Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) (b) According to the Capital Asset Pricing theory, what return would be required by an investor whose portfolio is made up of 40%

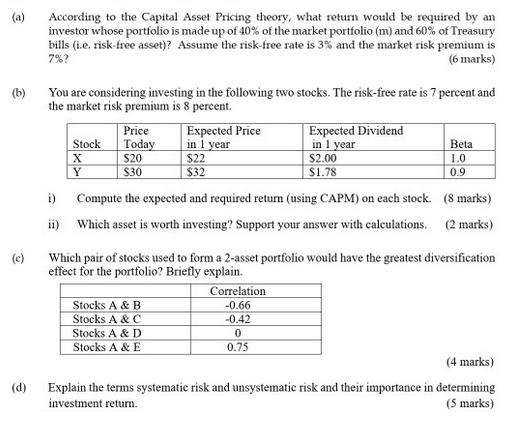

(a) (b) According to the Capital Asset Pricing theory, what return would be required by an investor whose portfolio is made up of 40% of the market portfolio (m) and 60% of Treasury bills (i.e. risk-free asset)? Assume the risk-free rate is 3% and the market risk premium is 7%? (6 marks) You are considering investing in the following two stocks. The risk-free rate is 7 percent and the market risk premium is 8 percent. Price Stock X Today $20 Expected Price in 1 year $22 Expected Dividend in 1 year Beta $2.00 1.0 Y $30 $32 i) Compute the expected and required return (using CAPM) on each stock. $1.78 0.9 (8 marks) (2 marks). ii) Which asset is worth investing? Support your answer with calculations. (c) Which pair of stocks used to form a 2-asset portfolio would have the greatest diversification effect for the portfolio? Briefly explain. (d) Correlation Stocks A & B -0.66 Stocks A & C -0.42 Stocks A & D Stocks A & E 0 0.75 (4 marks) Explain the terms systematic risk and unsystematic risk and their importance in determining investment return. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started