Answered step by step

Verified Expert Solution

Question

1 Approved Answer

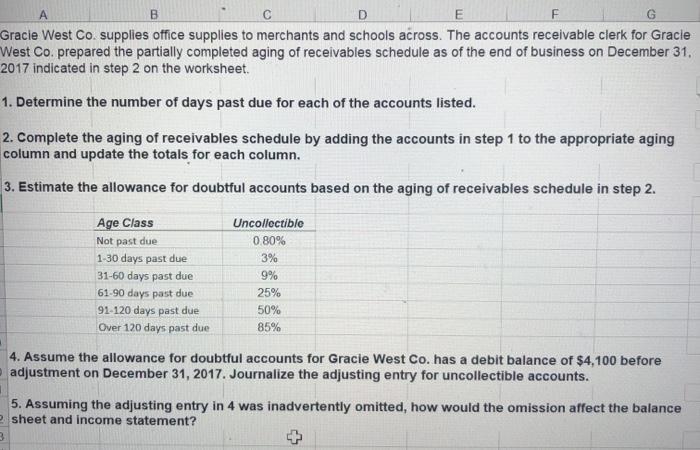

A B C E F G Gracie West Co. supplies office supplies to merchants and schools across. The accounts receivable clerk for Gracie West

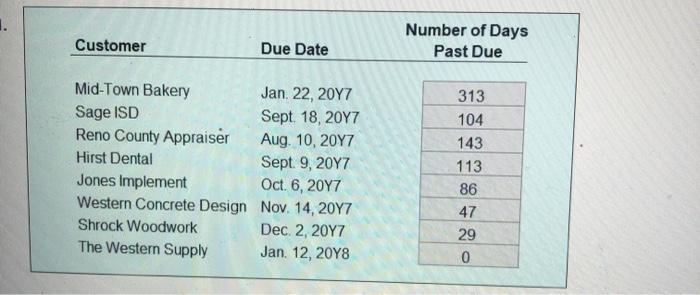

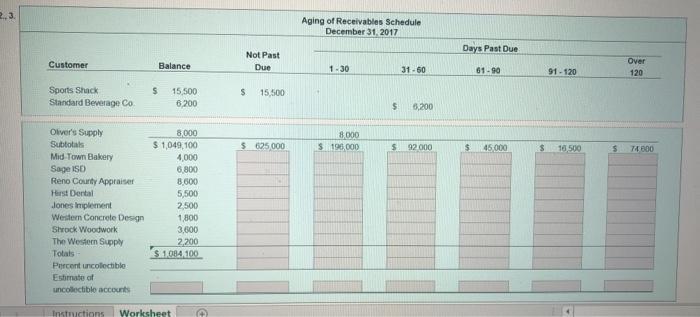

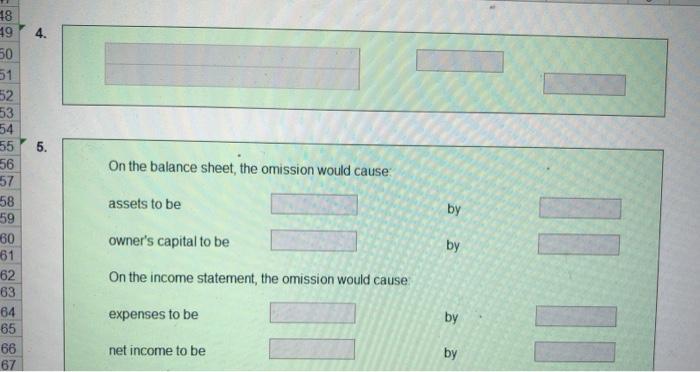

A B C E F G Gracie West Co. supplies office supplies to merchants and schools across. The accounts receivable clerk for Gracie West Co. prepared the partially completed aging of receivables schedule as of the end of business on December 31. 2017 indicated in step 2 on the worksheet. 1. Determine the number of days past due for each of the accounts listed. 2. Complete the aging of receivables schedule by adding the accounts in step 1 to the appropriate aging column and update the totals for each column. 3. Estimate the allowance for doubtful accounts based on the aging of receivables schedule in step 2. Age Class Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-120 days past due Over 120 days past due Uncollectible 0.80% 3% 9% 25% 50% 85% 4. Assume the allowance for doubtful accounts for Gracie West Co. has a debit balance of $4,100 before adjustment on December 31, 2017. Journalize the adjusting entry for uncollectible accounts. 5. Assuming the adjusting entry in 4 was inadvertently omitted, how would the omission affect the balance 2 sheet and income statement? 3 Customer Mid-Town Bakery Sage ISD Reno County Appraiser Hirst Dental Jones Implement Western Concrete Design Shrock Woodwork The Western Supply Due Date Jan 22, 2017 Sept. 18, 20Y7 Aug. 10, 20Y7 Sept. 9, 2017 Oct. 6, 20Y7 Nov. 14, 20Y7 Dec. 2, 2017 Jan 12, 2018 Number of Days Past Due 313 104 143 113 86 47 29 0 2.,3. Customer Sports Shack Standard Beverage Co. Oliver's Supply Subtotals Mid-Town Bakery Sage ISD Reno County Appraiser Hirst Dental Jones Implement Western Concrete Design Shrock Woodwork The Western Supply Totals Percent uncollectible Estimate of uncollectible accounts Balance $ 15,500 6,200 8,000 $1,049,100 4,000 6,800 8,600 5,500 2,500 1,800 3,600 2,200 $ 1,084,100 Instructions Worksheet Not Past Due $ 15,500 $ 625,000 Aging of Receivables Schedule December 31, 2017 1-30 8,000 $ 196,000 31-60 $ 6,200 S 92.000 Days Past Due 61-90 $ 45,000 $ 91-120 16,500 $ Over 120 74,000 48 19 50 51 52 53 54 55 56 57 58 59 60 61 62 63 288289 64 65 66 67 4. 5. On the balance sheet, the omission would cause assets to be owner's capital to be On the income statement, the omission would cause expenses to be net income to be by by by by ||||

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Customer Due Date Number of days past due Adams May 22 20Y4930313130313031223 days Oct 10 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started