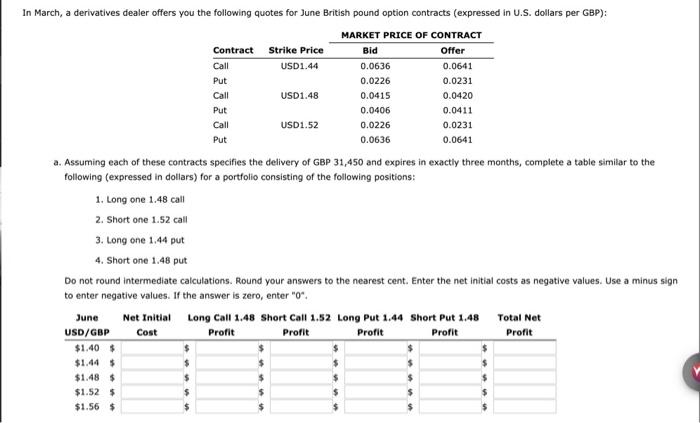

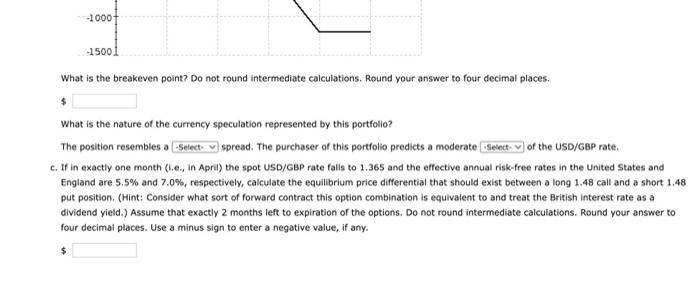

a. Assuming each of these contracts specifies the delivery of GBP 31,450 and expires in exactly three months, complete a table similar to the following (expressed in dollars) for a portfolio consisting of the following positions: 1. Long one 1.48 call 2. Short one 1.52 call 3. Long one 1.44 put 4. Short one 1.48 put Do not round intermediate calculations. Round your answers to the nearest cent. Enter the net initial costs as negative values. Use a minus sign to enter negative values. If the answer is zero, enter " 0 . What is the breakeven point? Do not round intermediate calculations. Round your answer to four decimal places. What is the nature of the currency speculation represented by this portfolio? The position resembles a spread. The purchaser of this portiolio predicts a moderate of the USD/GBP rate. c. If in exactly one month (i.e., in April) the spot USD/GBP rate falis to 1.365 and the effective annual risk-free rates in the United States and England are 5.5% and 7.0%, respectively, calculate the equilibrium price differential that should exist between a long 1.48 call and a short 1.48 put position. (Hint: Consider what sort of forward contract this option combination is equivalent to and treat the British interest rate as a dividend yield.) Assume that exactly 2 months left to expiration of the options. Do not round intermediate calculations. Round your answer to four decimai places. Use a minus sign to enter a negative value, if any. a. Assuming each of these contracts specifies the delivery of GBP 31,450 and expires in exactly three months, complete a table similar to the following (expressed in dollars) for a portfolio consisting of the following positions: 1. Long one 1.48 call 2. Short one 1.52 call 3. Long one 1.44 put 4. Short one 1.48 put Do not round intermediate calculations. Round your answers to the nearest cent. Enter the net initial costs as negative values. Use a minus sign to enter negative values. If the answer is zero, enter " 0 . What is the breakeven point? Do not round intermediate calculations. Round your answer to four decimal places. What is the nature of the currency speculation represented by this portfolio? The position resembles a spread. The purchaser of this portiolio predicts a moderate of the USD/GBP rate. c. If in exactly one month (i.e., in April) the spot USD/GBP rate falis to 1.365 and the effective annual risk-free rates in the United States and England are 5.5% and 7.0%, respectively, calculate the equilibrium price differential that should exist between a long 1.48 call and a short 1.48 put position. (Hint: Consider what sort of forward contract this option combination is equivalent to and treat the British interest rate as a dividend yield.) Assume that exactly 2 months left to expiration of the options. Do not round intermediate calculations. Round your answer to four decimai places. Use a minus sign to enter a negative value, if any