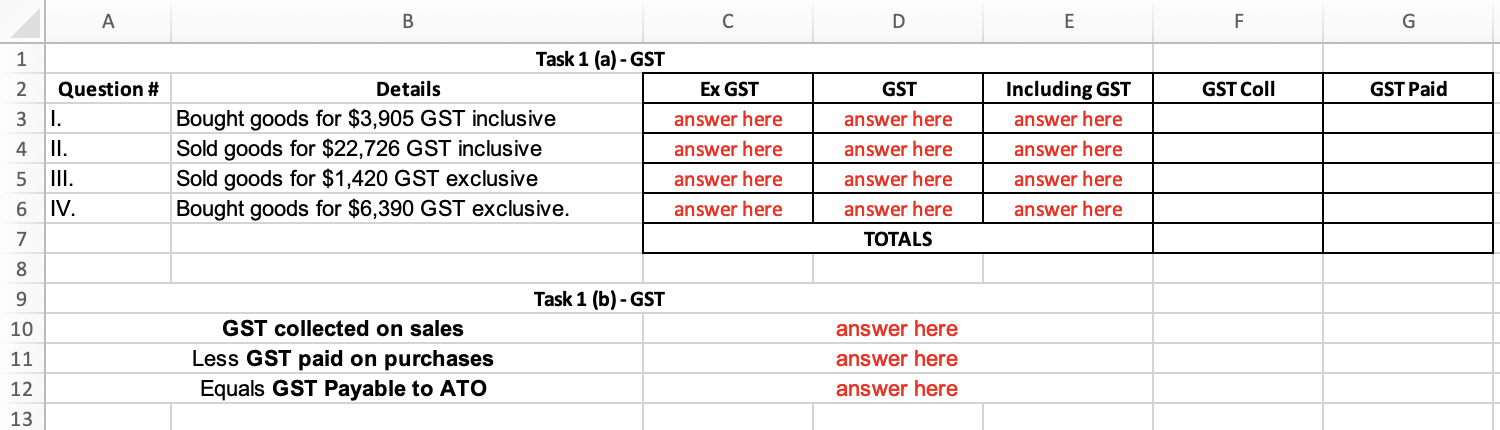

A B C D E F G Task 1 (a) - GST Question # Details Bought goods for $3,905 GST inclusive Sold goods for

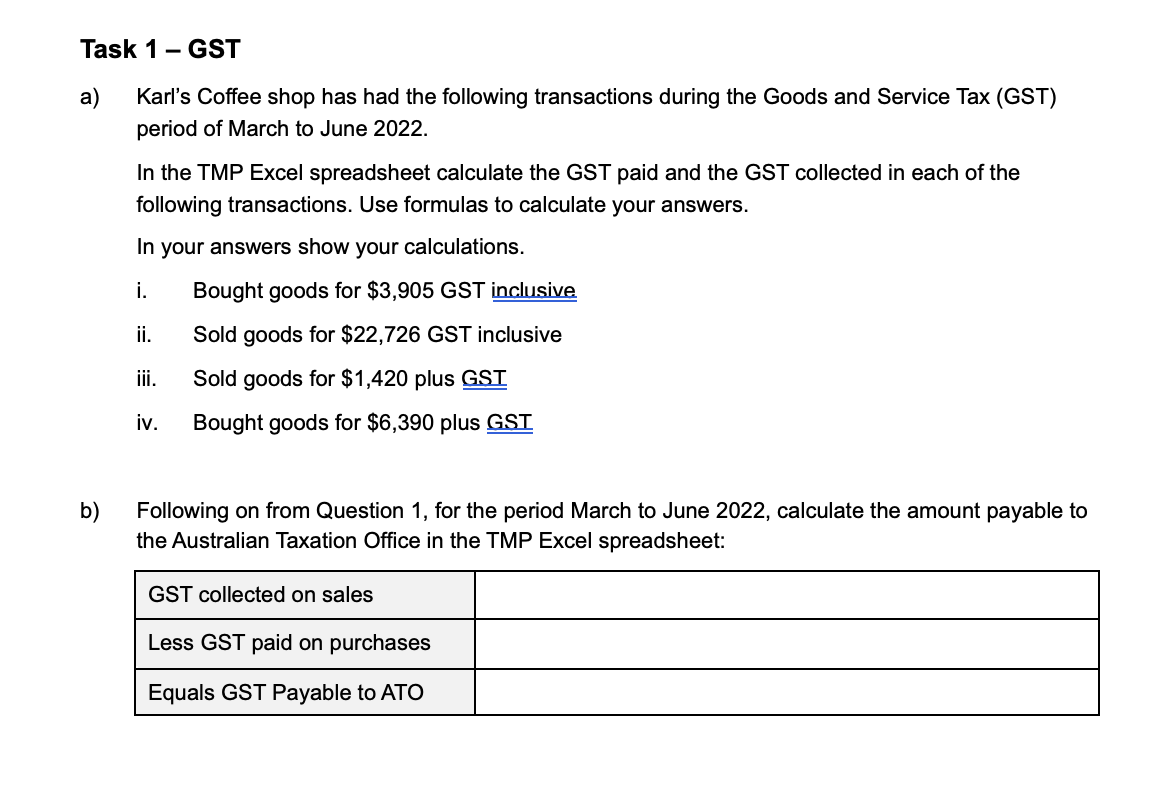

A B C D E F G Task 1 (a) - GST Question # Details Bought goods for $3,905 GST inclusive Sold goods for $22,726 GST inclusive Sold goods for $1,420 GST exclusive Ex GST answer here GST answer here Including GST GST Coll GST Paid answer here answer here answer here answer here answer here answer here answer here Bought goods for $6,390 GST exclusive. answer here answer here answer here TOTALS 12345678 3 1. 4 II. 5 III. 6 IV. 9 10 11 12 13 GST collected on sales Less GST paid on purchases Equals GST Payable to ATO Task 1 (b) - GST answer here answer here answer here Task 1 a) - GST Karl's Coffee shop has had the following transactions during the Goods and Service Tax (GST) period of March to June 2022. In the TMP Excel spreadsheet calculate the GST paid and the GST collected in each of the following transactions. Use formulas to calculate your answers. In your answers show your calculations. i. Bought goods for $3,905 GST inclusive ii. Sold goods for $22,726 GST inclusive iii. Sold goods for $1,420 plus GST iv. Bought goods for $6,390 plus GST b) Following on from Question 1, for the period March to June 2022, calculate the amount payable to the Australian Taxation Office in the TMP Excel spreadsheet: GST collected on sales Less GST paid on purchases Equals GST Payable to ATO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets work through each part of the question step by step Task 1 a GST For each transaction we need t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started