A:

B:

B:

C:

D:

E:

F:

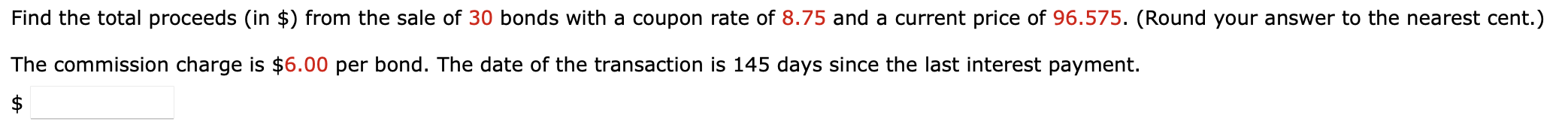

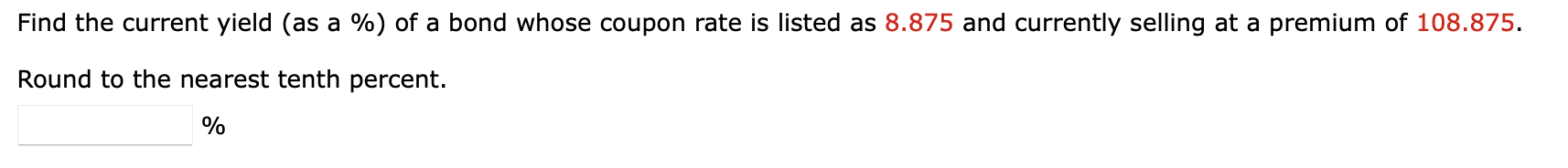

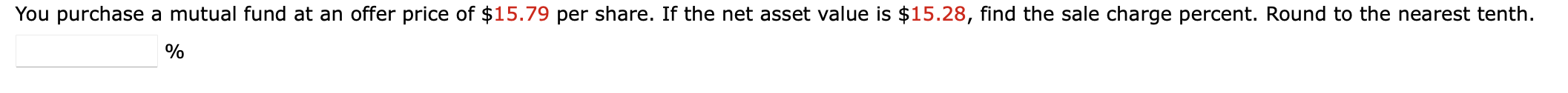

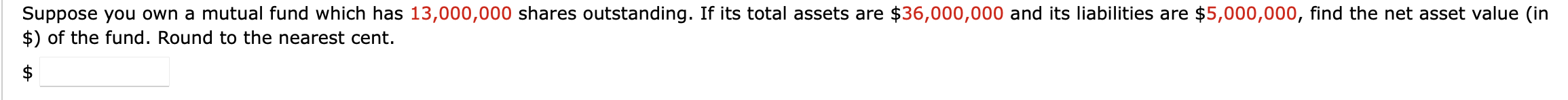

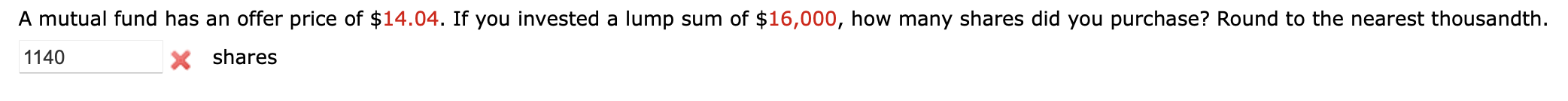

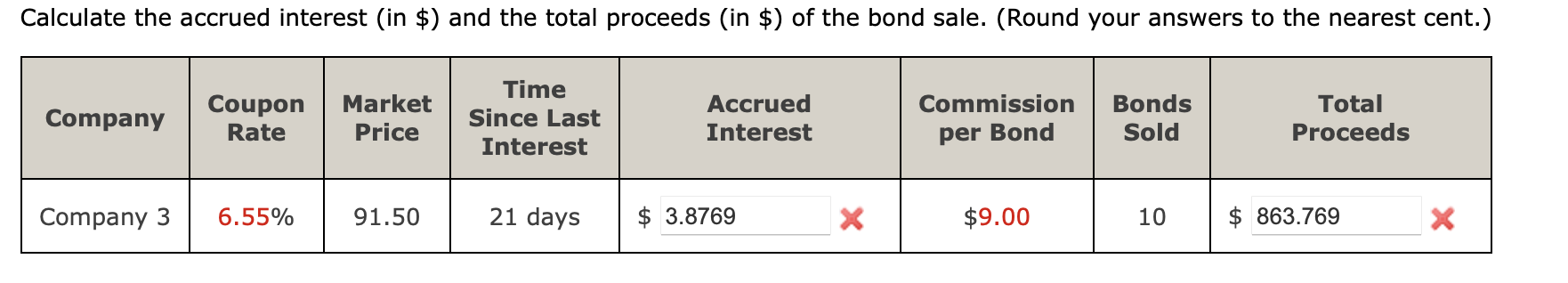

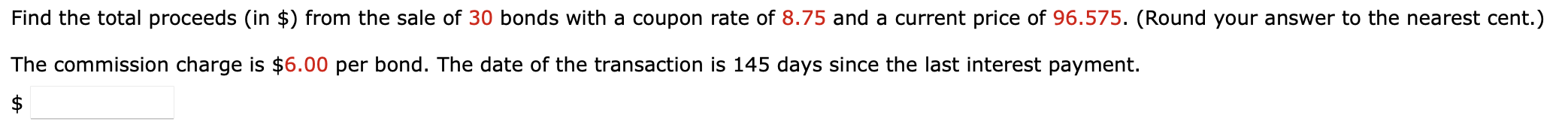

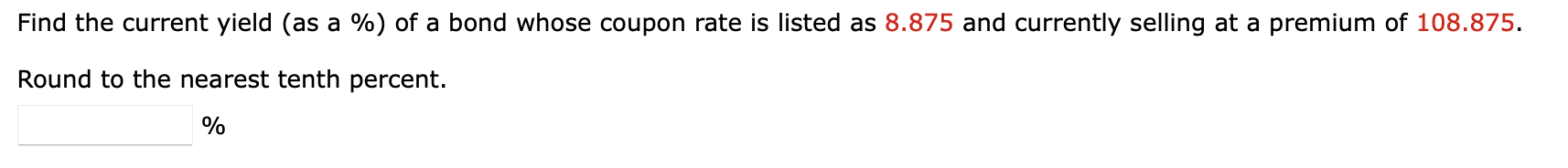

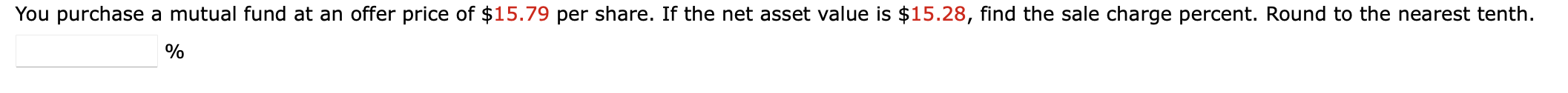

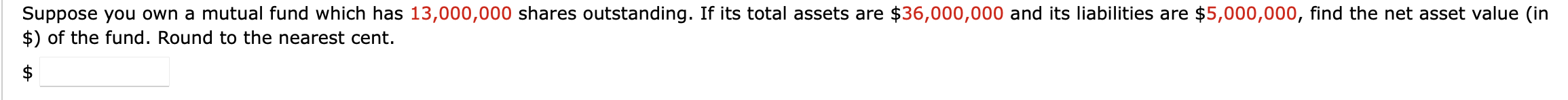

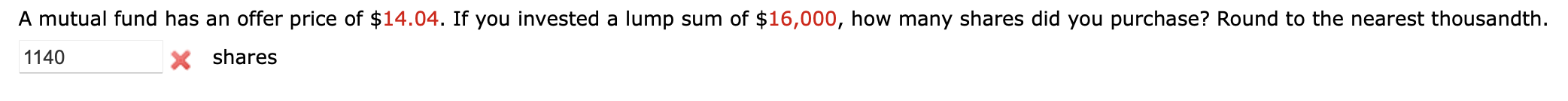

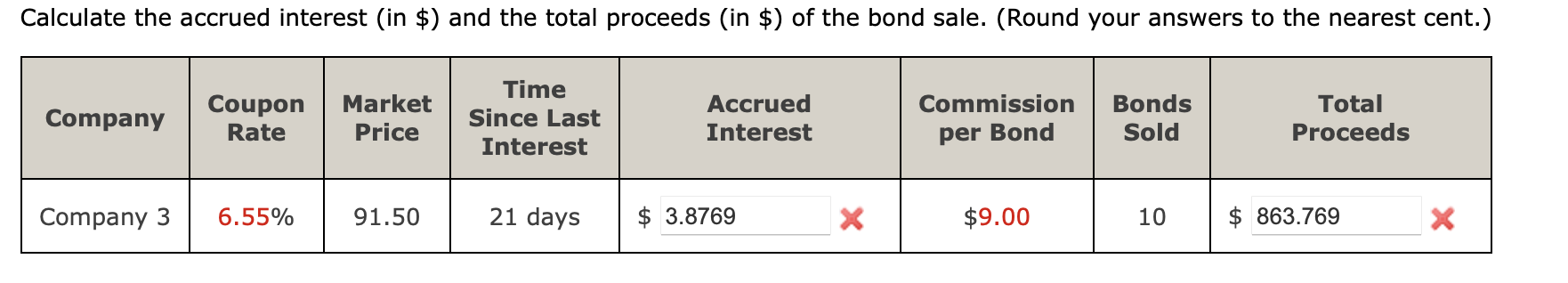

Calculate the accrued interest (in $) and the total proceeds (in $) of the bond sale. (Round your answers to the nearest cent.) Commission Company Coupon Rate Market Price Time Since Last Interest Accrued Interest Bonds Sold Total Proceeds per Bond Company 3 6.55% 91.50 21 days $ 3.8769 X $9.00 10 $ 863.769 X Find the total proceeds (in $) from the sale of 30 bonds with a coupon rate of 8.75 and a current price of 96.575. (Round your answer to the nearest cent.) The commission charge is $6.00 per bond. The date of the transaction is 145 days since the last interest payment. $ Find the current yield (as a % of a bond whose coupon rate is listed as 8.875 and currently selling at a premium of 108.875. Round to the nearest tenth percent. % You purchase a mutual fund at an offer price of $15.79 per share. If the net asset value is $15.28, find the sale charge percent. Round to the nearest tenth. % Suppose you own a mutual fund which has 13,000,000 shares outstanding. If its total assets are $36,000,000 and its liabilities are $5,000,000, find the net asset value (in $) of the fund. Round to the nearest cent. A mutual fund has an offer price of $14.04. If you invested a lump sum of $16,000, how many shares did you purchase? Round to the nearest thousandth. 1140 X shares Calculate the accrued interest (in $) and the total proceeds (in $) of the bond sale. (Round your answers to the nearest cent.) Commission Company Coupon Rate Market Price Time Since Last Interest Accrued Interest Bonds Sold Total Proceeds per Bond Company 3 6.55% 91.50 21 days $ 3.8769 X $9.00 10 $ 863.769 X Find the total proceeds (in $) from the sale of 30 bonds with a coupon rate of 8.75 and a current price of 96.575. (Round your answer to the nearest cent.) The commission charge is $6.00 per bond. The date of the transaction is 145 days since the last interest payment. $ Find the current yield (as a % of a bond whose coupon rate is listed as 8.875 and currently selling at a premium of 108.875. Round to the nearest tenth percent. % You purchase a mutual fund at an offer price of $15.79 per share. If the net asset value is $15.28, find the sale charge percent. Round to the nearest tenth. % Suppose you own a mutual fund which has 13,000,000 shares outstanding. If its total assets are $36,000,000 and its liabilities are $5,000,000, find the net asset value (in $) of the fund. Round to the nearest cent. A mutual fund has an offer price of $14.04. If you invested a lump sum of $16,000, how many shares did you purchase? Round to the nearest thousandth. 1140 X shares

B:

B: