Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Assuming that Pretty Inc. purchases 60% of the outstanding shares of Sweet Inc. for cash of $200,000 on December 1, 2023, calculate the

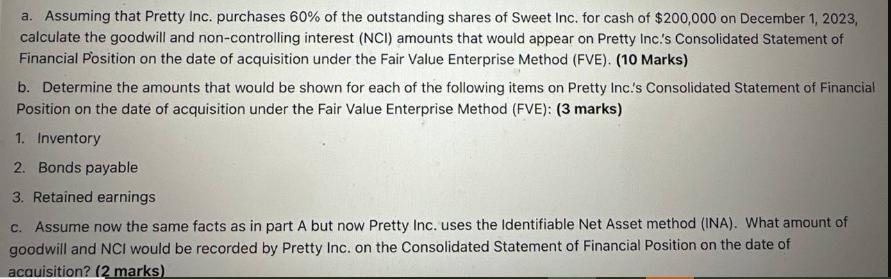

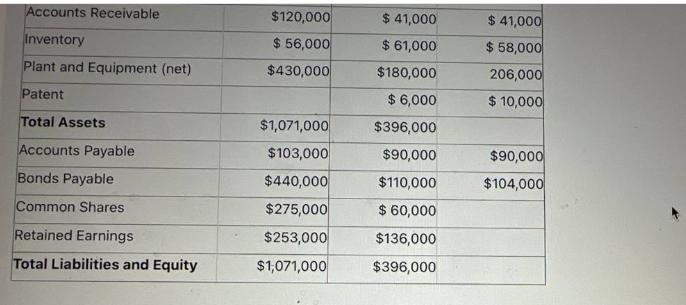

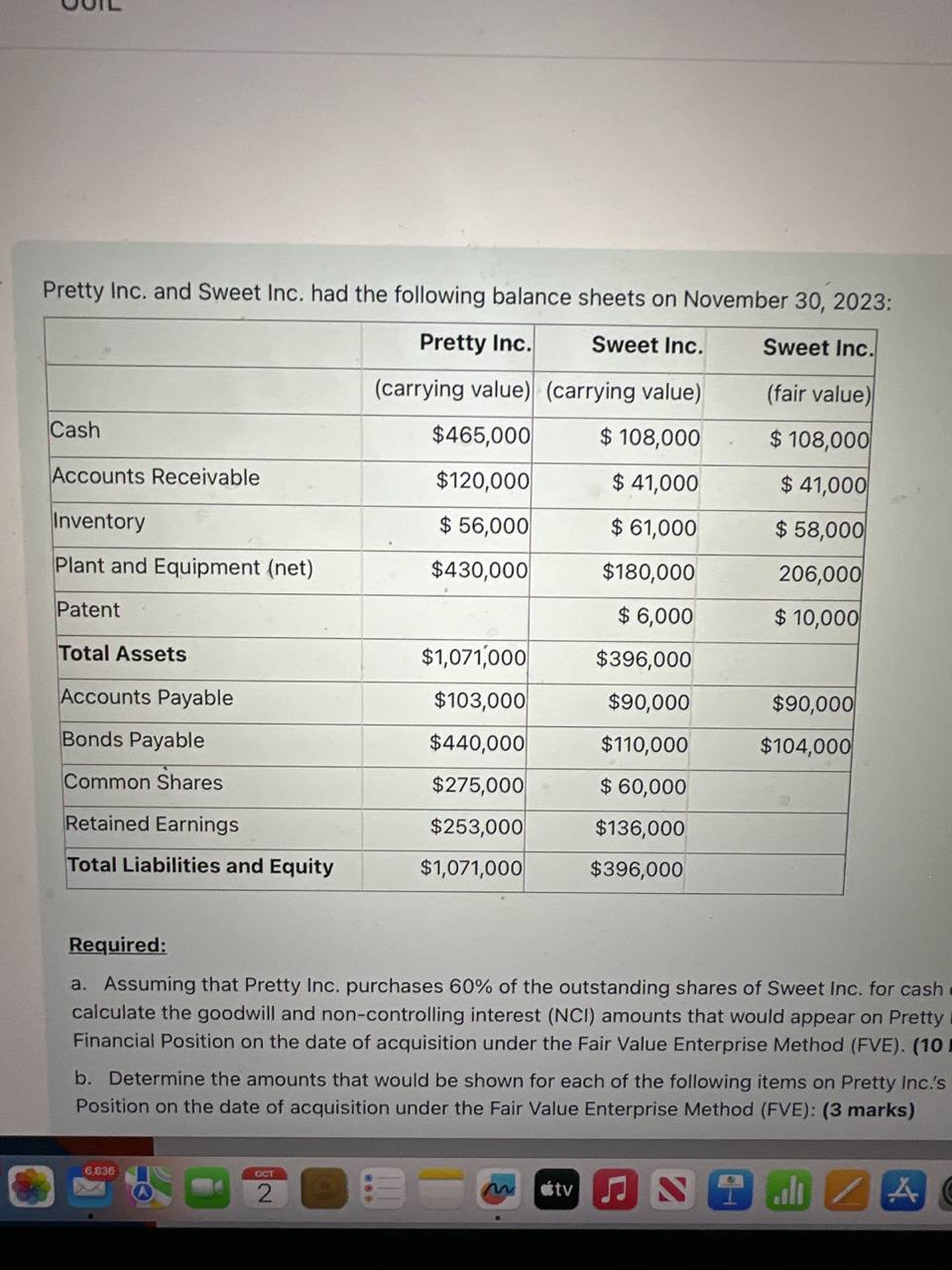

a. Assuming that Pretty Inc. purchases 60% of the outstanding shares of Sweet Inc. for cash of $200,000 on December 1, 2023, calculate the goodwill and non-controlling interest (NCI) amounts that would appear on Pretty Inc.'s Consolidated Statement of Financial Position on the date of acquisition under the Fair Value Enterprise Method (FVE). (10 Marks) b. Determine the amounts that would be shown for each of the following items on Pretty Inc's Consolidated Statement of Financial Position on the date of acquisition under the Fair Value Enterprise Method (FVE): (3 marks) 1. Inventory 2. Bonds payable 3. Retained earnings c. Assume now the same facts as in part A but now Pretty Inc. uses the Identifiable Net Asset method (INA). What amount of goodwill and NCI would be recorded by Pretty Inc. on the Consolidated Statement of Financial Position on the date of acquisition? (2 marks) Accounts Receivable $120,000 $ 41,000 Inventory $ 56,000 $ 61,000 $ 41,000 $ 58,000 Plant and Equipment (net) $430,000 $180,000 206,000 Patent $6,000 $ 10,000 Total Assets $1,071,000 $396,000 Accounts Payable $103,000 $90,000 $90,000 Bonds Payable $440,000 $110,000 $104,000 Common Shares $275,000 $ 60,000 Retained Earnings $253,000 $136,000 Total Liabilities and Equity $1,071,000 $396,000 Pretty Inc. and Sweet Inc. had the following balance sheets on November 30, 2023: Pretty Inc. Sweet Inc. Sweet Inc. (carrying value) (carrying value) (fair value) Cash $465,000 $108,000 $108,000 Accounts Receivable $120,000 $41,000 $41,000 Inventory $ 56,000 $ 61,000 $58,000 Plant and Equipment (net) $430,000 $180,000 206,000 Patent $6,000 $10,000 Total Assets $1,071,000 $396,000 Accounts Payable $103,000 $90,000 $90,000 Bonds Payable $440,000 $110,000 $104,000 Common Shares $275,000 $ 60,000 Retained Earnings $253,000 $136,000 Total Liabilities and Equity $1,071,000 $396,000 Required: a. Assuming that Pretty Inc. purchases 60% of the outstanding shares of Sweet Inc. for cash calculate the goodwill and non-controlling interest (NCI) amounts that would appear on Pretty Financial Position on the date of acquisition under the Fair Value Enterprise Method (FVE). (10 E b. Determine the amounts that would be shown for each of the following items on Pretty Inc.'s Position on the date of acquisition under the Fair Value Enterprise Method (FVE): (3 marks) 6,836 OCT 2 tv N al AC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started