Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a b c d e f g h i j 10 parts images are as large as I can get them! Please try to zoom

a

b

c

d

e

f

g

h

i

j

10 parts

images are as large as I can get them! Please try to zoom in.

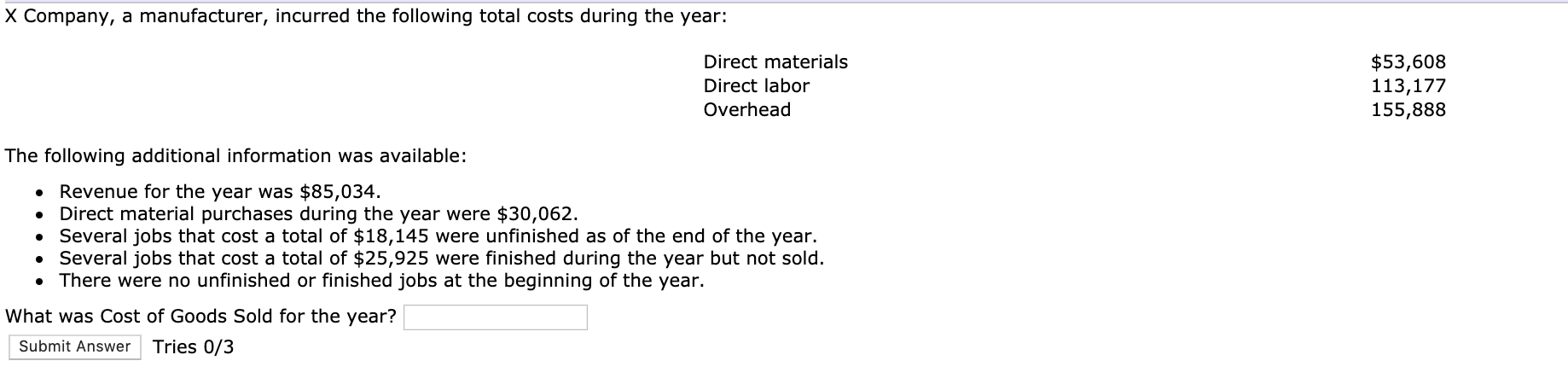

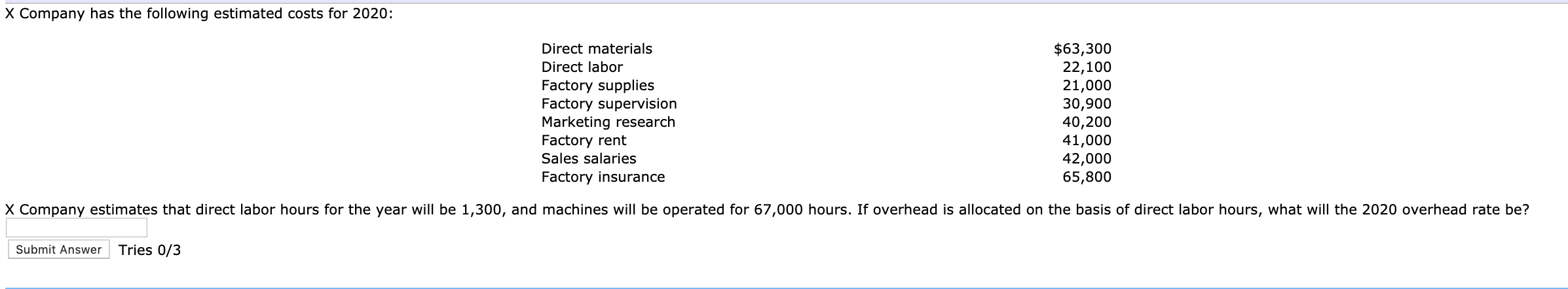

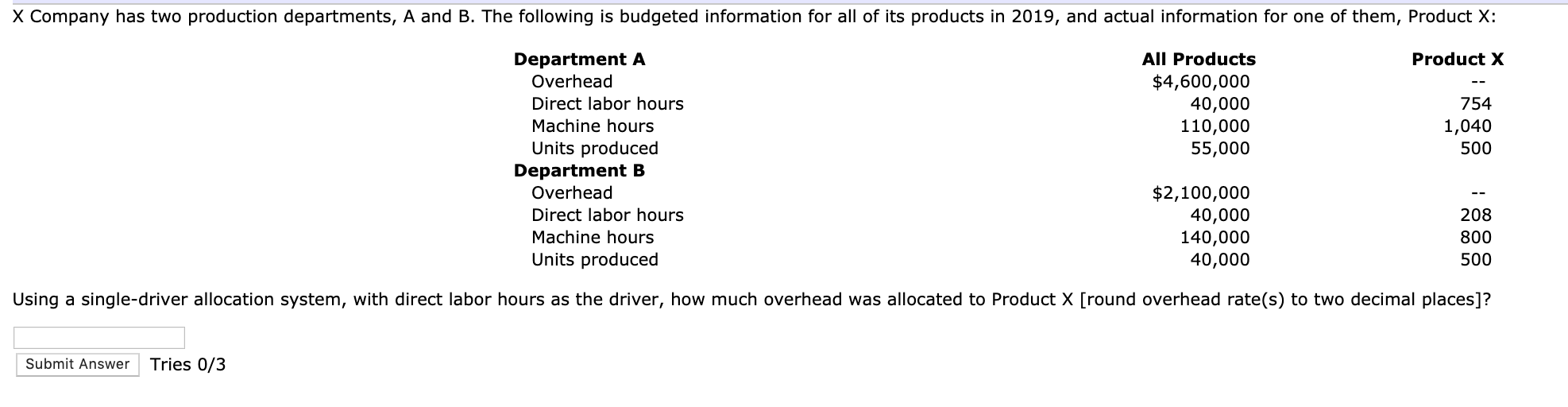

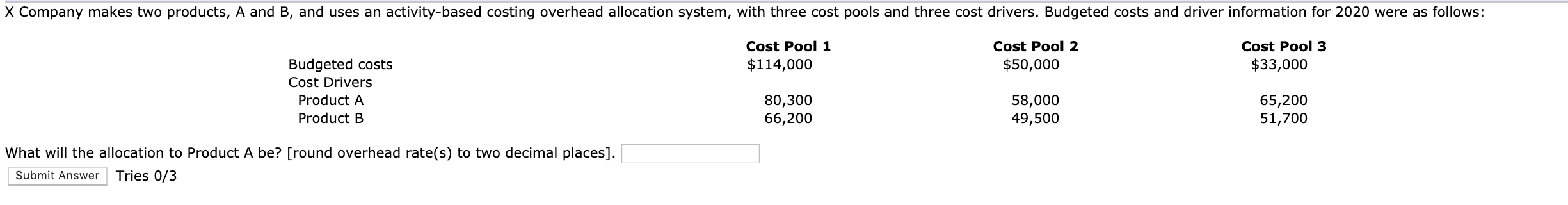

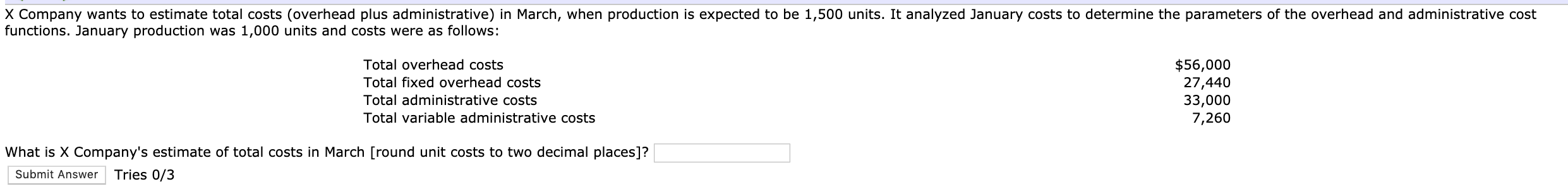

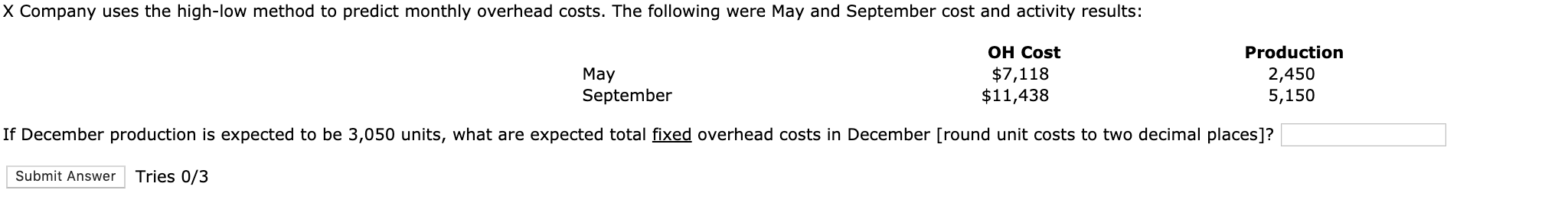

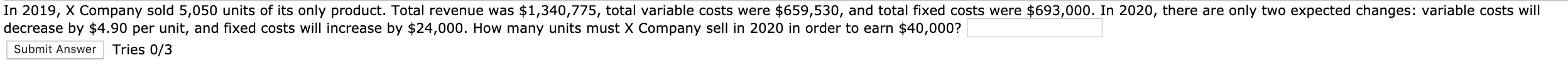

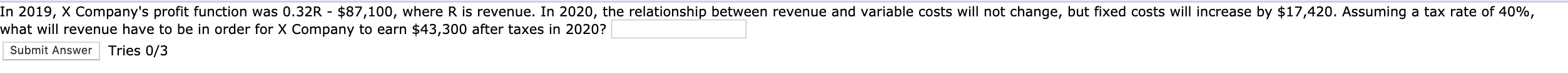

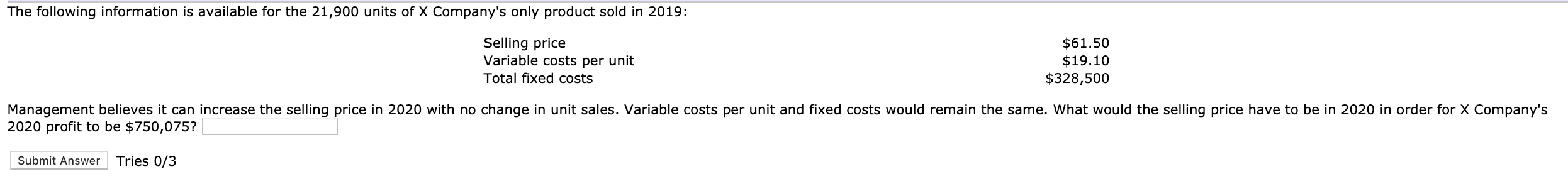

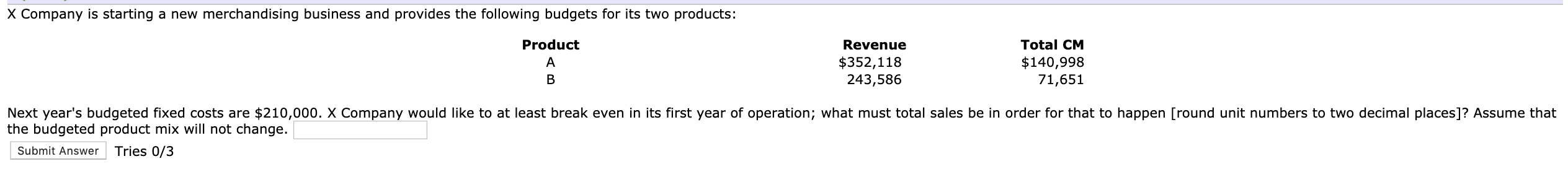

X Company, a manufacturer, incurred the following total costs during the year: Direct materials Direct labor Overhead $53,608 113,177 155,888 The following additional information was available: Revenue for the year was $85,034. Direct material purchases during the year were $30,062. Several jobs that cost a total of $18,145 were unfinished as of the end of the year. Several jobs that cost a total of $25,925 were finished during the year but not sold. There were no unfinished or finished jobs at the beginning of the year. What was Cost of Goods Sold for the year? Submit Answer Tries 0/3 X Company has the following estimated costs for 2020: Direct materials Direct labor Factory supplies Factory supervision Marketing research Factory rent Sales salaries Factory insurance $63,300 22,100 21,000 30,900 40,200 41,000 42,000 65,800 X Company estimates that direct labor hours for the year will be 1,300, and machines will be operated for 67,000 hours. If overhead is allocated on the basis of direct labor hours, what will the 2020 overhead rate be? Submit Answer Tries 0/3 X Company has two production departments, A and B. The following is budgeted information for all of its products in 2019, and actual information for one of them, Product X: Product X -- All Products $4,600,000 40,000 110,000 55,000 754 1,040 500 Department A Overhead Direct labor hours Machine hours Units produced Department B Overhead Direct labor hours Machine hours Units produced $2,100,000 40,000 140,000 40,000 208 800 500 Using a single-driver allocation system, with direct labor hours as the driver, how much overhead was allocated to Product X [round overhead rate(s) to two decimal places]? Submit Answer Tries 0/3 X Company makes two products, A and B, and uses an activity-based costing overhead allocation system, with three cost pools and three cost drivers. Budgeted costs and driver information for 2020 were as follows: Cost Pool 1 $114,000 Cost Pool 2 $50,000 Cost Pool 3 $33,000 Budgeted costs Cost Drivers Product A Product B 80,300 66,200 58,000 49,500 65,200 51,700 What will the allocation to Product A be? [round overhead rate(s) to two decimal places]. Submit Answer Tries 0/3 X Company wants to estimate total costs (overhead plus administrative) in March, when production is expected to be 1,500 units. It analyzed January costs to determine the parameters of the overhead and administrative cost functions. January production was 1,000 units and costs were as follows: Total overhead costs Total fixed overhead costs Total administrative costs Total variable administrative costs $56,000 27,440 33,000 7,260 What is X Company's estimate of total costs in March (round unit costs to two decimal places]? Submit Answer Tries 0/3 X Company uses the high-low method to predict monthly overhead costs. The following were May and September cost and activity results: May OH Cost $7,118 $11,438 Production 2,450 5,150 September If December production is expected to be 3,050 units, what are expected total fixed overhead costs in December [round unit costs to two decimal places]? Submit Answer Tries 0/3 In 2019, X Company sold 5,050 units of its only product. Total revenue was $1,340,775, total variable costs were $659,530, and total fixed costs were $693,000. In 2020, there are only two expected changes: variable costs will decrease by $4.90 per unit, and fixed costs will increase by $24,000. How many units must X Company sell in 2020 in order to earn $40,000? Submit Answer Tries 0/3 In 2019, X Company's profit function was 0.32R - $87,100, where R is revenue. In 2020, the relationship between revenue and variable costs will not change, but fixed costs will increase by $17,420. Assuming a tax rate of 40%, what will revenue have to be in order for X Company to earn $43,300 after taxes in 2020? Submit Answer Tries 0/3 The following information is available for the 21,900 units of X Company's only product sold in 2019: Selling price Variable costs per unit Total fixed costs $61.50 $19.10 $328,500 Management believes it can increase the selling price in 2020 with no change in unit sales. Variable costs per unit and fixed costs would remain the same. What would the selling price have to be in 2020 in order for X Company's 2020 profit to be $750,075? Submit Answer Tries 0/3 X Company is starting a new merchandising business and provides the following budgets for its two products: Product Revenue $352,118 243,586 Total CM $140,998 71,651 B Next year's budgeted fixed costs are $210,000. X Company would like to at least break even in its first year of operation; what must total sales be in order for that to happen [round unit numbers to two decimal places]? Assume that the budgeted product mix will not change. Submit Answer Tries 0/3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started