Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A , B and C are partners sharing profits in the proportion of one - half, one - fourth and one - fourth respectively. Their

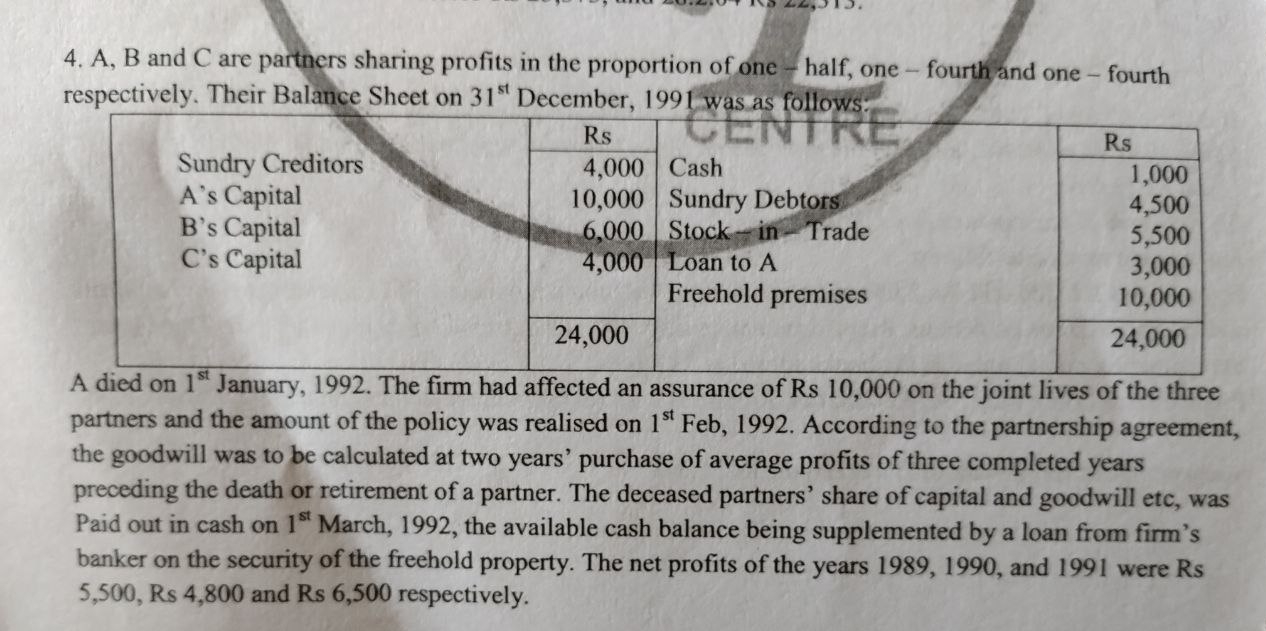

and C are partners sharing profits in the proportion of one half, one fourth and one fourth respectively. Their Balance Sheet on December, was as follows.

tableRsRsSundry Creditors,Cash,As Capital,Sundry Debtors,Bs Capital,StockinTrade,Cs Capital,Loan to AFreehold premises,

A died on January, The firm had affected an assurance of Rs on the joint lives of the three partners and the amount of the policy was realised on Feb, According to the partnership agreement, the goodwill was to be calculated at two years' purchase of average profits of three completed years preceding the death or retirement of a partner. The deceased partners' share of capital and goodwill etc, was Paid out in cash on March, the available cash balance being supplemented by a loan from firm's banker on the security of the freehold property. The net profits of the years and were Rs Rs and Rs respectively.

You are required to show the ledger accounts of the partners and the Balance Sheet of and as it would stand after As share is paid out.

Answer: Capital balance B Rs C Rs Amount payable to As executors Rs Balance Sheet Rs

and C are partners sharing profits in the proportion of one half, one fourth and one fourth respectively. Their Balance Sheet on December, was as follows:

tableRsRsSundry Creditors,Cash,As Capital,Sundry Debtors,Bs Capital,Stock inTrade,Cs Capital,Loan to AFreehold premises,

A died on January, The firm had affected an assurance of Rs on the joint lives of the three partners and the amount of the policy was realised on Feb, According to the partnership agreement, the goodwill was to be calculated at two years' purchase of average profits of three completed years preceding the death or retirement of a partner. The deceased partners' share of capital and goodwill etc, was Paid out in cash on March, the available cash balance being supplemented by a loan from firm's banker on the security of the freehold property. The net profits of the years and were Rs Rs and Rs respectively. You are required to show the ledger accounts of the partners and the Balance Sheet of B and C as it would stand after As share is paid out.

Answer: Capital balance B Rs C Rs Amount payable to As executors Rs Balance Sheet Rs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started