Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A B C D E Lacey Harmoniski had just moved to the Endura Republic as a part of a business school summer internship. His mentor

A B C D E

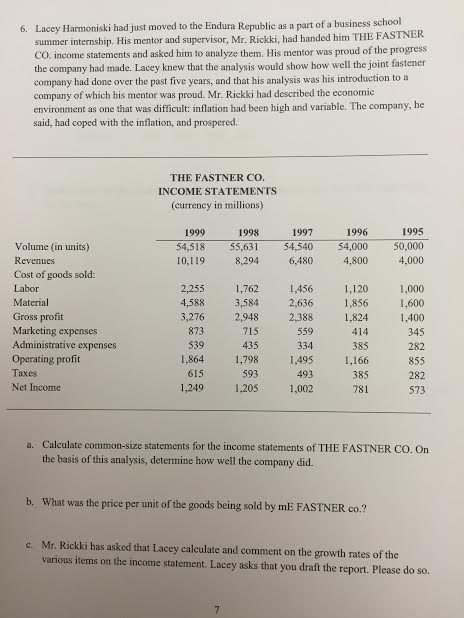

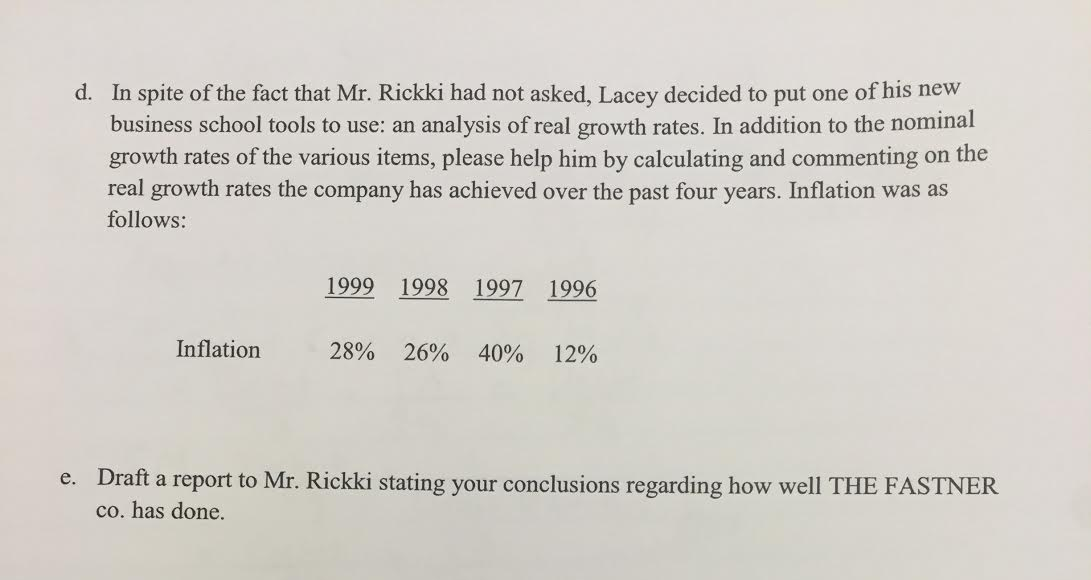

Lacey Harmoniski had just moved to the Endura Republic as a part of a business school summer internship. His mentor and supervisor, Mr. Rickki, had handed him THE FASTNER CO. income statements and asked him to analyze them. His mentor was proud of the progress the company had made. Lacey knew that the analysis would show how well the joint fastener company had done over the past five years, and that his analysis was his introduction to a company of which his mentor was proud. Mr. Rickki had described the economic environment as one that was difficult: inflation had been high and variable. The company, he said, had coped with the inflation, and prospered. 6. THE FASTNER CO INCOME STATEMENTS (currency in millions) 1996 1995 1997 54,518 55,63 54,540 54,000 50,000 10,119 8,294 6,480 4800 4,000 1999 1998 Volume (in units) Revenues Cost of goods sold: Labor Material Gross profit Marketing expenses Administrative expenses Operating profit Taxes Net Income 2.255 3584 2388 4,588 2.948 559 385 855 2,255 762 456 1,120 1,000 4,588 3,584 2,636 1,856 1,600 3,276 2,9482,388 1,824 1,400 1,162 .636 1824 456 1856 1400 345 282 873 539 164 1,002 1,864435 1,864 1,798 1,495 1,166 334 282 573 493 385 1,249 1,205 1,002 a. Calculate common-size statements for the income statements of THE FASTNER CO. On the basis of this analysis, determine how well the company did. b. What was the price per unit of the goods being sold by mE FASTNER co.:? Mr. Rickki bas asked that Lacey calculate and comment on the growth rates of the various items on the income statement. Lacey asks that you draft the report. Please do so. cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started