Answered step by step

Verified Expert Solution

Question

1 Approved Answer

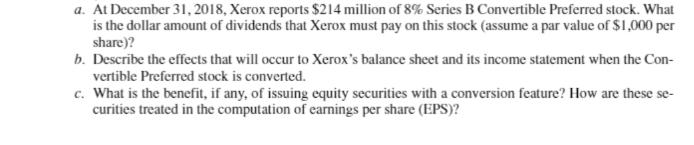

a. At December 31, 2018, Xerox reports $214 million of 8% Series B Convertible Preferred stock. What is the dollar amount of dividends that

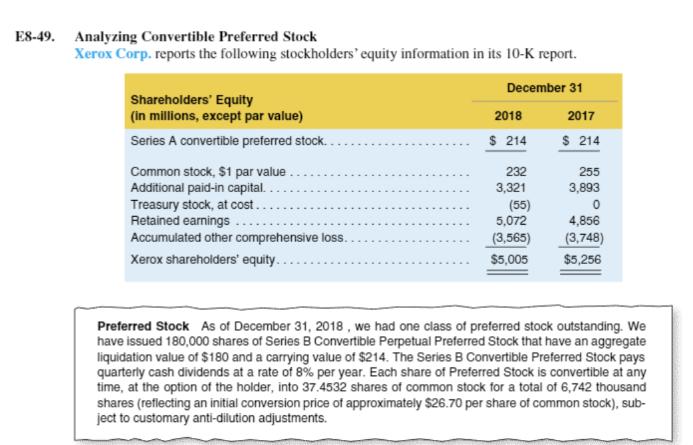

a. At December 31, 2018, Xerox reports $214 million of 8% Series B Convertible Preferred stock. What is the dollar amount of dividends that Xerox must pay on this stock (assume a par value of $1,000 per share)? b. Describe the effects that will occur to Xerox's balance sheet and its income statement when the Con- vertible Preferred stock is converted. c. What is the benefit, if any, of issuing equity securities with a conversion feature? How are these se- curities treated in the computation of earnings per share (EPS)? E8-49. Analyzing Convertible Preferred Stock Xerox Corp. reports the following stockholders' equity information in its 10-K report. December 31 Shareholders' Equity (in millions, except par value) 2018 2017 Series A convertible preferred stock.. $ 214 $ 214 Common stock, $1 par value. 232 255 Additional paid-in capital... 3,321 3,893 Treasury stock, at cost.. (55) Retained earnings. 5,072 4,856 Accumulated other comprehensive loss. (3,565) (3,748) Xerox shareholders' equity.... $5,005 $5,256 Preferred Stock As of December 31, 2018, we had one class of preferred stock outstanding. We have issued 180,000 shares of Series B Convertible Perpetual Preferred Stock that have an aggregate liquidation value of $180 and a carrying value of $214. The Series B Convertible Preferred Stock pays quarterly cash dividends at a rate of 8% per year. Each share of Preferred Stock is convertible at any time, at the option of the holder, into 37.4532 shares of common stock for a total of 6,742 thousand shares (reflecting an initial conversion price of approximately $26.70 per share of common stock), sub- ject to customary anti-dilution adjustments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642d7f874b93_973688.pdf

180 KBs PDF File

6642d7f874b93_973688.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started