Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Assume that spot exchange rate equals 100 Japanese Yen () to one US dollar() and the six month forward rate equals 101 Japanese

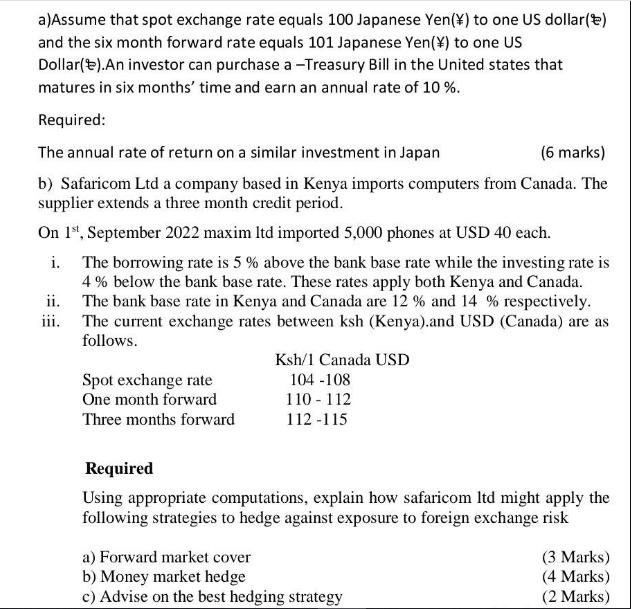

a) Assume that spot exchange rate equals 100 Japanese Yen () to one US dollar() and the six month forward rate equals 101 Japanese Yen () to one US Dollar (). An investor can purchase a -Treasury Bill in the United states that matures in six months' time and earn an annual rate of 10 %. Required: The annual rate of return on a similar investment in Japan (6 marks) b) Safaricom Ltd a company based in Kenya imports computers from Canada. The supplier extends a three month credit period. On 1st, September 2022 maxim Itd imported 5,000 phones at USD 40 each. i. The borrowing rate is 5% above the bank base rate while the investing rate is 4% below the bank base rate. These rates apply both Kenya and Canada. The bank base rate in Kenya and Canada are 12 % and 14 % respectively. The current exchange rates between ksh (Kenya).and USD (Canada) are as follows. ii. iii. Spot exchange rate One month forward Three months forward Ksh/1 Canada USD 104-108 110-112 112-115 Required Using appropriate computations, explain how safaricom ltd might apply the following strategies to hedge against exposure to foreign exchange risk a) Forward market cover b) Money market hedge c) Advise on the best hedging strategy (3 Marks) (4 Marks) (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the annual rate of return on a similar investment in Japan you can use the interest rate parity principle which equates the returns on similar investments in different currencies Annual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started