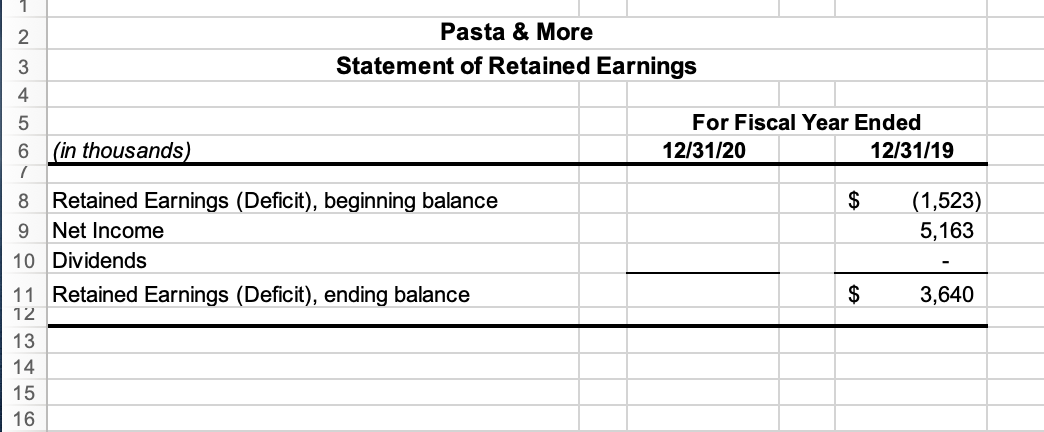

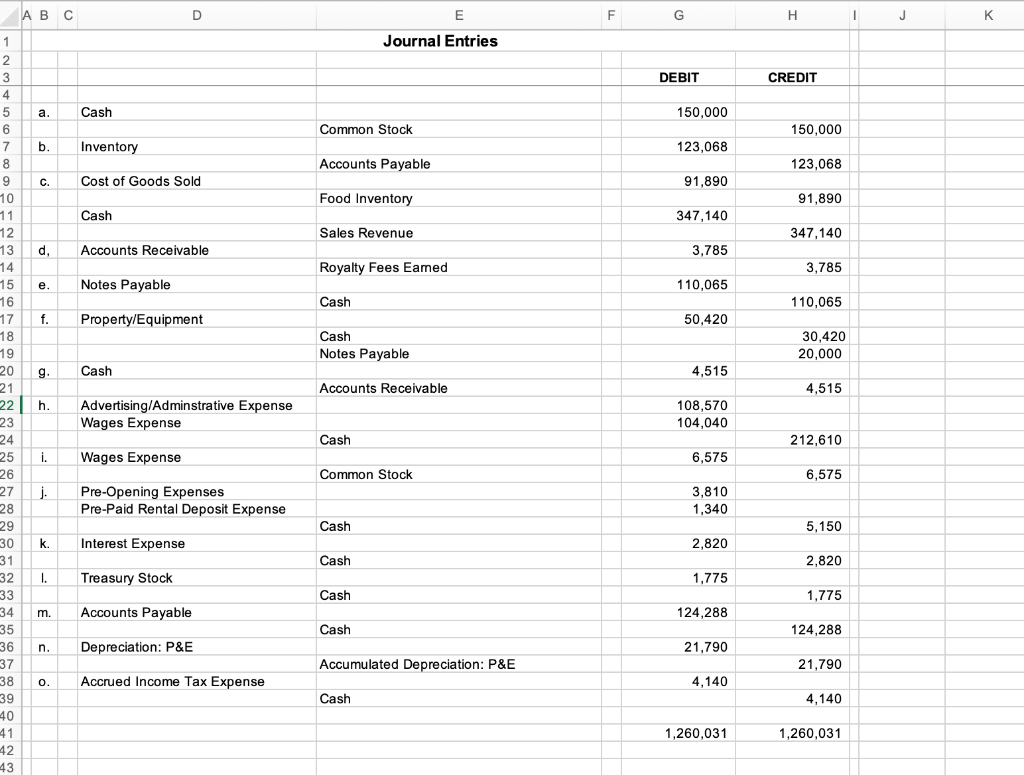

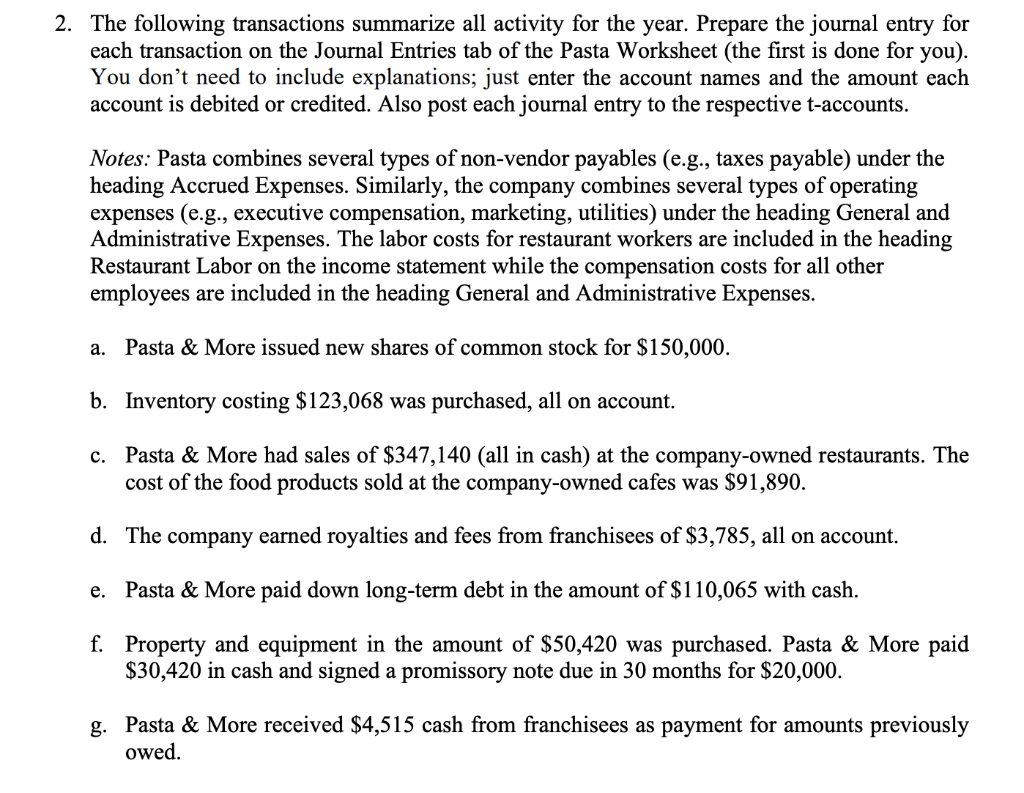

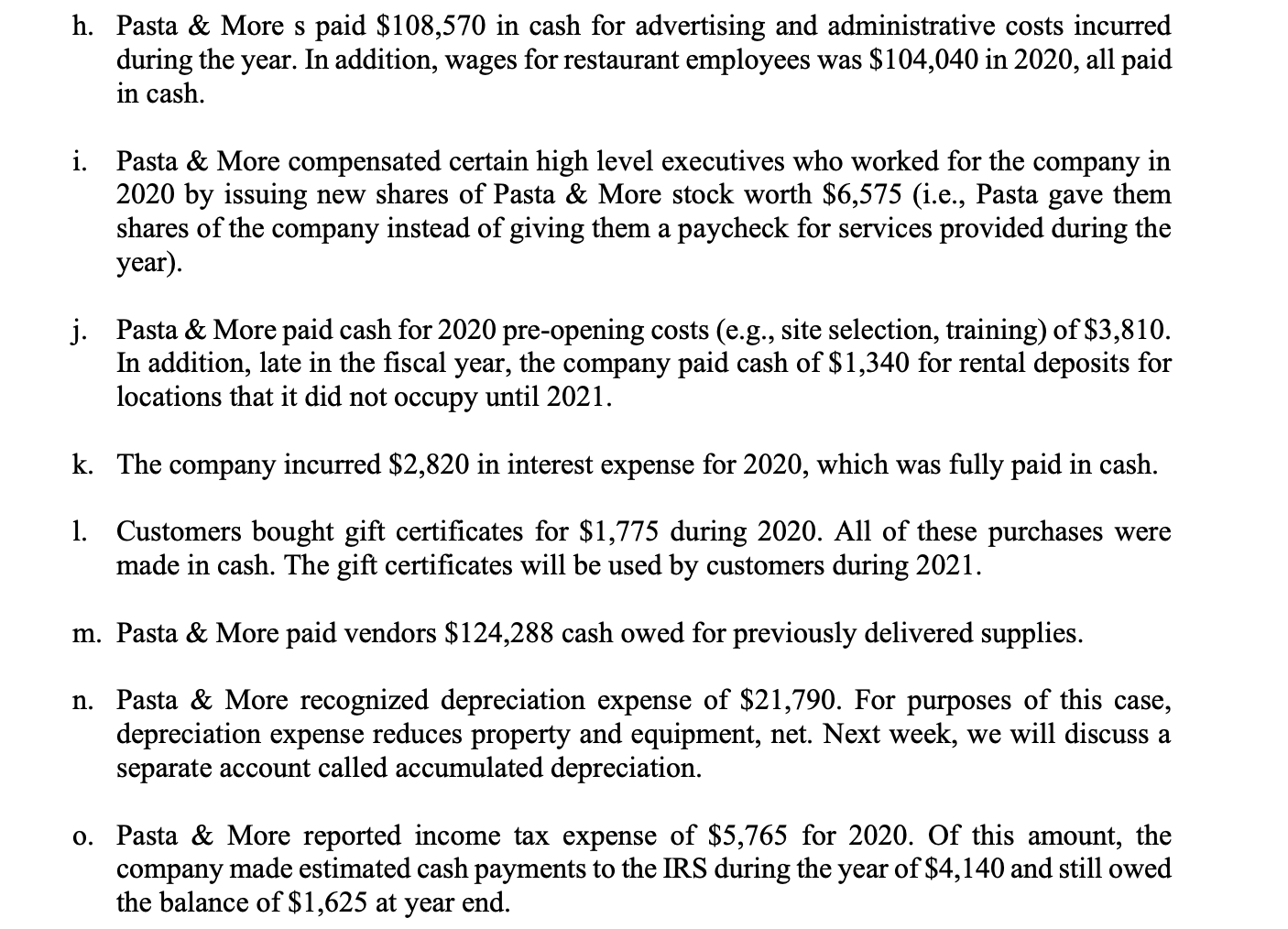

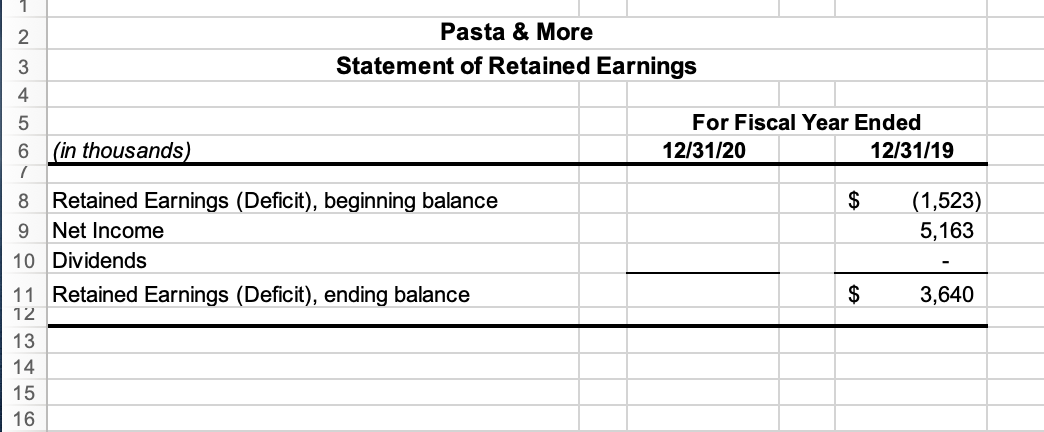

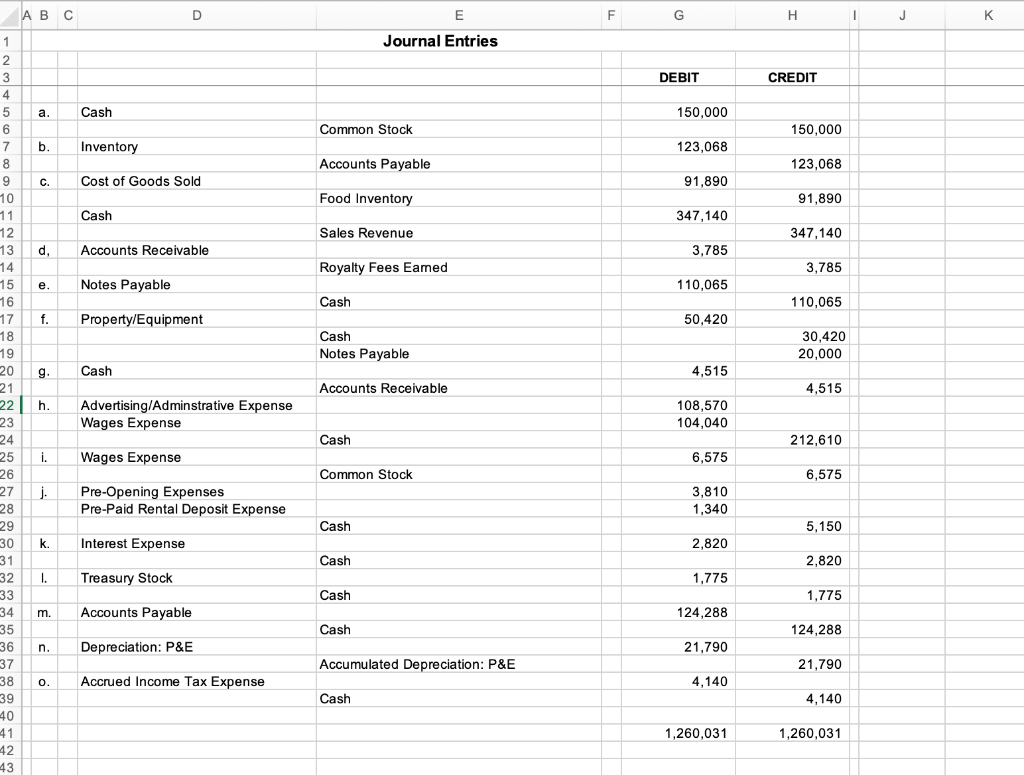

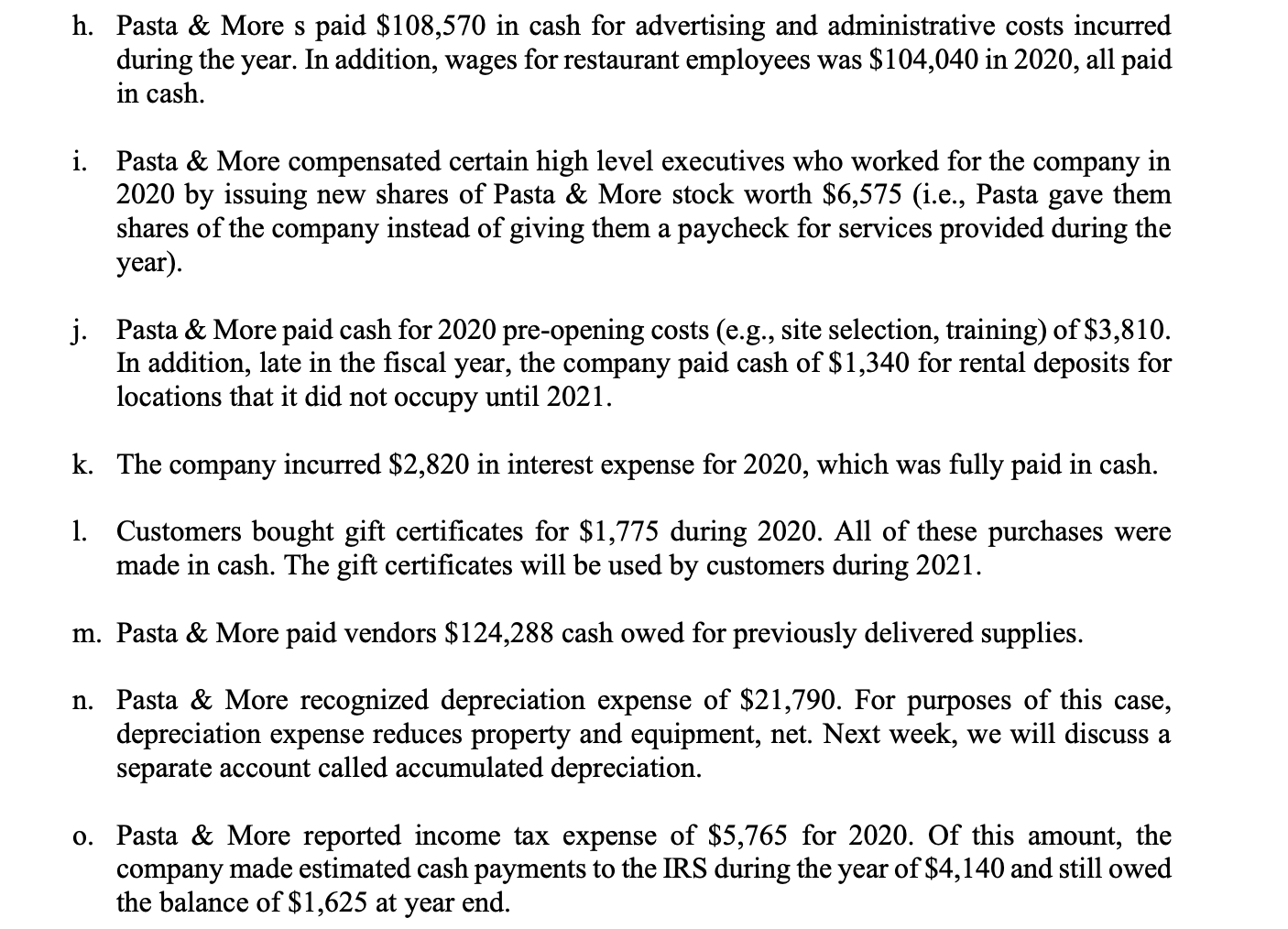

A B C D E F Journal Entries DEBIT CREDIT a. Cash b. Inventory Common Stock c. Cost of Goods Sold Accounts Payable \begin{tabular}{|r|r|} \hline 150,000 & 150,000 \\ \hline 123,068 & 123,068 \\ \hline 91,890 & 91,890 \\ \hline 347,140 & \\ \hline \end{tabular} d, Accounts Receivable Sales Revenue e. Notes Payable Royalty Fees Eamed f. Property/Equipment Cash Cash Notes Payable g. Cash Accounts Receivable h. Advertising/Adminstrative Expense Wages Expense Cash i. Wages Expense Common Stock j. Pre-Opening Expenses Pre-Paid Rental Deposit Expense Cash k. Interest Expense I. Treasury Stock Cash m. Accounts Payable Cash 3,785 K The following transactions summarize all activity for the year. Prepare the journal entry for each transaction on the Journal Entries tab of the Pasta Worksheet (the first is done for you). You don't need to include explanations; just enter the account names and the amount each account is debited or credited. Also post each journal entry to the respective t-accounts. Notes: Pasta combines several types of non-vendor payables (e.g., taxes payable) under the heading Accrued Expenses. Similarly, the company combines several types of operating expenses (e.g., executive compensation, marketing, utilities) under the heading General and Administrative Expenses. The labor costs for restaurant workers are included in the heading Restaurant Labor on the income statement while the compensation costs for all other employees are included in the heading General and Administrative Expenses. a. Pasta \& More issued new shares of common stock for $150,000. b. Inventory costing $123,068 was purchased, all on account. c. Pasta \& More had sales of $347,140 (all in cash) at the company-owned restaurants. The cost of the food products sold at the company-owned cafes was $91,890. d. The company earned royalties and fees from franchisees of $3,785, all on account. e. Pasta \& More paid down long-term debt in the amount of $110,065 with cash. f. Property and equipment in the amount of $50,420 was purchased. Pasta \& More paid $30,420 in cash and signed a promissory note due in 30 months for $20,000. g. Pasta \& More received $4,515 cash from franchisees as payment for amounts previously owed. h. Pasta \& More s paid $108,570 in cash for advertising and administrative costs incurred during the year. In addition, wages for restaurant employees was $104,040 in 2020 , all paid in cash. i. Pasta \& More compensated certain high level executives who worked for the company in 2020 by issuing new shares of Pasta \& More stock worth \$6,575 (i.e., Pasta gave them shares of the company instead of giving them a paycheck for services provided during the year). j. Pasta \& More paid cash for 2020 pre-opening costs (e.g., site selection, training) of $3,810. In addition, late in the fiscal year, the company paid cash of $1,340 for rental deposits for locations that it did not occupy until 2021. k. The company incurred $2,820 in interest expense for 2020 , which was fully paid in cash. 1. Customers bought gift certificates for $1,775 during 2020 . All of these purchases were made in cash. The gift certificates will be used by customers during 2021. m. Pasta \& More paid vendors $124,288 cash owed for previously delivered supplies. n. Pasta \& More recognized depreciation expense of $21,790. For purposes of this case, depreciation expense reduces property and equipment, net. Next week, we will discuss a separate account called accumulated depreciation. o. Pasta \& More reported income tax expense of $5,765 for 2020 . Of this amount, the company made estimated cash payments to the IRS during the year of $4,140 and still owed the balance of $1,625 at year end. 3. Prepare the trial balance as of December 31, 2020 under the Trial Balance tab using the ending balances in the t-accounts. I have started the trial balance by giving you the correct ending balance in the cash account. 4. Prepare the Income Statement, Statement of Retained Earnings and Balance Sheet. 5. Prepare the journal entry to close out the revenue and expense accounts to retained earnings. Enter it in the space provided on the Trial Balance tab. You do not need to post the closing entry to the respective t-accounts. A B C D E F Journal Entries DEBIT CREDIT a. Cash b. Inventory Common Stock c. Cost of Goods Sold Accounts Payable \begin{tabular}{|r|r|} \hline 150,000 & 150,000 \\ \hline 123,068 & 123,068 \\ \hline 91,890 & 91,890 \\ \hline 347,140 & \\ \hline \end{tabular} d, Accounts Receivable Sales Revenue e. Notes Payable Royalty Fees Eamed f. Property/Equipment Cash Cash Notes Payable g. Cash Accounts Receivable h. Advertising/Adminstrative Expense Wages Expense Cash i. Wages Expense Common Stock j. Pre-Opening Expenses Pre-Paid Rental Deposit Expense Cash k. Interest Expense I. Treasury Stock Cash m. Accounts Payable Cash 3,785 K The following transactions summarize all activity for the year. Prepare the journal entry for each transaction on the Journal Entries tab of the Pasta Worksheet (the first is done for you). You don't need to include explanations; just enter the account names and the amount each account is debited or credited. Also post each journal entry to the respective t-accounts. Notes: Pasta combines several types of non-vendor payables (e.g., taxes payable) under the heading Accrued Expenses. Similarly, the company combines several types of operating expenses (e.g., executive compensation, marketing, utilities) under the heading General and Administrative Expenses. The labor costs for restaurant workers are included in the heading Restaurant Labor on the income statement while the compensation costs for all other employees are included in the heading General and Administrative Expenses. a. Pasta \& More issued new shares of common stock for $150,000. b. Inventory costing $123,068 was purchased, all on account. c. Pasta \& More had sales of $347,140 (all in cash) at the company-owned restaurants. The cost of the food products sold at the company-owned cafes was $91,890. d. The company earned royalties and fees from franchisees of $3,785, all on account. e. Pasta \& More paid down long-term debt in the amount of $110,065 with cash. f. Property and equipment in the amount of $50,420 was purchased. Pasta \& More paid $30,420 in cash and signed a promissory note due in 30 months for $20,000. g. Pasta \& More received $4,515 cash from franchisees as payment for amounts previously owed. h. Pasta \& More s paid $108,570 in cash for advertising and administrative costs incurred during the year. In addition, wages for restaurant employees was $104,040 in 2020 , all paid in cash. i. Pasta \& More compensated certain high level executives who worked for the company in 2020 by issuing new shares of Pasta \& More stock worth \$6,575 (i.e., Pasta gave them shares of the company instead of giving them a paycheck for services provided during the year). j. Pasta \& More paid cash for 2020 pre-opening costs (e.g., site selection, training) of $3,810. In addition, late in the fiscal year, the company paid cash of $1,340 for rental deposits for locations that it did not occupy until 2021. k. The company incurred $2,820 in interest expense for 2020 , which was fully paid in cash. 1. Customers bought gift certificates for $1,775 during 2020 . All of these purchases were made in cash. The gift certificates will be used by customers during 2021. m. Pasta \& More paid vendors $124,288 cash owed for previously delivered supplies. n. Pasta \& More recognized depreciation expense of $21,790. For purposes of this case, depreciation expense reduces property and equipment, net. Next week, we will discuss a separate account called accumulated depreciation. o. Pasta \& More reported income tax expense of $5,765 for 2020 . Of this amount, the company made estimated cash payments to the IRS during the year of $4,140 and still owed the balance of $1,625 at year end. 3. Prepare the trial balance as of December 31, 2020 under the Trial Balance tab using the ending balances in the t-accounts. I have started the trial balance by giving you the correct ending balance in the cash account. 4. Prepare the Income Statement, Statement of Retained Earnings and Balance Sheet. 5. Prepare the journal entry to close out the revenue and expense accounts to retained earnings. Enter it in the space provided on the Trial Balance tab. You do not need to post the closing entry to the respective t-accounts