Answered step by step

Verified Expert Solution

Question

1 Approved Answer

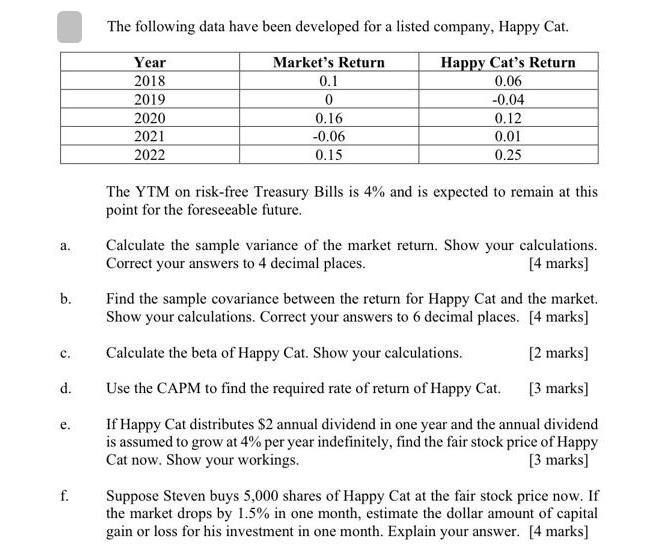

a. b. C. d. e. f. The following data have been developed for a listed company, Happy Cat. Market's Return 0.1 Happy Cat's Return

a. b. C. d. e. f. The following data have been developed for a listed company, Happy Cat. Market's Return 0.1 Happy Cat's Return 0.06 0 -0.04 0.16 0.12 -0.06 0.01 0.15 0.25 Year 2018 2019 2020 2021 2022 The YTM on risk-free Treasury Bills is 4% and is expected to remain at this point for the foreseeable future. Calculate the sample variance of the market return. Show your calculations. Correct your answers to 4 decimal places. [4 marks] Find the sample covariance between the return for Happy Cat and the market. Show your calculations. Correct your answers to 6 decimal places. [4 marks] Calculate the beta of Happy Cat. Show your calculations. [2 marks] Use the CAPM to find the required rate of return of Happy Cat. [3 marks] If Happy Cat distributes $2 annual dividend in one year and the annual dividend is assumed to grow at 4% per year indefinitely, find the fair stock price of Happy Cat now. Show your workings. [3 marks] Suppose Steven buys 5,000 shares of Happy Cat at the fair stock price now. If the market drops by 1.5% in one month, estimate the dollar amount of capital gain or loss for his investment in one month. Explain your answer. [4 marks]

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the sample variance of the market return well use the formula Sample Variance X X2 n 1 Where X individual market return X mean of market returns n number of observations Lets calculate th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started