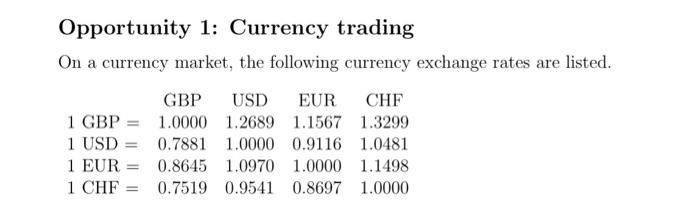

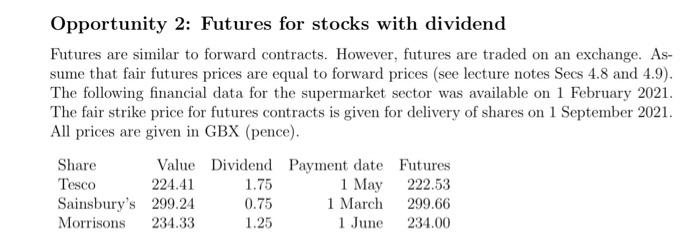

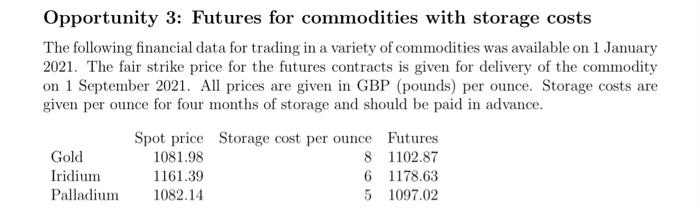

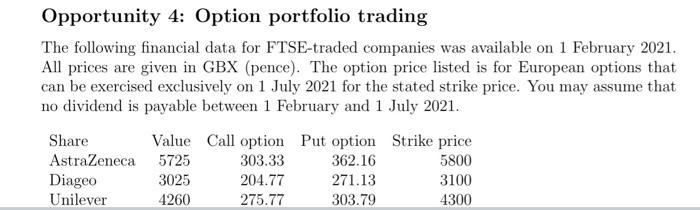

a Arbitrage is a key concept in financial mathematics. In this project, you are expected to consider some financial trading opportunities and identify, from the given data set, a mispricing that can lead in turn to an arbitrage opportunity. Then you will have to report a corresponding arbitrage strategy for returning a risk-free profit and estimate the magnitude for the expected profit, both in written and in oral form. 3 Data A trader has access to the following four investment opportunities. One of them features a significant misprice that needs to be identified. Once identified, an arbitrage strategy can be devised to make a risk-free profit (see below for further guidance). The trader also has access to bonds at the UK market interest rate at 0.67%. Opportunity 1: Currency trading On a currency market, the following currency exchange rates are listed. GBP USD EUR CHF 1 GBP = 1.0000 1.2689 1.1567 1.3299 1 USD = 0.7881 1.0000 0.9116 1.0481 1 EUR 0.8645 1.0970 1.0000 1.1498 1 CHF 0.7519 0.9541 0.8697 1.0000 Opportunity 2: Futures for stocks with dividend Futures are similar to forward contracts. However, futures are traded on an exchange. As- sume that fair futures prices are equal to forward prices (see lecture notes Secs 4.8 and 4.9). The following financial data for the supermarket sector was available on 1 February 2021. The fair strike price for futures contracts is given for delivery of shares on 1 September 2021. All prices are given in GBX (pence). Share Value Dividend Payment date Futures Tesco 224.41 1.75 1 May 222.53 Sainsbury's 299.24 0.75 1 March 299.66 Morrisons 234.33 1.25 1 June 234.00 Opportunity 3: Futures for commodities with storage costs The following financial data for trading in a variety of commodities was available on 1 January 2021. The fair strike price for the futures contracts is given for delivery of the commodity on 1 September 2021. All prices are given in GBP (pounds) per ounce. Storage costs are given per ounce for four months of storage and should be paid in advance. Spot price Storage cost per ounce Futures Gold 1081.98 8 1102.87 Iridium 1161.39 6 1178.63 Palladium 1082.14 5 1097.02 Opportunity 4: Option portfolio trading The following financial data for FTSE-traded companies was available on 1 February 2021. All prices are given in GBX (pence). The option price listed is for European options that can be exercised exclusively on 1 July 2021 for the stated strike price. You may assume that no dividend is payable between 1 February and 1 July 2021. Share Value Call option Put option Strike price AstraZeneca 5725 303.33 362.16 5800 Diageo 3025 204.77 271.13 3100 Unilever 4260 275.77 303.79 4300 a Arbitrage is a key concept in financial mathematics. In this project, you are expected to consider some financial trading opportunities and identify, from the given data set, a mispricing that can lead in turn to an arbitrage opportunity. Then you will have to report a corresponding arbitrage strategy for returning a risk-free profit and estimate the magnitude for the expected profit, both in written and in oral form. 3 Data A trader has access to the following four investment opportunities. One of them features a significant misprice that needs to be identified. Once identified, an arbitrage strategy can be devised to make a risk-free profit (see below for further guidance). The trader also has access to bonds at the UK market interest rate at 0.67%. Opportunity 1: Currency trading On a currency market, the following currency exchange rates are listed. GBP USD EUR CHF 1 GBP = 1.0000 1.2689 1.1567 1.3299 1 USD = 0.7881 1.0000 0.9116 1.0481 1 EUR 0.8645 1.0970 1.0000 1.1498 1 CHF 0.7519 0.9541 0.8697 1.0000 Opportunity 2: Futures for stocks with dividend Futures are similar to forward contracts. However, futures are traded on an exchange. As- sume that fair futures prices are equal to forward prices (see lecture notes Secs 4.8 and 4.9). The following financial data for the supermarket sector was available on 1 February 2021. The fair strike price for futures contracts is given for delivery of shares on 1 September 2021. All prices are given in GBX (pence). Share Value Dividend Payment date Futures Tesco 224.41 1.75 1 May 222.53 Sainsbury's 299.24 0.75 1 March 299.66 Morrisons 234.33 1.25 1 June 234.00 Opportunity 3: Futures for commodities with storage costs The following financial data for trading in a variety of commodities was available on 1 January 2021. The fair strike price for the futures contracts is given for delivery of the commodity on 1 September 2021. All prices are given in GBP (pounds) per ounce. Storage costs are given per ounce for four months of storage and should be paid in advance. Spot price Storage cost per ounce Futures Gold 1081.98 8 1102.87 Iridium 1161.39 6 1178.63 Palladium 1082.14 5 1097.02 Opportunity 4: Option portfolio trading The following financial data for FTSE-traded companies was available on 1 February 2021. All prices are given in GBX (pence). The option price listed is for European options that can be exercised exclusively on 1 July 2021 for the stated strike price. You may assume that no dividend is payable between 1 February and 1 July 2021. Share Value Call option Put option Strike price AstraZeneca 5725 303.33 362.16 5800 Diageo 3025 204.77 271.13 3100 Unilever 4260 275.77 303.79 4300