute for the following: 1. Carrying value of the equipment on Jan. 1, 2024 2. Sound value of the equipment on Jan. 1, 2024 3. Revaluation Surplus to be recognized on Jan, 1, 2024 4. Revaluation Surplus to be reported on Dec. 31, 2024 5. Depreciation expense for the year 2024 (B) ABC Corporation rents out its photocopying machines. They costed P500,000. They are depreciated using the straight-line method over 5 years to a total salvage value of P100,000. Due to a decrease in demand as of the start of the fourth year, the three-year old assets are being tested for impairment. After another year, it seems that the demand has recovered. Details are as follows: Start of 4th Year P 200,000 40,000 100,000 5% Fair value Cost to dispose Net annual cashflow from continued used Effective Interest 5th Year 150,000 30,000 200,000 4% Compute for the following: 6. Carrying amount of the machines before impairment 7. Fair value less cost to dispose as of the start of the 4th year 8. Value in use as of the start of the 4th year 9. Recoverable Amount as of the start of the 4th year 10. Impairment loss 11. Carrying amount of the machines as of the start of the 5th year before adjustment 12. Fair value less cost to dispose as of the start of the 5th year 13. Value in use as of the start of the 5th year 14. Recoverable Amount as of the start of the 5th year 15. Should-be carrying value of the machine, if there was no impairment, as of start of the 5th year 16. Gain on reversal of impairment (C) ABC Corporation bought a piece of land and all structures on it. It contracts out the purchased assets under operating leases. It has the following components: Carrying Amount Building P 10,000,000 2,000,000 Building Improvements Land Improvements 3,000,000 Land 9,000,000 Goodwill 1,000,000 P25,000,000 Total Due to a gas leak in the area, ABC foresees that there will be a decrease in rent income from this cash generating unit. Net cashflows forecasted are as follows: Year Amount P 3,000,000 4,000,000 5,000,000 Year Amount 4 5,000,000 55,000,000 1 2 3 Total P 22,000,000 ABC deems it appropriate to have a discount rate of 8%. Compute for the following: 17. Impairment loss 18. Carrying value of the building after impairment 19. Carrying value of the building improvements after impairment 20. Carrying value of the goodwill after impairment

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Revaluation Carrying value of the equipment on Jan 1 2024 To calculate the carrying value we need to subtract the accumulated depreciation from the original cost of the asset The accumulated depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started