Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. As the financial consultant of Explicit Investment Company, you have been asked to advice a group of companies in the various stages of

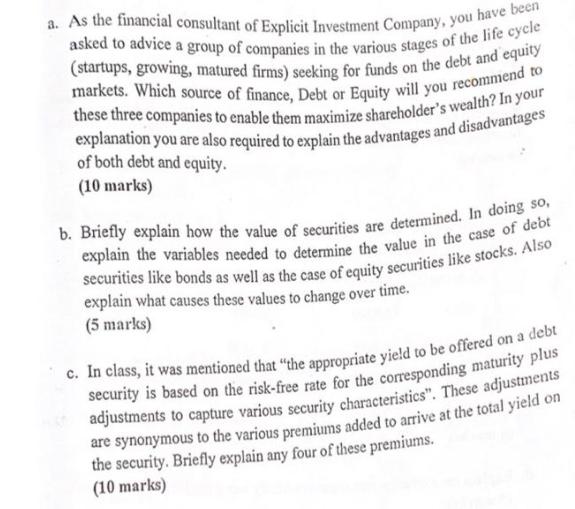

a. As the financial consultant of Explicit Investment Company, you have been asked to advice a group of companies in the various stages of the life cycle (startups, growing, matured firms) seeking for funds on the debt and equity markets. Which source of finance, Debt or Equity will you recommend to these three companies to enable them maximize shareholder's wealth? In your explanation you are also required to explain the advantages and disadvantages of both debt and equity. (10 marks) b. Briefly explain how the value of securities are determined. In doing so, explain the variables needed to determine the value in the case of debt securities like bonds as well as the case of equity securities like stocks. Also explain what causes these values to change over time. (5 marks) c. In class, it was mentioned that "the appropriate yield to be offered on a debt security is based on the risk-free rate for the corresponding maturity plus adjustments to capture various security characteristics". These adjustments are synonymous to the various premiums added to arrive at the total yield on the security. Briefly explain any four of these premiums. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a When advising companies in different stages of the life cycle startups growing matured firms on whether to seek funds through debt or equity markets its essential to consider the advantages and disa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started