Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a B C D E F options for part A) are 12 to 24 months B)24 to 36 C)36 to 48 D)48 to 60 option

a

B C D E

F

options for part A) are 12 to 24 months B)24 to 36 C)36 to 48 D)48 to 60

option for part E) first blank is a) 30 b) 60 c) 90 d)120

2nd blank other option is the first bill containing the error was mailed you

3rd and fourth have option similar to first part

Note if the following answers are not correct then tell which one are

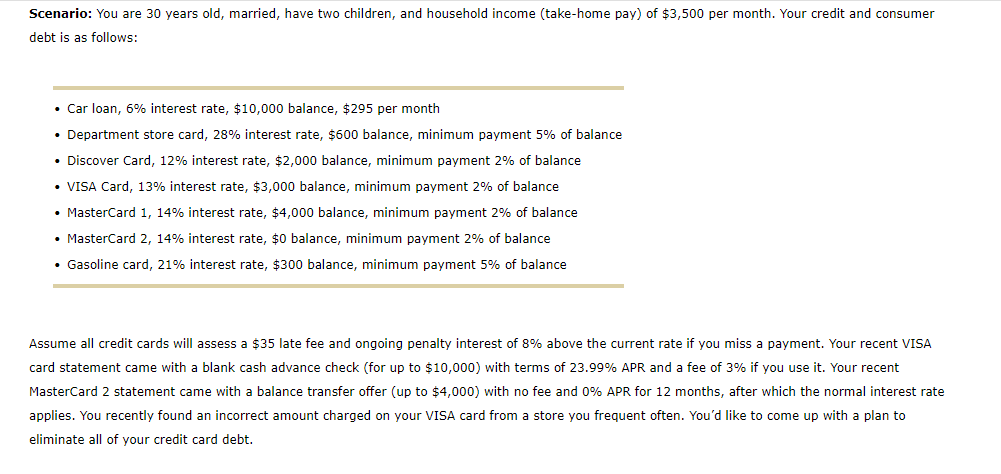

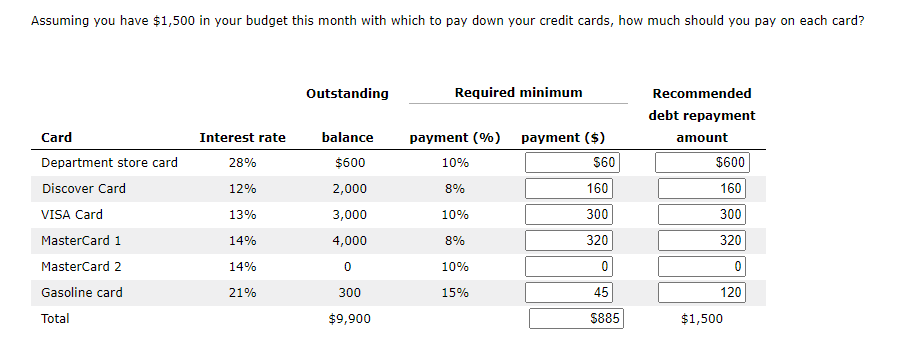

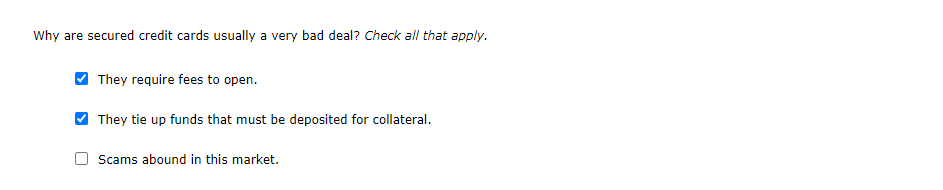

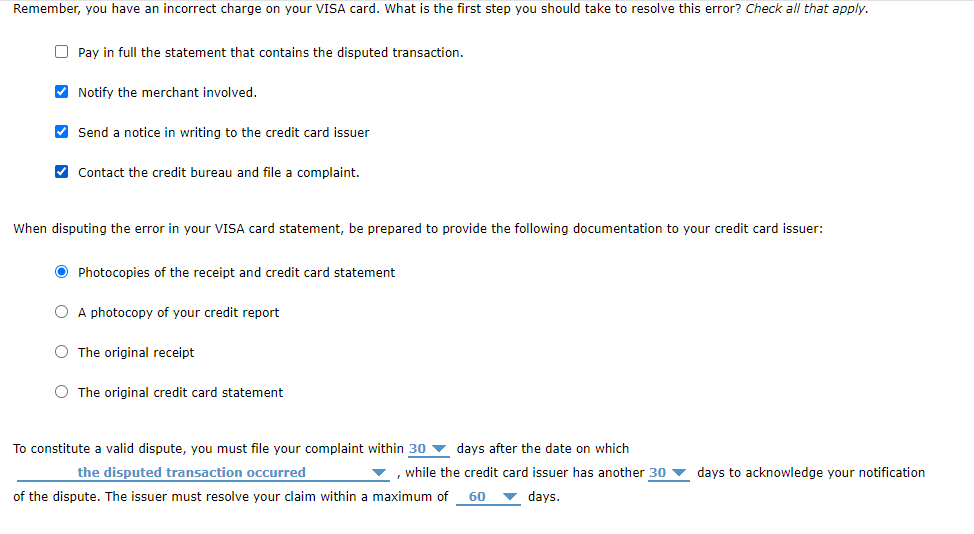

Scenario: You are 30 years old, married, have two children, and household income (take-home pay) of $3,500 per month. Your credit and consumer debt is as follows: . Car loan, 6% interest rate, $10,000 balance, $295 per month Department store card, 28% interest rate, $600 balance, minimum payment 5% of balance Discover Card, 12% interest rate, $2,000 balance, minimum payment 2% of balance VISA Card, 13% interest rate, $3,000 balance, minimum payment 2% of balance MasterCard 1, 14% interest rate, $4,000 balance, minimum payment 2% of balance MasterCard 2, 14% interest rate, $0 balance, minimum payment 2% of balance Gasoline card, 21% interest rate, $300 balance, minimum payment 5% of balance Assume all credit cards will assess a $35 late fee and ongoing penalty interest of 8% above the current rate if you miss a payment. Your recent VISA card statement came with a blank cash advance check (for up to $10,000) with terms of 23.99% APR and a fee of 3% if you use it. Your recent MasterCard 2 statement came with a balance transfer offer (up to $4,000) with no fee and 0% APR for 12 months, after which the normal interest rate applies. You recently found an incorrect amount charged on your VISA card from a store you frequent often. You'd like to come up with a plan to eliminate all of your credit card debt. Assuming you have $1,500 in your budget this month with which to pay down your credit cards, how much should you pay on each card? Outstanding Required minimum Recommended debt repayment amount $600 Interest rate 28% balance $600 2,000 payment (%) payment ($) 10% $60 12% 8% 160 160 Card Department store card Discover Card VISA Card MasterCard 1 MasterCard 2 Gasoline card 13% 3,000 10% 300 300 14% 4,000 8% 320 320 14% 0 10% 21% 300 15% 45 120 Total $9,900 $885 $1,500 Hint: You may use a financial calculator or the data in the table below to answer the following question: Assuming that you do not charge anything else to your Discover card and that you continue to make the current month's minimum required payment until the debt is repaid, it will take between 12 and 24 months to totally repay your outstanding balance. Monthly Installment Payment Required to Repay $1,000 APR Months 12 24 36 48 60 10% 87.92 46.14 32.27 25.36 21.25 11% 88.38 46.61 32.74 25.85 21.74 12% 88.85 47.07 33.21 26.33 22.24 13% 89.32 47.54 33.69 26.83 22.75 14% 89.79 48.01 34.18 27.33 23.27 Why are secured credit cards usually a very bad deal? Check all that apply. They require fees to open. They tie up funds that must be deposited for collateral. Scams abound in this market. Remember, you have an incorrect charge on your VISA card. What is the first step you should take to resolve this error? Check all that apply. O Pay in full the statement that contains the disputed transaction. Notify the merchant involved. Send a notice in writing to the credit card issuer Contact the credit bureau and file a complaint. When disputing the error in your VISA card statement, be prepared to provide the following documentation to your credit card issuer: Photocopies of the receipt and credit card statement O A photocopy of your credit report The original receipt The original credit card statement To constitute a valid dispute, you must file your complaint within 30 days after the date on which the disputed transaction occurred while the credit card issuer has another 30 days to acknowledge your notification of the dispute. The issuer must resolve your claim within a maximum of 60 days. Why are secured credit cards usually a very bad deal? Check all that apply. They require fees to open. They tie up funds that must be deposited for collateral. Scams abound in this market. Scenario: You are 30 years old, married, have two children, and household income (take-home pay) of $3,500 per month. Your credit and consumer debt is as follows: . Car loan, 6% interest rate, $10,000 balance, $295 per month Department store card, 28% interest rate, $600 balance, minimum payment 5% of balance Discover Card, 12% interest rate, $2,000 balance, minimum payment 2% of balance VISA Card, 13% interest rate, $3,000 balance, minimum payment 2% of balance MasterCard 1, 14% interest rate, $4,000 balance, minimum payment 2% of balance MasterCard 2, 14% interest rate, $0 balance, minimum payment 2% of balance Gasoline card, 21% interest rate, $300 balance, minimum payment 5% of balance Assume all credit cards will assess a $35 late fee and ongoing penalty interest of 8% above the current rate if you miss a payment. Your recent VISA card statement came with a blank cash advance check (for up to $10,000) with terms of 23.99% APR and a fee of 3% if you use it. Your recent MasterCard 2 statement came with a balance transfer offer (up to $4,000) with no fee and 0% APR for 12 months, after which the normal interest rate applies. You recently found an incorrect amount charged on your VISA card from a store you frequent often. You'd like to come up with a plan to eliminate all of your credit card debt. Assuming you have $1,500 in your budget this month with which to pay down your credit cards, how much should you pay on each card? Outstanding Required minimum Recommended debt repayment amount $600 Interest rate 28% balance $600 2,000 payment (%) payment ($) 10% $60 12% 8% 160 160 Card Department store card Discover Card VISA Card MasterCard 1 MasterCard 2 Gasoline card 13% 3,000 10% 300 300 14% 4,000 8% 320 320 14% 0 10% 21% 300 15% 45 120 Total $9,900 $885 $1,500 Hint: You may use a financial calculator or the data in the table below to answer the following question: Assuming that you do not charge anything else to your Discover card and that you continue to make the current month's minimum required payment until the debt is repaid, it will take between 12 and 24 months to totally repay your outstanding balance. Monthly Installment Payment Required to Repay $1,000 APR Months 12 24 36 48 60 10% 87.92 46.14 32.27 25.36 21.25 11% 88.38 46.61 32.74 25.85 21.74 12% 88.85 47.07 33.21 26.33 22.24 13% 89.32 47.54 33.69 26.83 22.75 14% 89.79 48.01 34.18 27.33 23.27 Why are secured credit cards usually a very bad deal? Check all that apply. They require fees to open. They tie up funds that must be deposited for collateral. Scams abound in this market. Remember, you have an incorrect charge on your VISA card. What is the first step you should take to resolve this error? Check all that apply. O Pay in full the statement that contains the disputed transaction. Notify the merchant involved. Send a notice in writing to the credit card issuer Contact the credit bureau and file a complaint. When disputing the error in your VISA card statement, be prepared to provide the following documentation to your credit card issuer: Photocopies of the receipt and credit card statement O A photocopy of your credit report The original receipt The original credit card statement To constitute a valid dispute, you must file your complaint within 30 days after the date on which the disputed transaction occurred while the credit card issuer has another 30 days to acknowledge your notification of the dispute. The issuer must resolve your claim within a maximum of 60 days. Why are secured credit cards usually a very bad deal? Check all that apply. They require fees to open. They tie up funds that must be deposited for collateral. Scams abound in this marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started