Answered step by step

Verified Expert Solution

Question

1 Approved Answer

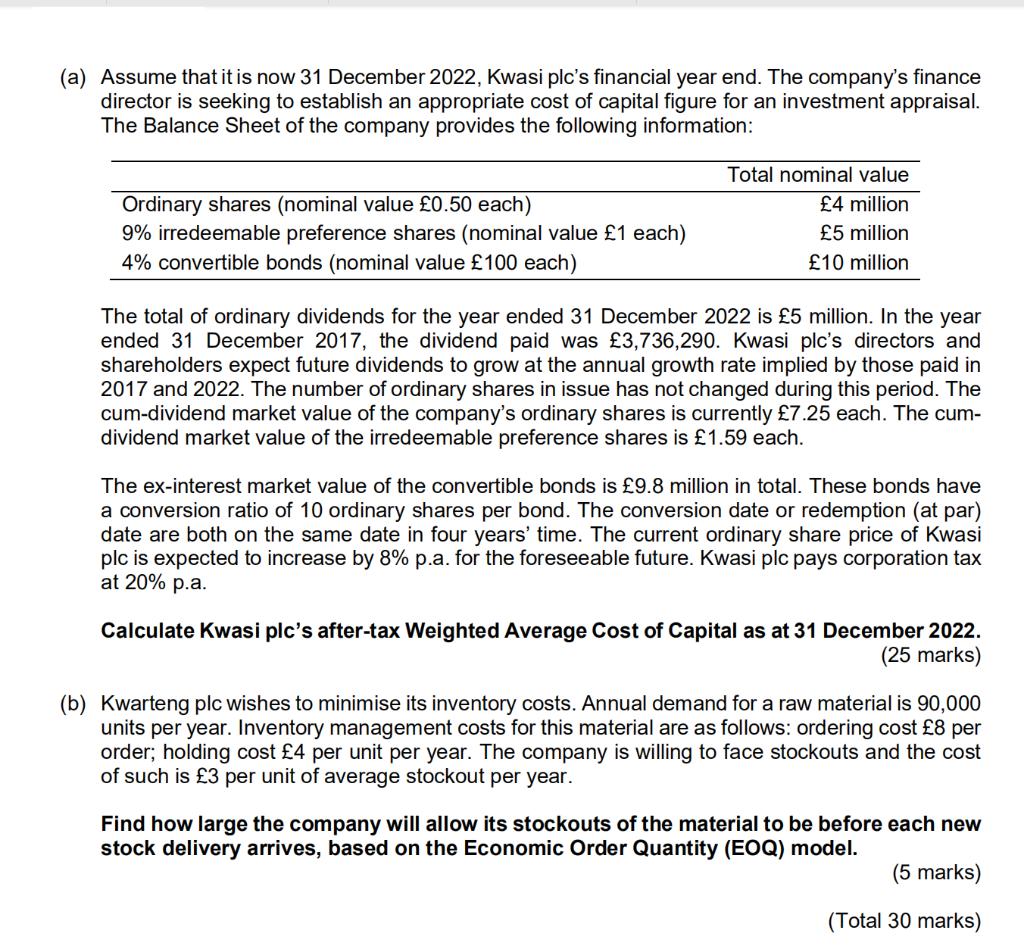

(a) Assume that it is now 31 December 2022, Kwasi plc's financial year end. The company's finance director is seeking to establish an appropriate

(a) Assume that it is now 31 December 2022, Kwasi plc's financial year end. The company's finance director is seeking to establish an appropriate cost of capital figure for an investment appraisal. The Balance Sheet of the company provides the following information: Ordinary shares (nominal value 0.50 each) 9% irredeemable preference shares (nominal value 1 each) 4% convertible bonds (nominal value 100 each) Total nominal value 4 million 5 million 10 million The total of ordinary dividends for the year ended 31 December 2022 is 5 million. In the year ended 31 December 2017, the dividend paid was 3,736,290. Kwasi plc's directors and shareholders expect future dividends to grow at the annual growth rate implied by those paid in 2017 and 2022. The number of ordinary shares in issue has not changed during this period. The cum-dividend market value of the company's ordinary shares is currently 7.25 each. The cum- dividend market value of the irredeemable preference shares is 1.59 each. The ex-interest market value of the convertible bonds is 9.8 million in total. These bonds have a conversion ratio of 10 ordinary shares per bond. The conversion date or redemption (at par) date are both on the same date in four years' time. The current ordinary share price of Kwasi plc is expected to increase by 8% p.a. for the foreseeable future. Kwasi plc pays corporation tax at 20% p.a. Calculate Kwasi plc's after-tax Weighted Average Cost of Capital as at 31 December 2022. (25 marks) (b) Kwarteng plc wishes to minimise its inventory costs. Annual demand for a raw material is 90,000 units per year. Inventory management costs for this material are as follows: ordering cost 8 per order; holding cost 4 per unit per year. The company is willing to face stockouts and the cost of such is 3 per unit of average stockout per year. Find how large the company will allow its stockouts of the material to be before each new stock delivery arrives, based on the Economic Order Quantity (EOQ) model. (5 marks) (Total 30 marks)

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Kwasi plcs aftertax Weighted Average Cost of Capital WACC as at 31 December 2022 can be calculated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started