Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a b c d Problem 11-72 (LO 11-5) (Algo) [The following information applies to the questions displayed below] Carolina Corporation, an S corporation, has no

a

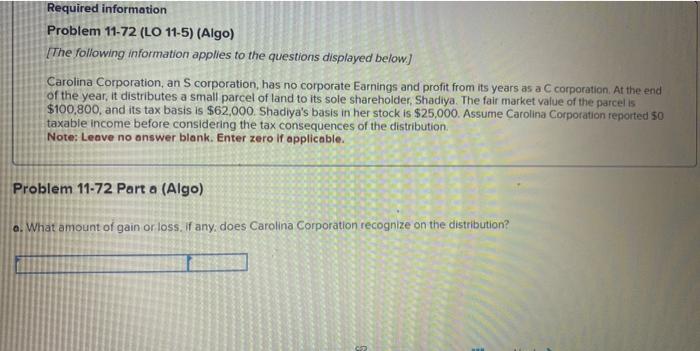

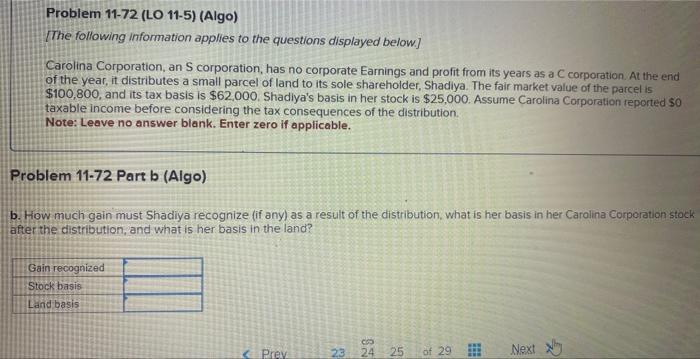

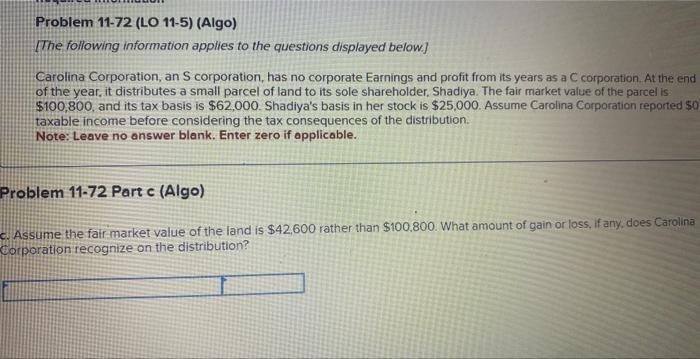

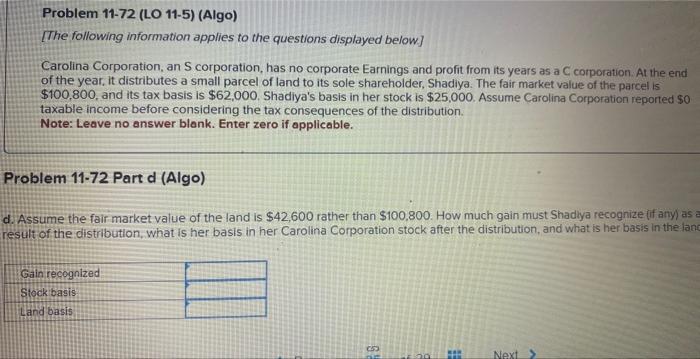

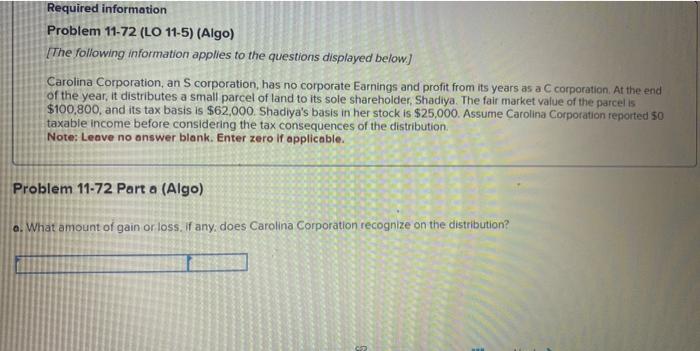

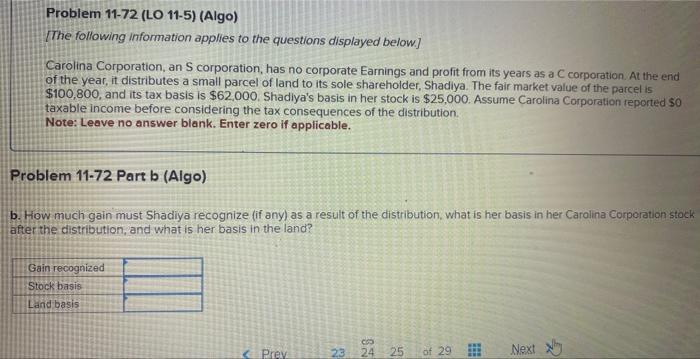

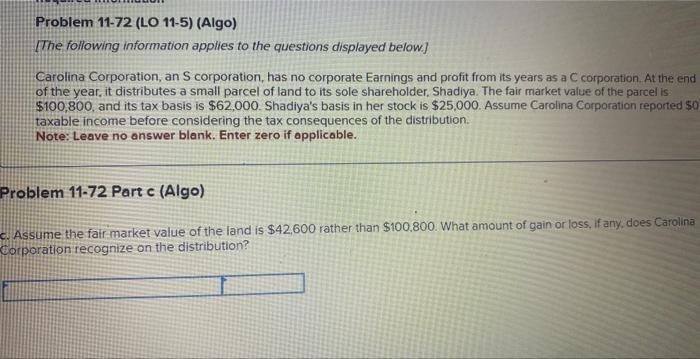

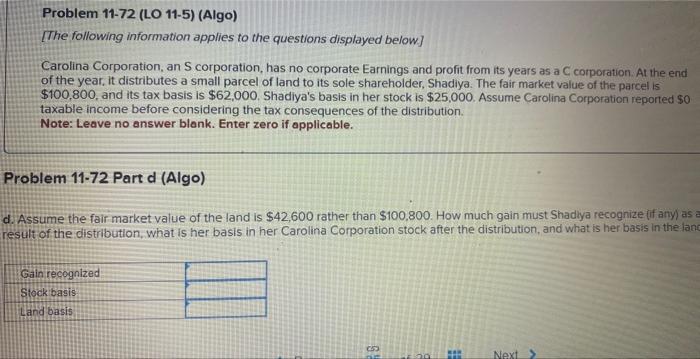

Problem 11-72 (LO 11-5) (Algo) [The following information applies to the questions displayed below] Carolina Corporation, an S corporation, has no corporate Earnings and profit from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $100,800, and its tax basis is $62,000. Shadiya's basis in her stock is $25,000. Assume Carolina Corporation reported 50 taxable income before considering the tax consequences of the distribution. Note: Leave no answer blank. Enter zero If applicable. Problem 11-72 Part a (Algo) o. What amount of gain or loss, if any, does Carolina Corporation recognize on the distribution? Problem 11-72 (LO 11-5) (Algo) [The following information applies to the questions displayed below.] Carolina Corporation, an S corporation, has no corporate Earnings and profit from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $100,800, and its tax basis is $62,000. Shadiya's basis in her stock is $25,000. Assume Carolina Corporation reported 50 taxable income before considering the tax consequences of the distribution. Note: Leave no answer blank. Enter zero if applicable. Problem 11-72 Part b (Algo) b. How much gain must Shadiya recognize (if any) as a result of the distribution, what is her basis in her Carolina Corporation stock after the distribution, and what is her basis in the land? Problem 11-72 (LO 11-5) (Algo) [The following information applies to the questions displayed below] Carolina Corporation, an S corporation, has no corporate Earnings and profit from its years as a C corporation. At the end of the year, it distributes a small parcel of land to its sole shareholder. Shadiya. The fair market value of the parcel is $100,800, and its tax basis is $62,000. Shadiya's basis in her stock is $25,000. Assume Carolina Corporation reponted $0 taxable income before considering the tax consequences of the distribution. Note: Leave no answer blank. Enter zero if applicable. roblem 11-72 Part c (Algo) Assume the fair market value of the land is $42,600 rather than $100.800. What amount of gain or loss, if any, does Carolina orporation recognize on the distribution? Problem 11-72 (LO 11-5) (Algo) [The following information applies to the questions displayed below] Carolina Corporation, an S corporation, has no corporate Earnings and profit from its years as a C corporation: At the end of the year, it distributes a small parcel of land to its sole shareholder, Shadiya. The fair market value of the parcel is $100,800, and its tax basis is $62,000. Shadiya's basis in her stock is $25,000. Assume Carolina Corporation reported $0 taxable income before considering the tax consequences of the distribution. Note: Leave no answer blank. Enter zero if applicable. roblem 11-72. Part d (Algo) Assume the fair market value of the land is $42,600 rather than $100.800. How much gain must Shadiya recognize (if any) as i esult of the distribution, what is her basis in her Carolina Corporation stock after the distribution, and what is her basis in the lan b

c

d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started