Answered step by step

Verified Expert Solution

Question

1 Approved Answer

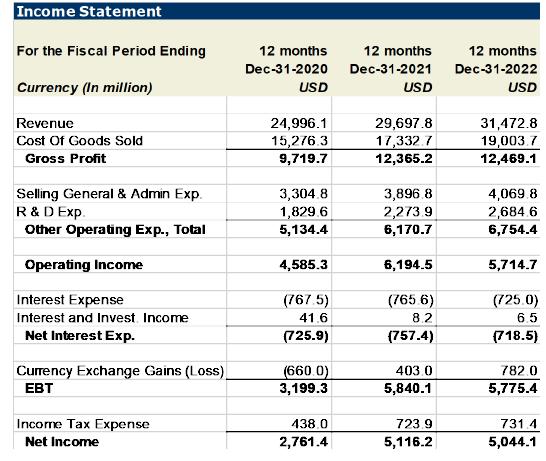

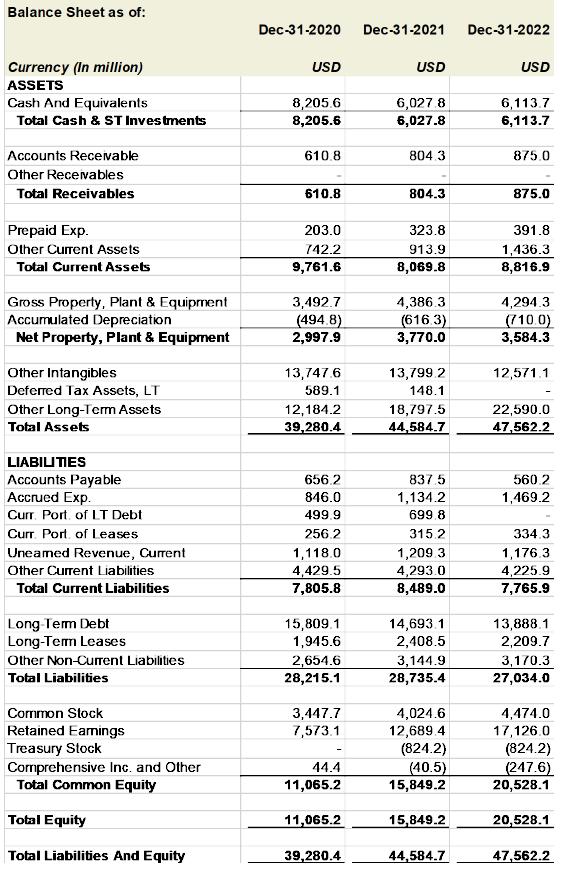

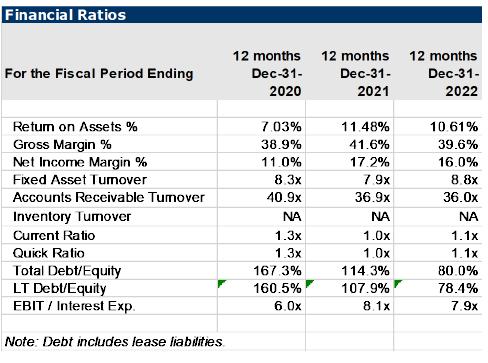

(a) Appraise Netflixs long-term solvency and asset management ratios over the last three years. The presentation of the answer should be well-organised, impactful and should

(a) Appraise Netflix’s long-term solvency and asset management ratios over the last three years. The presentation of the answer should be well-organised, impactful and should not exceed 400 words.

(b) Calculate Netflix’s return on equity for 2021 and 2022 using the DuPont identity and show view based on the observations. it is required to show all relevant workings.

Income Statement For the Fiscal Period Ending Currency (In million) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. R & D Exp. Other Operating Exp., Total Operating Income Interest Expense Interest and Invest Income Net Interest Exp. Currency Exchange Gains (Loss) EBT Income Tax Expense Net Income 12 months Dec-31-2020 USD 24,996.1 15,276.3 9,719.7 3,304.8 1,829.6 5,134.4 4,585.3 (767.5) 41.6 (725.9) (660.0) 3,199.3 438.0 2,761.4 12 months Dec-31-2021 USD 29,697.8 17,332.7 12,365.2 3,896.8 2,273.9 6,170.7 6,194.5 (765.6) 8,2 (757.4) 403.0 5,840.1 723.9 5,116.2 12 months Dec-31-2022 USD 31,472.8 19,003.7 12,469.1 4,069.8 2,684.6 6,754.4 5,714.7 (725.0) 6.5 (718.5) 782.0 5,775.4 731 4 5,044.1

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Netflixs Financial Health Analysis a Solvency and Asset Management Ratios Solvency Netflixs debt ratios Total DebtEquity LT DebtEquity have improved s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started