Answered step by step

Verified Expert Solution

Question

1 Approved Answer

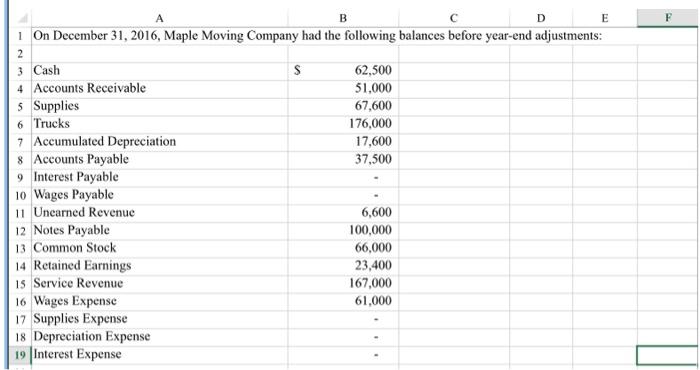

A B D 1 On December 31, 2016, Maple Moving Company had the following balances before year-end adjustments: 2 3 Cash 4 Accounts Receivable

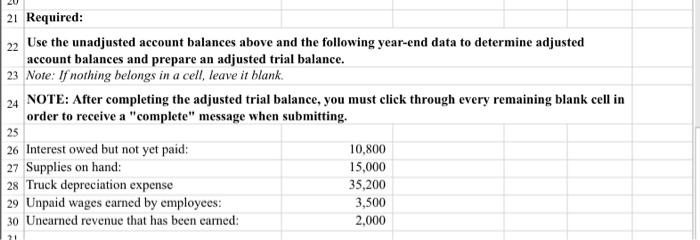

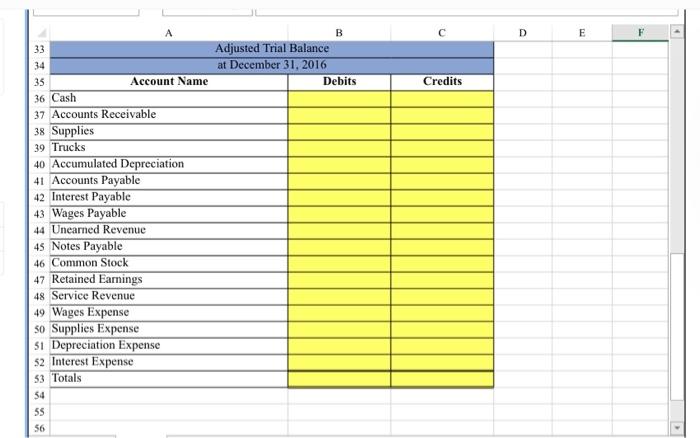

A B D 1 On December 31, 2016, Maple Moving Company had the following balances before year-end adjustments: 2 3 Cash 4 Accounts Receivable 5 Supplies 6 Trucks 7 Accumulated Depreciation 8 Accounts Payable 9 Interest Payable 10 Wages Payable 11 Unearned Revenue 12 Notes Payable 13 Common Stock 14 Retained Earnings 15 Service Revenue S 62,500 51,000 67,600 176,000 17,600 37,500 6,600 100,000 66,000 23,400 167,000 16 Wages Expense 61,000 17 Supplies Expense 18 Depreciation Expense 19 Interest Expense E 21 Required: 22 Use the unadjusted account balances above and the following year-end data to determine adjusted account balances and prepare an adjusted trial balance. 23 Note: If nothing belongs in a cell, leave it blank. 24 NOTE: After completing the adjusted trial balance, you must click through every remaining blank cell in order to receive a "complete" message when submitting. 25 26 Interest owed but not yet paid: 28 Truck depreciation expense 27 Supplies on hand: 29 Unpaid wages earned by employees: 30 Unearned revenue that has been earned: 10,800 15,000 35,200 3,500 2,000 33 34 35 36 Cash A Adjusted Trial Balance B at December 31, 2016 Account Name Debits Credits 37 Accounts Receivable 38 Supplies 39 Trucks 40 Accumulated Depreciation 41 Accounts Payable 42 Interest Payable 43 Wages Payable 44 Unearned Revenue 45 Notes Payable 46 Common Stock 47 Retained Earnings 48 Service Revenue 49 Wages Expense 50 Supplies Expense 51 Depreciation Expense 52 Interest Expense 53 Totals 54 55 56 D E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started