Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) As the owner of a small architectural firm, you approach the Commonwealth Bank to obtain a term loan so that the firm can

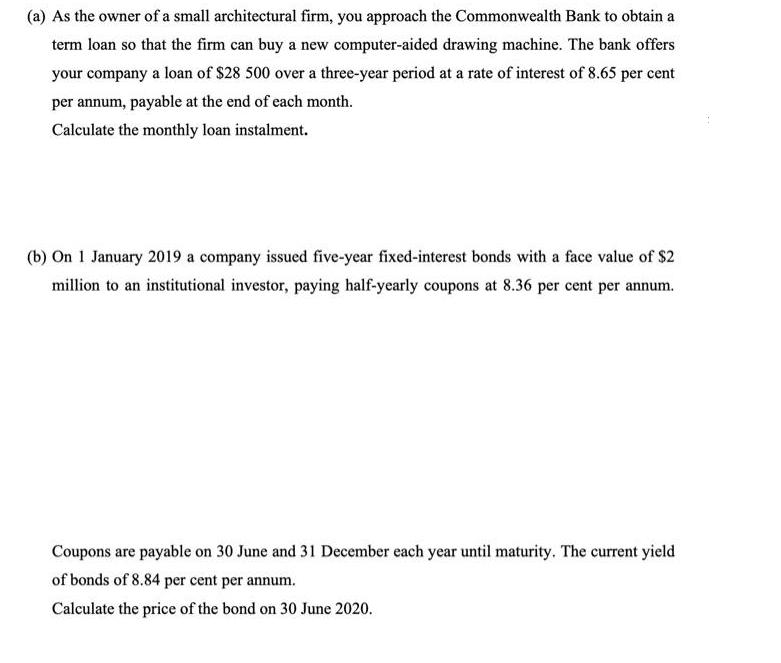

(a) As the owner of a small architectural firm, you approach the Commonwealth Bank to obtain a term loan so that the firm can buy a new computer-aided drawing machine. The bank offers your company a loan of $28 500 over a three-year period at a rate of interest of 8.65 per cent per annum, payable at the end of each month. Calculate the monthly loan instalment. (b) On 1 January 2019 a company issued five-year fixed-interest bonds with a face value of $2 million to an institutional investor, paying half-yearly coupons at 8.36 per cent per annum. Coupons are payable on 30 June and 31 December each year until maturity. The current yield of bonds of 8.84 per cent per annum. Calculate the price of the bond on 30 June 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Monthly payment Pxrx1rn1rn1 Here 1 Interest rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started