Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A B C D E F G H I J K L M N O ! Required information The following information applies to the questions

A

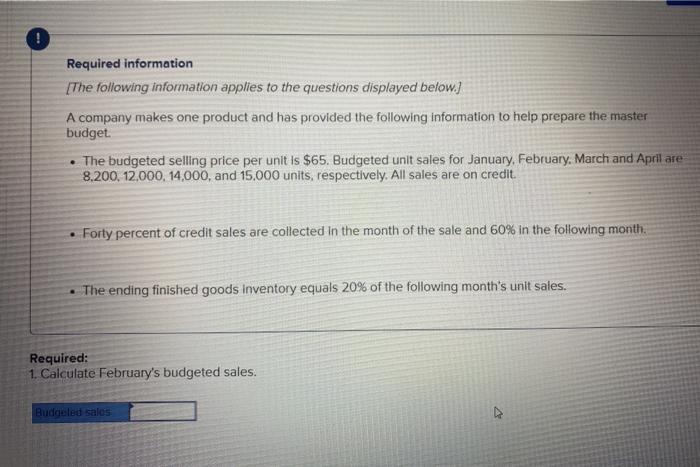

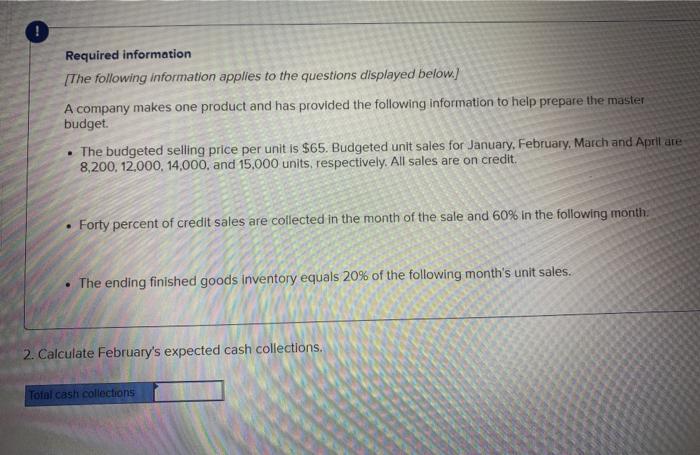

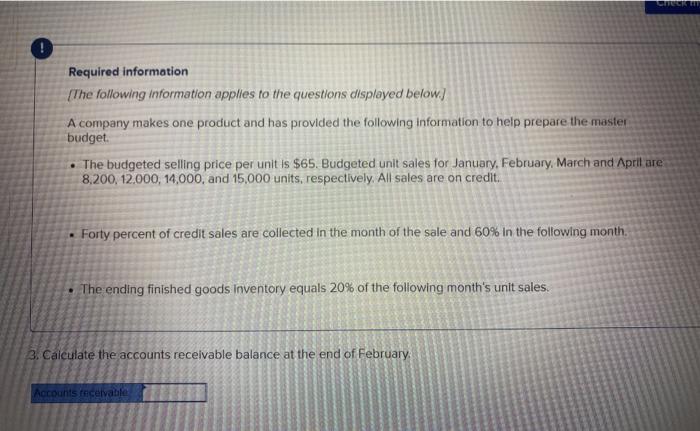

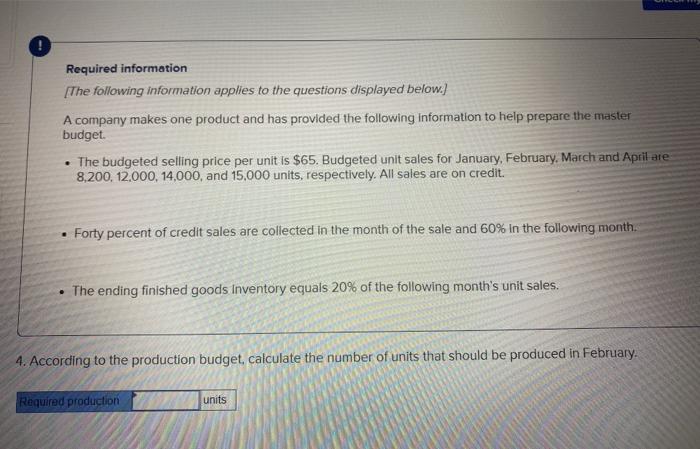

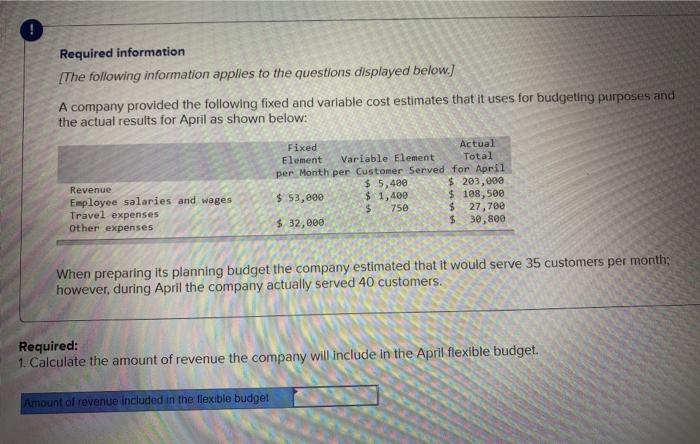

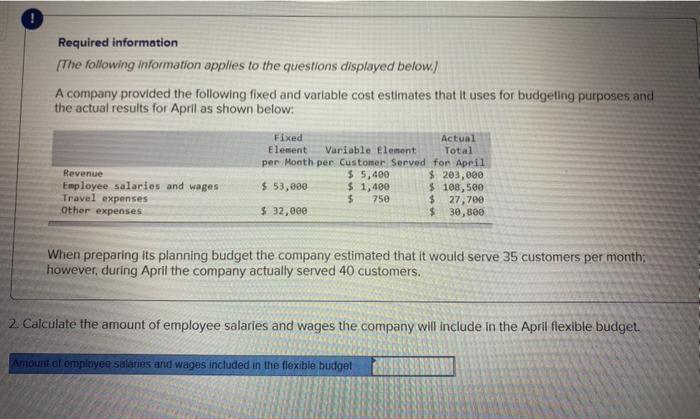

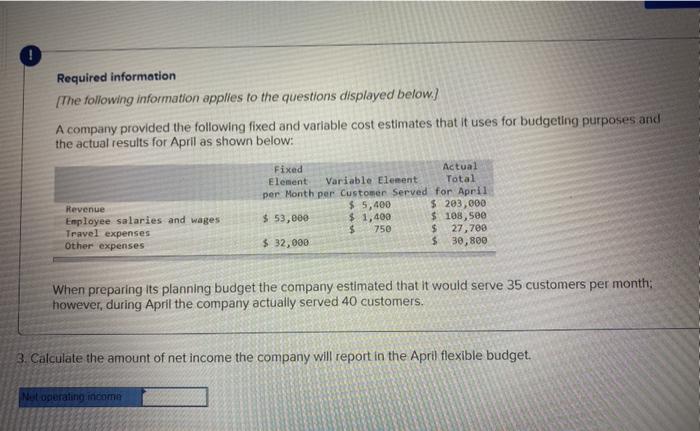

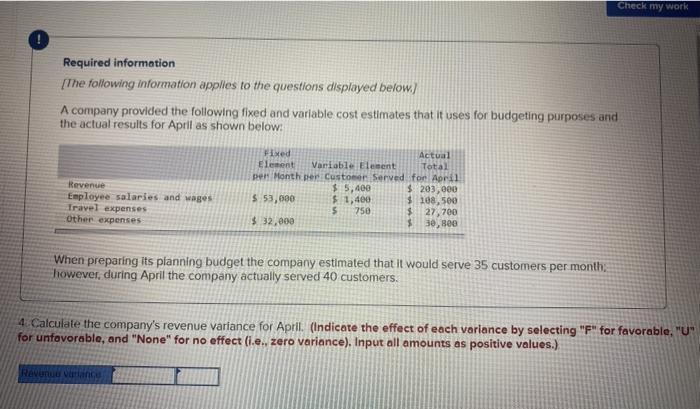

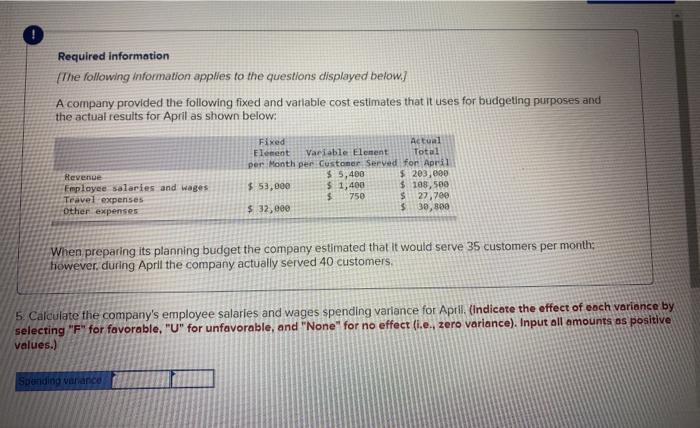

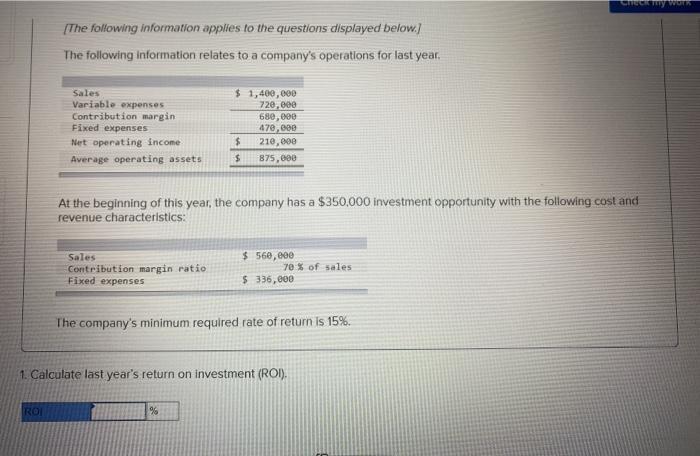

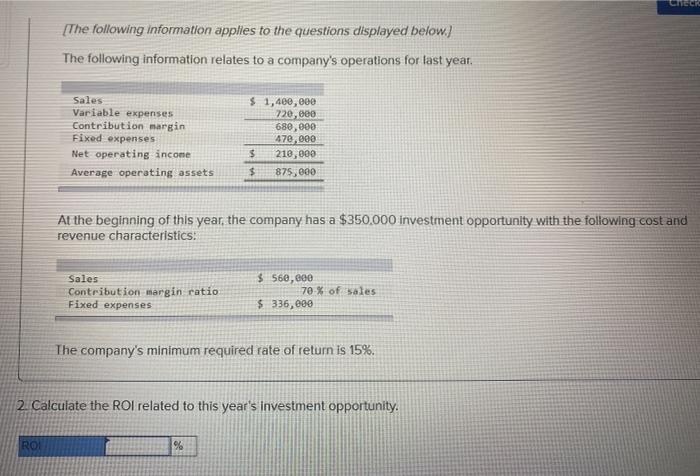

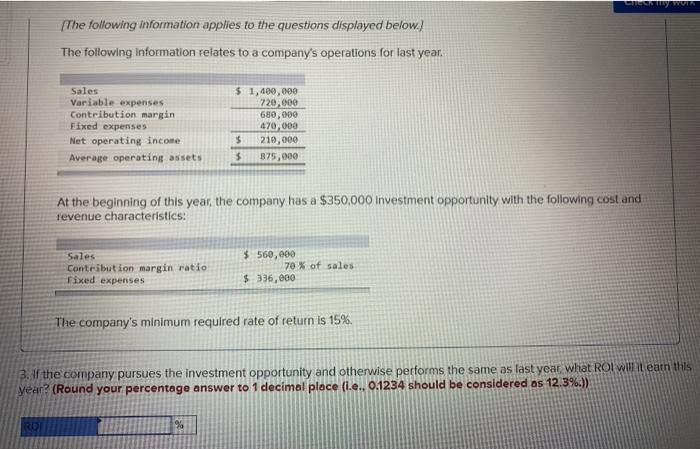

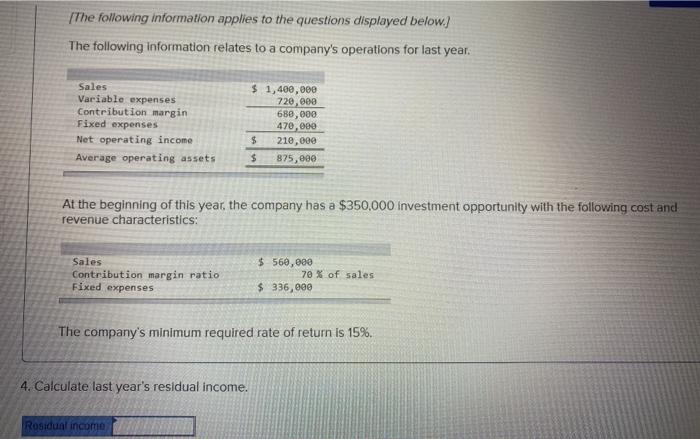

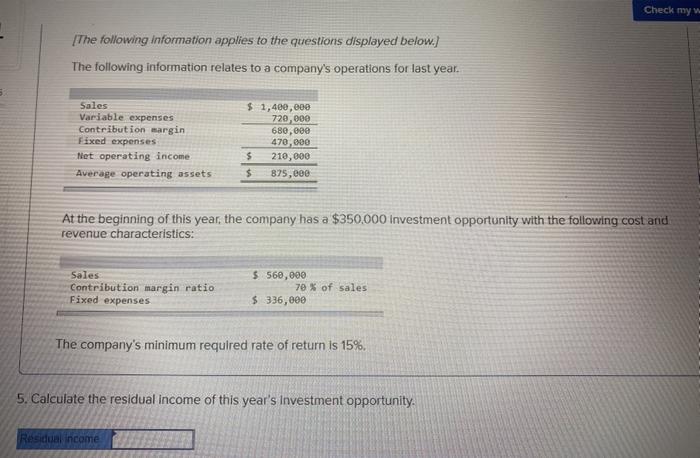

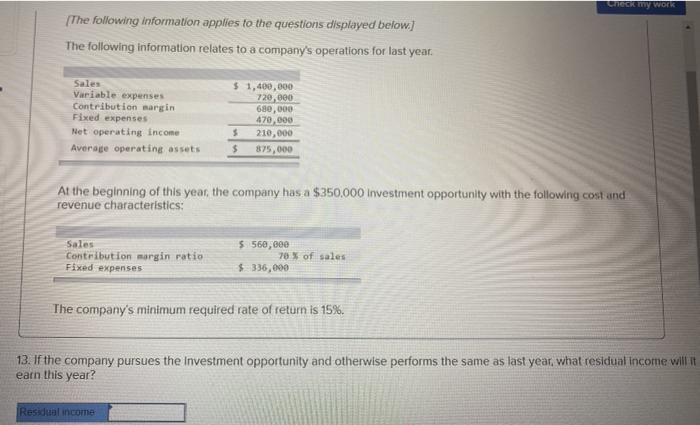

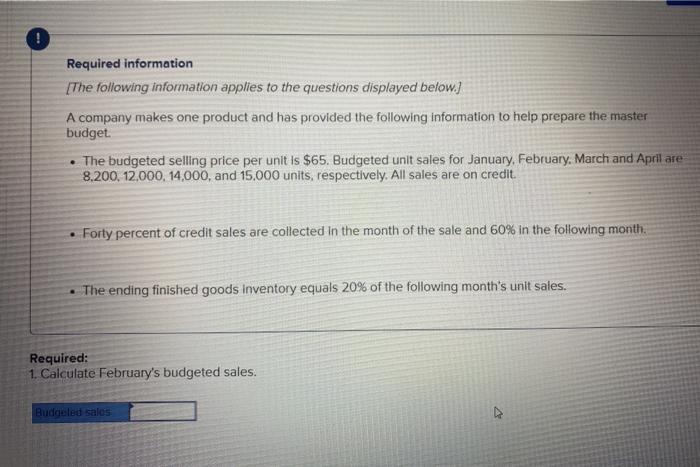

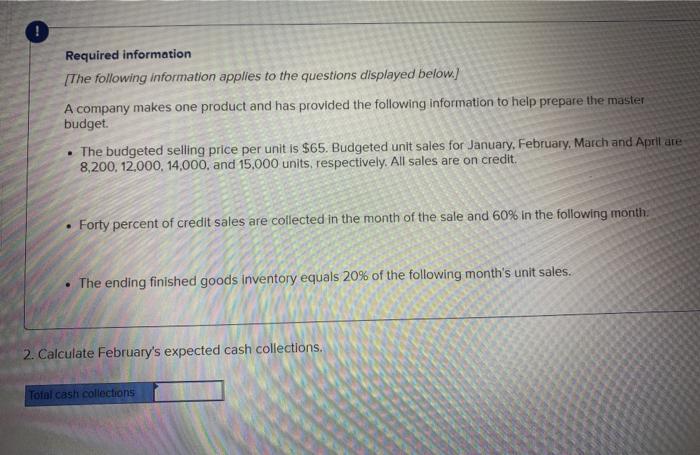

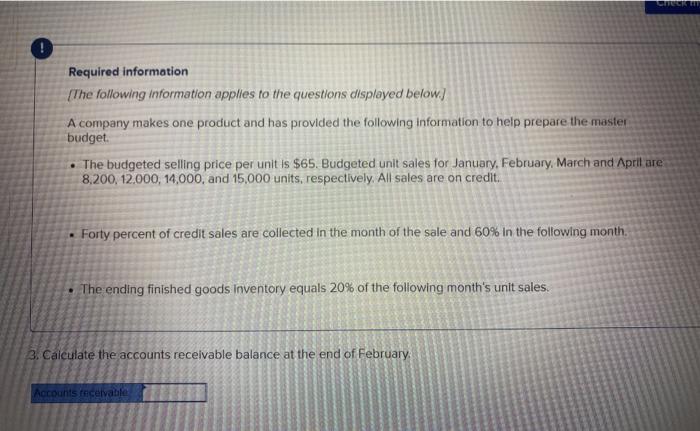

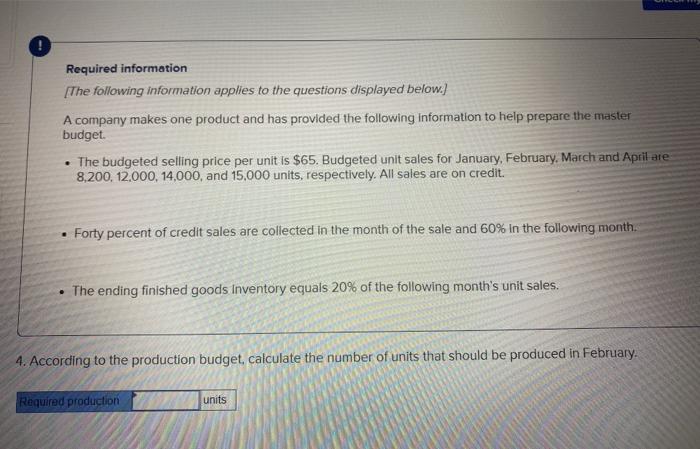

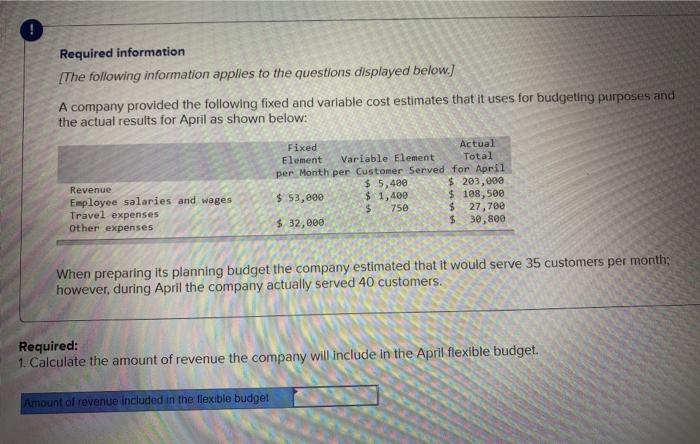

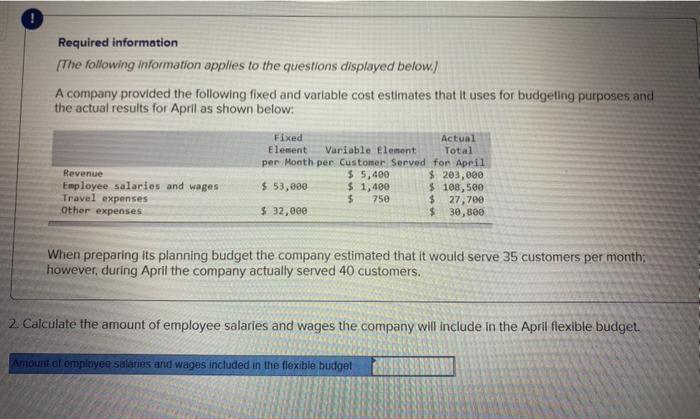

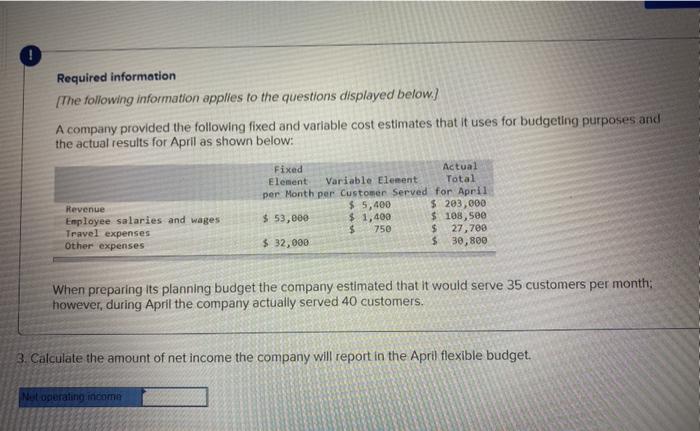

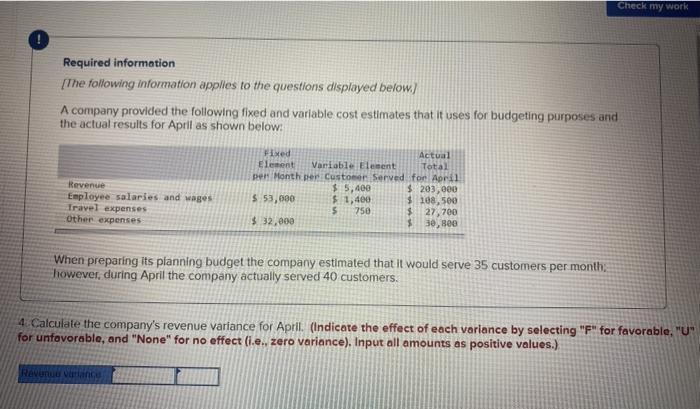

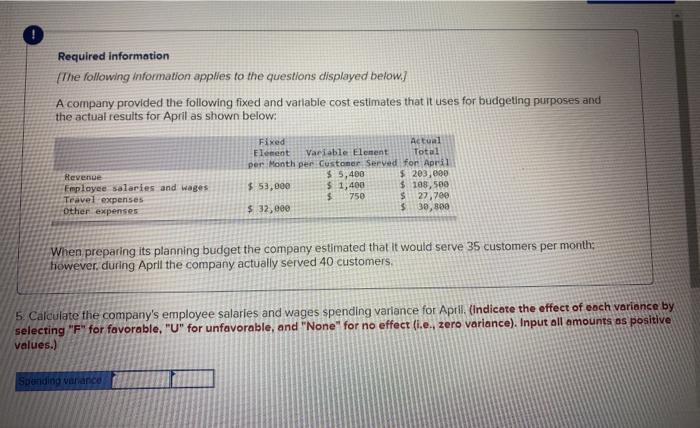

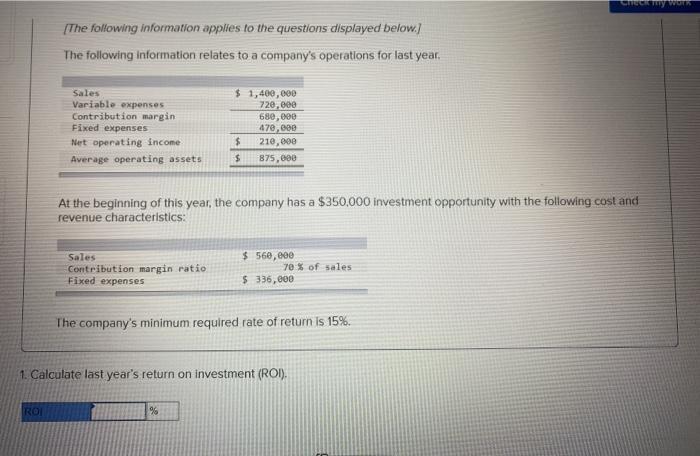

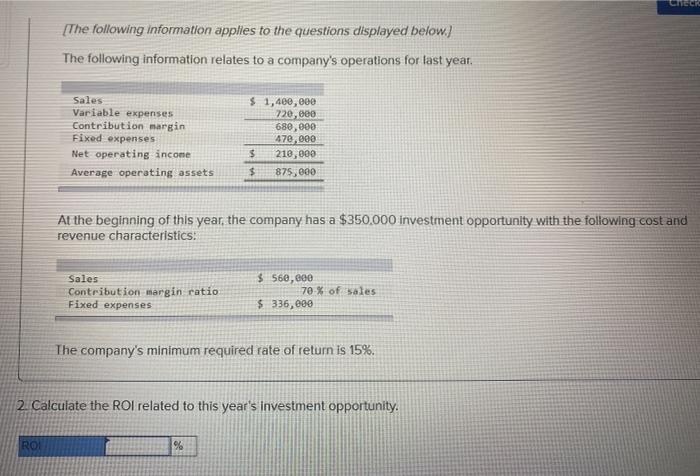

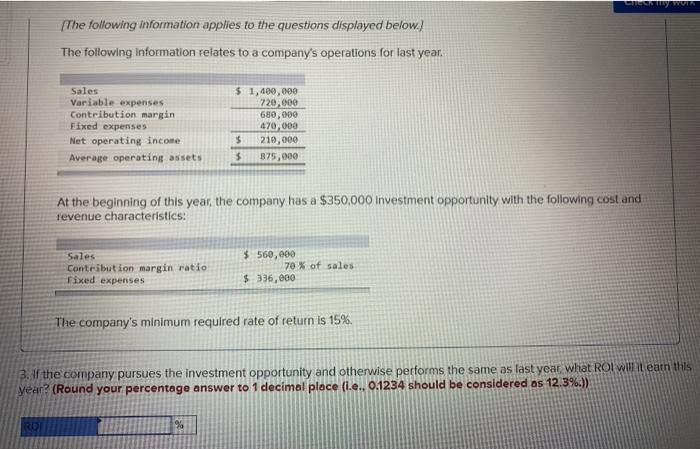

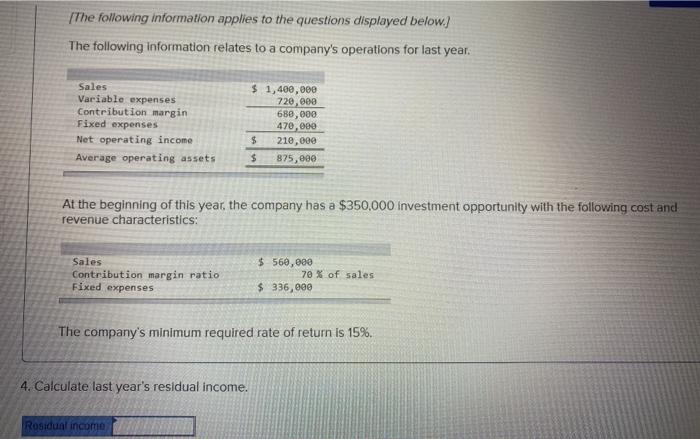

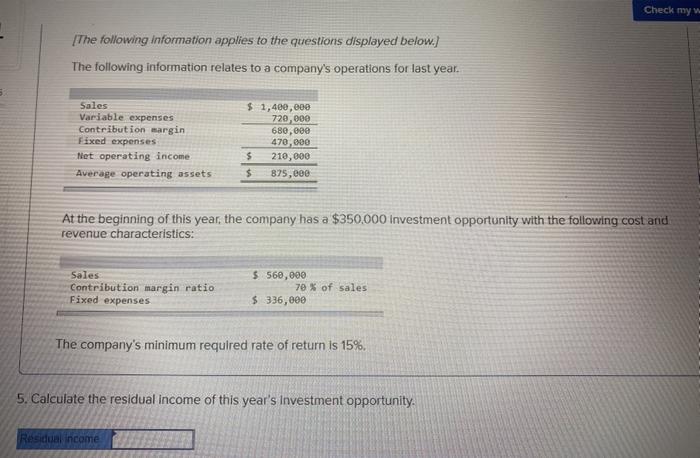

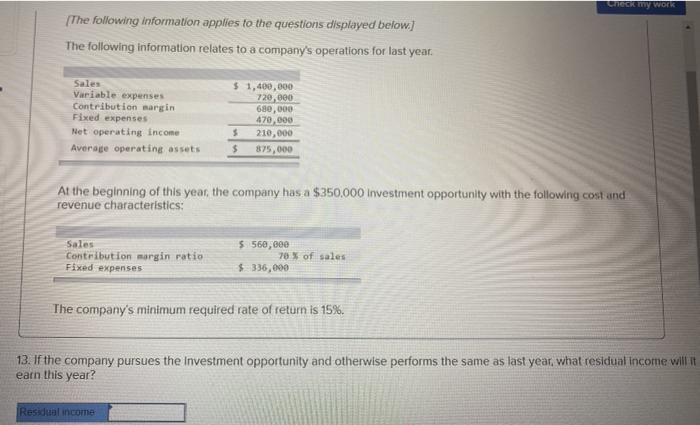

! Required information The following information applies to the questions displayed below.) A company makes one product and has provided the following information to help prepare the master budget. The budgeted selling price per unit is $65. Budgeted unit sales for January, February March and April are 8.200, 12.00014,000, and 15,000 units, respectively. All sales are on credit . Forty percent of credit sales are collected in the month of the sale and 60% in the following month The ending finished goods Inventory equals 20% of the following month's unit sales. Required: 1. Calculate February's budgeted sales. Budgeled salos ! Required information [The following information applies to the questions displayed below.) A company makes one product and has provided the following information to help prepare the master budget . The budgeted selling price per unit is $65. Budgeted unit sales for January, February March and April are 8,200, 12.000, 14,000, and 15,000 units, respectively. All sales are on credit. Forty percent of credit sales are collected in the month of the sale and 60% in the following month The ending finished goods Inventory equals 20% of the following month's unit sales. 2. Calculate February's expected cash collections. Total cash collections CECRL ! Required information [The following information applies to the questions displayed below.) A company makes one product and has provided the following information to help prepare the master budget The budgeted selling price per unit is $65. Budgeted unit sales for January, February March and April are 8,200, 12,000, 14,000, and 15,000 units, respectively. All sales are on credit. . Forty percent of credit sales are collected in the month of the sale and 60% In the following month. The ending finished goods Inventory equals 20% of the following month's unit sales. 3. Calculate the accounts receivable balance at the end of February Accounts receivable Required information [The following information applies to the questions displayed below.) A company makes one product and has provided the following information to help prepare the master budget. The budgeted selling price per unit is $65. Budgeted unit sales for January, February March and April are 8,200, 12,000, 14,000, and 15,000 units, respectively. All sales are on credit. Forty percent of credit sales are collected in the month of the sale and 60% In the following month. The ending finished goods Inventory equals 20% of the following month's unit sales. 4. According to the production budget, calculate the number of units that should be produced in February. Required production units Required information The following information applies to the questions displayed below.) A company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for April as shown below: Revenue Employee salaries and wages Travel expenses Other expenses Fixed Actual Element Variable Element Total per Month per Customer Served for April $5,400 $ 200,000 $ 53,000 $ 1,400 $ 188,500 $ 750 $ 27,700 $ 32,000 $ 30,800 When preparing its planning budget the company estimated that it would serve 35 customers per month however, during April the company actually served 40 customers. Required: 1. Calculate the amount of revenue the company will include in the April flexible budget. Amount of revenue included in the flexible budget Required information [The following information applies to the questions displayed below.) A company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for April as shown below: Revenue Employee salaries and wages Travel expenses Other expenses Fixed Actual Element Variable Element Total per Month per Customer Served for April $5,400 $ 203,000 $ 53,000 $ 1,400 $ 108,500 $ 750 $ 27,700 $ 32,000 $ 30,800 When preparing its planning budget the company estimated that it would serve 35 customers per month however, during April the company actually served 40 customers. 2. Calculate the amount of employee salaries and wages the company will include in the April flexible budget. Amount of omployee salaries and wages included in the flexible budget Required information [The following information applies to the questions displayed below.) A company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for April as shown below: Revenue Employee salaries and wages Travel expenses Other expenses Fixed Actual Element Variable Element Total per Month per Customer Served for April $ 5,400 $ 203,000 $ 53,000 $ 1,400 $ 108,500 $ $ 27,700 $ 32,000 $ 30,800 750 When preparing its planning budget the company estimated that it would serve 35 customers per month; however, during April the company actually served 40 customers. 3. Calculate the amount of net income the company will report in the April flexible budget. Not operating income Check my work Required information The following information applies to the questions displayed below) A company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for April as shown below: Revenue Employee salaries and wages Travel expenses Other expenses Fixed Actual Element Variable Elevent Total per Month De Customer Served for April $ 5,400 $ 203,000 $ 53,000 $1,400 $ 188,500 5 750 $ 27,700 $ 32.000 $ 39,800 When preparing its planning budget the company estimated that it would serve 35 customers per month however, during April the company actually served 40 customers. 4 Calculate the company's revenue variance for April (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Renance Required information The following information applies to the questions displayed below] A company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for April as shown below: Revenue Employee salaries and wages Travel expenses Other expenses Fixed Actual Element Variable Element Total per Month per Customer Served for April $5,400 $203,00 $ 53,000 $ 1,400 $ 108,500 $ 750 $ 27,700 $ 32,000 $ 30,00 When preparing its planning budget the company estimated that it would serve 35 customers per month however, during April the company actually served 40 customers 5. Calculate the company's employee salaries and wages spending variance for April (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Spending variance Checy NOS [The following information applies to the questions displayed below.) The following information relates to a company's operations for last year. Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,400,000 720,000 680,000 470, 800 $ 210,000 $ 875,000 At the beginning of this year, the company has a $350,000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 560,000 70 % of sales $336,000 The company's minimum required rate of return is 15%. 1. Calculate last year's return on investment (ROI). RO % CICER [The following information applies to the questions displayed below.) The following information relates to a company's operations for last year, Sales Variable expenses Contribution margin Fixed expenses Net operating incone Average operating assets $ 1,400,000 720,000 680,000 470,000 $ 218,000 $ 875,000 At the beginning of this year, the company has a $350.000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 560,000 70 % of Sales $336,000 The company's minimum required rate of return is 15%. 2. Calculate the ROI related to this year's investment opportunity. RO % [The following information applies to the questions displayed below) The following Information relates to a company's operations for last year. Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,400,000 720,000 680,000 470,000 $ 210,000 5 375,000 At the beginning of this year, the company has a $350,000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 560,000 70 % of sales $ 336,000 The company's minimum required rate of return is 15%. 3. If the company pursues the investment opportunity and otherwise performs the same as last year what ROI weatn this year? (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%.)) ROL % The following information applies to the questions displayed below.) The following information relates to a company's operations for last year. Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,400,000 720,000 680,000 470.000 $ 210,000 $ 875,000 At the beginning of this year, the company has a $350,000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 560,000 70 % of sales $ 336,800 The company's minimum required rate of return is 15%. 4. Calculate last year's residual income. Rosidual income Check my The following information applies to the questions displayed below.) The following information relates to a company's operations for last year. Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,400,000 720,000 680,000 470,000 $ 210,000 $ 875,000 At the beginning of this year, the company has a $350.000 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses $ 560,000 70 % of sales $336,000 The company's minimum required rate of return is 15% 5. Calculate the residual income of this year's Investment opportunity Residual income Check my work The following information applies to the questions displayed below.) The following information relates to a company's operations for last year. Sales Variable expenses Contribution margin Fixed expenses Net operating income Average operating assets $ 1,400,000 720,000 680,000 470.000 $ 210,000 $ 375,000 At the beginning of this year, the company has a $350,000 Investment opportunity with the following cost and revenue characteristics: Sales Contribution margin patio Fixed expenses $ 560,000 78 % of sales $336,000 The company's minimum required rate of return is 15%. 13. If the company pursues the Investment opportunity and otherwise performs the same as last year what residual income willit earn this year? Residual income

B

C

D

E

F

G

H

I

J

K

L

M

N

O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started