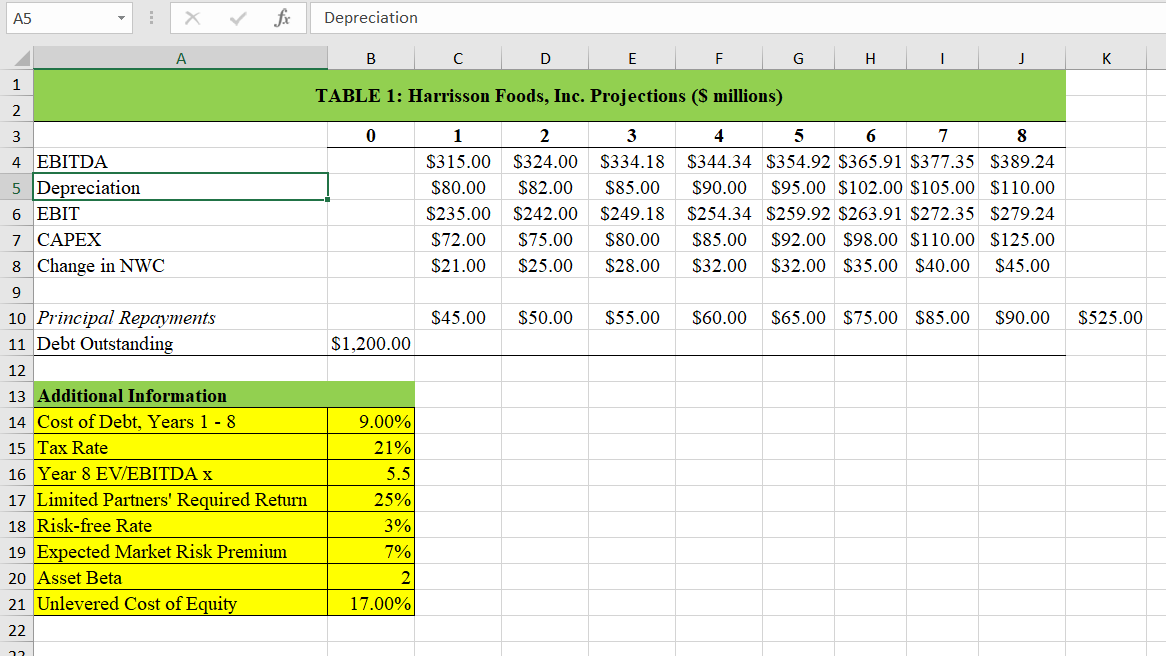

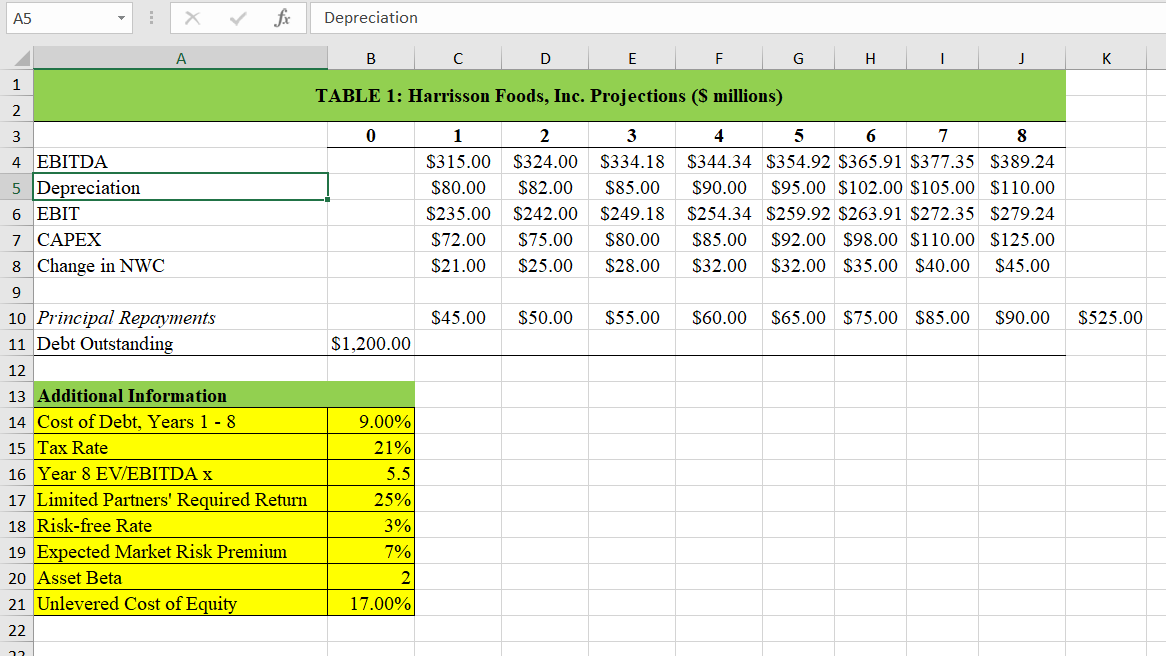

A B C D E F H M N P Section II: Numerical Question (62 points) Harrison Foods Inc., is an all-equity firm with a cost of capital of 17.0% 1 A PE fund is looking to purchase Harrison Foods in a leveraged buyout (LBO) transaction. $1.2 billion ($1.200 million) of the purchase price will be financed through debt carrying an interest rate of 9.0%. The debt will be paid down over the next 8 years based on a pre-determined schedule of principal repayments. The PE fund believes that Harrison Foods will have a terminal EV/EBITDA multiple of 5.5x (at the end of Year 8). The corporate tax rate is 21%. The Excel Sheet Harrison Foods shows the principal repayment schedule as well as Harrison Foods projected financials during PE funds investment period a Suppose the equity holders' (i.e. limited partners') in the PE fund require a rate of return of 25% on their equity investment. a i. What is the maximum that the limited partners will be willing to contribute towards the purchase of Harrison Foods ? [25 points) ii. Based on your answer to (1) above, what is the maximum that the PE fund can bid for Harrison Foods today? [3 points] b. Implement the recursive flow to equity approach to determine the maximum the PE fund can bid for Harrison Foods Inc., today. How does your answer compare to [a(ii)] above? Why are the answers different? [25 points] Suppose you weren't told (as above) that Harrison Foods' expected EV/EBITDA exit multiple is 5.5x. Instead, you believe that after Year 8 Harrisson Foods will maintain its Year 8 debt ratio indefinitely and that (financial) cash flows will grow at 3%. How would you estimate Harrisson Foods Terminal Value based on this information? Clearly state any assumptions you make. points] Footnotes: (1) Calculated using Harrison Food's unlevered beta of 2.0.risk-free rate of 3% and expected market risk premium of 7%. (2) Interest expense in any given year is calculated using beginning of year debt balance: Interest Expense, = Interest Rate x Debt Balanace-1 A5 X fx Depreciation A B D E F G H J K 1 TABLE 1: Harrisson Foods, Inc. Projections (S millions) 2 0 1 $315.00 $80.00 $235.00 $72.00 $21.00 2 $324.00 $82.00 $242.00 $75.00 $25.00 3 $334.18 $85.00 $249.18 $80.00 $28.00 4 5 6 7 8 $344.34 $354.92 $365.91 $377.35 $389.24 $90.00 $95.00 $102.00 $105.00 $110.00 $254.34 $259.92 $263.91 $272.35 $279.24 $85.00 $92.00 $98.00 $110.00 $125.00 $32.00 $32.00 $35.00 $40.00 $45.00 $45.00 $50.00 $55.00 $60.00 $65.00 $75.00 $85.00 $90.00 $525.00 $1,200.00 3 4 EBITDA 5 Depreciation 6 EBIT 7 CAPEX 8 Change in NWC 9 10 Principal Repayments 11 Debt Outstanding 12 13 Additional Information 14 Cost of Debt, Years 1 - 8 15 Tax Rate 16 Year 8 EV/EBITDA X 17 Limited Partners' Required Return 18 Risk-free Rate 19 Expected Market Risk Premium 20 Asset Beta 21 Unlevered Cost of Equity 22 9.00% 21% 5.5 25% 3% 7% 2 17.00% A B C D E F H M N P Section II: Numerical Question (62 points) Harrison Foods Inc., is an all-equity firm with a cost of capital of 17.0% 1 A PE fund is looking to purchase Harrison Foods in a leveraged buyout (LBO) transaction. $1.2 billion ($1.200 million) of the purchase price will be financed through debt carrying an interest rate of 9.0%. The debt will be paid down over the next 8 years based on a pre-determined schedule of principal repayments. The PE fund believes that Harrison Foods will have a terminal EV/EBITDA multiple of 5.5x (at the end of Year 8). The corporate tax rate is 21%. The Excel Sheet Harrison Foods shows the principal repayment schedule as well as Harrison Foods projected financials during PE funds investment period a Suppose the equity holders' (i.e. limited partners') in the PE fund require a rate of return of 25% on their equity investment. a i. What is the maximum that the limited partners will be willing to contribute towards the purchase of Harrison Foods ? [25 points) ii. Based on your answer to (1) above, what is the maximum that the PE fund can bid for Harrison Foods today? [3 points] b. Implement the recursive flow to equity approach to determine the maximum the PE fund can bid for Harrison Foods Inc., today. How does your answer compare to [a(ii)] above? Why are the answers different? [25 points] Suppose you weren't told (as above) that Harrison Foods' expected EV/EBITDA exit multiple is 5.5x. Instead, you believe that after Year 8 Harrisson Foods will maintain its Year 8 debt ratio indefinitely and that (financial) cash flows will grow at 3%. How would you estimate Harrisson Foods Terminal Value based on this information? Clearly state any assumptions you make. points] Footnotes: (1) Calculated using Harrison Food's unlevered beta of 2.0.risk-free rate of 3% and expected market risk premium of 7%. (2) Interest expense in any given year is calculated using beginning of year debt balance: Interest Expense, = Interest Rate x Debt Balanace-1 A5 X fx Depreciation A B D E F G H J K 1 TABLE 1: Harrisson Foods, Inc. Projections (S millions) 2 0 1 $315.00 $80.00 $235.00 $72.00 $21.00 2 $324.00 $82.00 $242.00 $75.00 $25.00 3 $334.18 $85.00 $249.18 $80.00 $28.00 4 5 6 7 8 $344.34 $354.92 $365.91 $377.35 $389.24 $90.00 $95.00 $102.00 $105.00 $110.00 $254.34 $259.92 $263.91 $272.35 $279.24 $85.00 $92.00 $98.00 $110.00 $125.00 $32.00 $32.00 $35.00 $40.00 $45.00 $45.00 $50.00 $55.00 $60.00 $65.00 $75.00 $85.00 $90.00 $525.00 $1,200.00 3 4 EBITDA 5 Depreciation 6 EBIT 7 CAPEX 8 Change in NWC 9 10 Principal Repayments 11 Debt Outstanding 12 13 Additional Information 14 Cost of Debt, Years 1 - 8 15 Tax Rate 16 Year 8 EV/EBITDA X 17 Limited Partners' Required Return 18 Risk-free Rate 19 Expected Market Risk Premium 20 Asset Beta 21 Unlevered Cost of Equity 22 9.00% 21% 5.5 25% 3% 7% 2 17.00%