Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. b. C. Assume there is a population of MBS's. These are non-agency MBS's such as subprime and alt-A MBS's. A set of financial

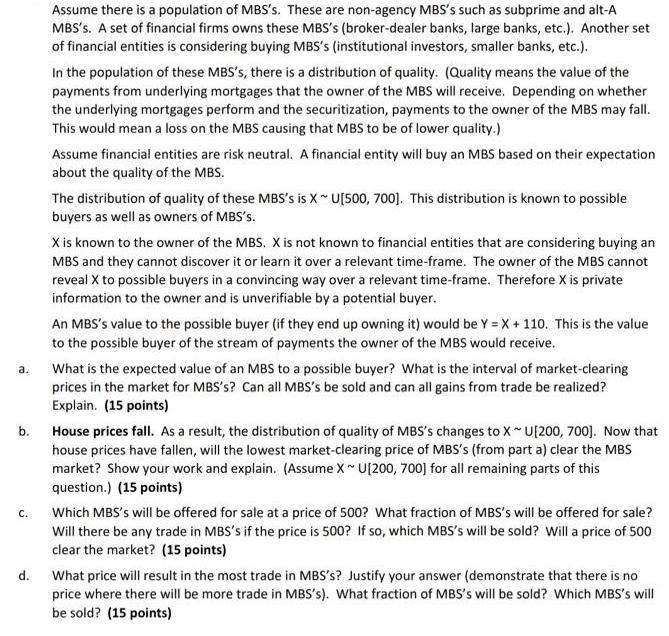

a. b. C. Assume there is a population of MBS's. These are non-agency MBS's such as subprime and alt-A MBS's. A set of financial firms owns these MBS's (broker-dealer banks, large banks, etc.). Another set of financial entities is considering buying MBS's (institutional investors, smaller banks, etc.). In the population of these MBS's, there is a distribution of quality. (Quality means the value of the payments from underlying mortgages that the owner of the MBS will receive. Depending on whether the underlying mortgages perform and the securitization, payments to the owner of the MBS may fall. This would mean a loss on the MBS causing that MBS to be of lower quality.) Assume financial entities are risk neutral. A financial entity will buy an MBS based on their expectation about the quality of the MBS. The distribution of quality of these MBS's is X~ U[500, 700]. This distribution is known to possible buyers as well as owners of MBS's. X is known to the owner of the MBS. X is not known to financial entities that are considering buying an MBS and they cannot discover it or learn it over a relevant time-frame. The owner of the MBS cannot reveal X to possible buyers in a convincing way over a relevant time-frame. Therefore X is private information to the owner and is unverifiable by a potential buyer. An MBS's value to the possible buyer (if they end up owning it) would be Y=X+ 110. This is the value to the possible buyer of the stream of payments the owner of the MBS would receive. What is the expected value of an MBS to a possible buyer? What is the interval of market-clearing prices in the market for MBS's? Can all MBS's be sold and can all gains from trade be realized? Explain. (15 points) House prices fall. As a result, the distribution of quality of MBS's changes to X U[200, 700]. Now that house prices have fallen, will the lowest market-clearing price of MBS's (from part a) clear the MBS market? Show your work and explain. (Assume X~ U[200, 700] for all remaining parts of this question.) (15 points) Which MBS's will be offered for sale at a price of 500? What fraction of MBS's will be offered for sale? Will there be any trade in MBS's if the price is 500? If so, which MBS's will be sold? Will a price of 500 clear the market? (15 points) d. What price will result in the most trade in MBS's? Justify your answer (demonstrate that there is no price where there will be more trade in MBS's). What fraction of MBS's will be sold? Which MBS's will be sold? (15 points)

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a The expected value of an M BS to a possible buyer is Y X 110 or 610 The interval of market cle ari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started