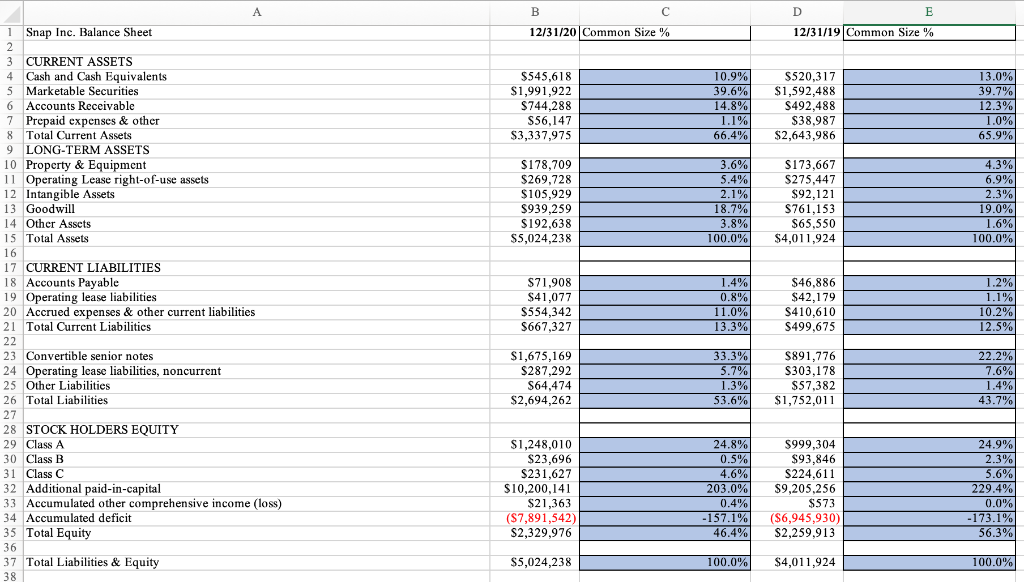

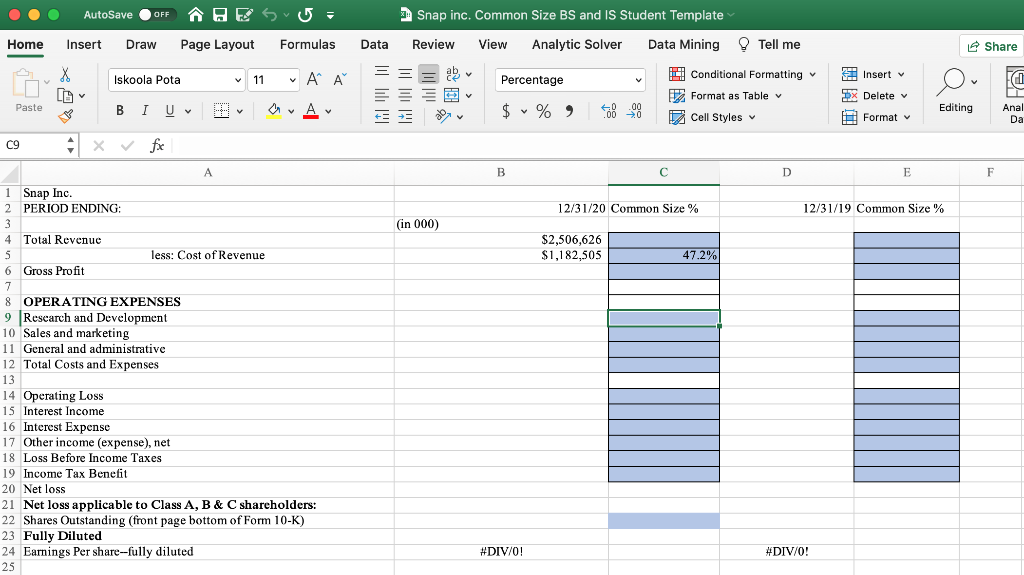

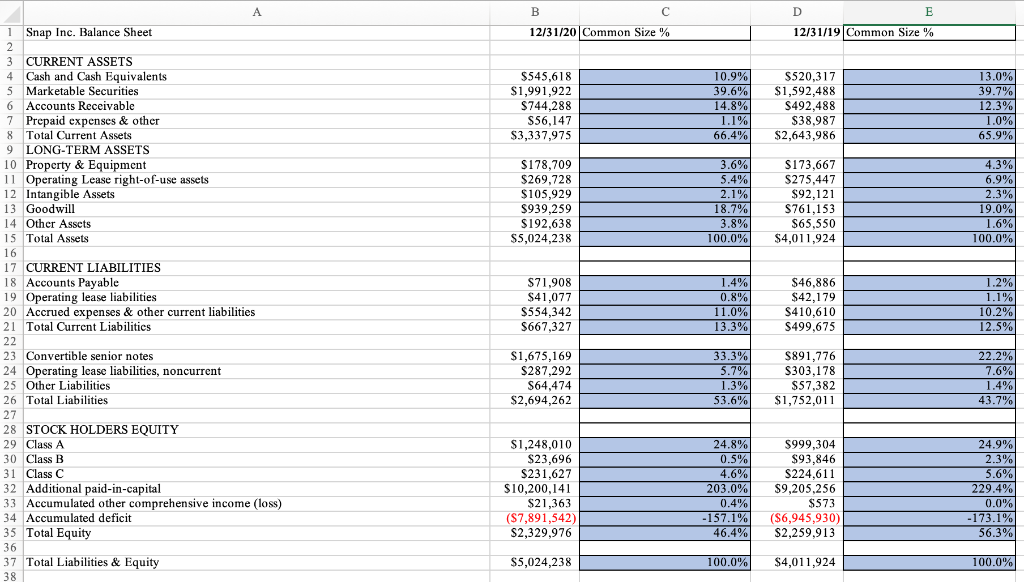

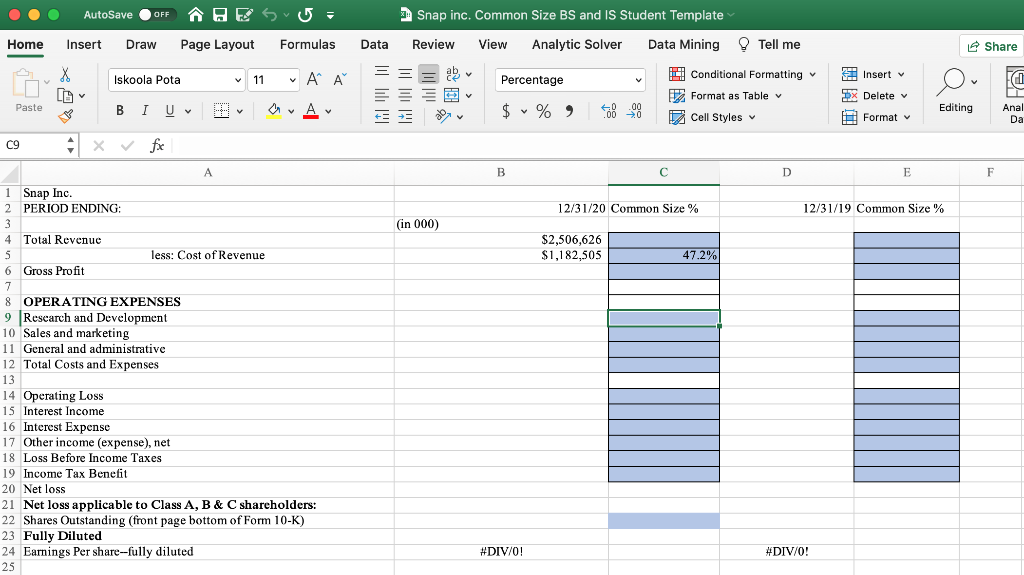

A B D E 12/31/19 Common Size % 12/31/20 Common Size % $545,618 $1,991,922 $744,288 S56,147 $3,337,975 10.9% 39.6% 14.8% S520,317 $1,592,488 S492,488 $38.987 $2,643,986 13.0% 39.7% 12.3% 1.0% 65.9% 1.1% 66.4% $178.709 $269,728 $105,929 $939,259 $192,638 S5,024.238 3.6% 5.4% 2.1% 18.7% 3.8% 100.0% S173,667 $275,447 $92,121 $761,153 $65,550 $4,011,924 4.3% 6.9% 2.3% 19.0% 1.6% 100.0% 1 Snap Inc. Balance Sheet 2 3 CURRENT ASSETS 4 Cash and Cash Equivalents Marketable Securities 6 Accounts Receivable 7 Prepaid expenses & other 8 Total Current Assets 9 LONG-TERM ASSETS 10 Property & Equipment 11 Operating Lease right-of-use assets 12 Intangible Assets 13 Goodwill 14 Other Assets 15 Total Assets 16 17 CURRENT LIABILITIES 18 Accounts Payable 19 Operating lease liabilities 20 Accrued expenses & other current liabilities 21 Total Current Liabilities 22 23 Convertible senior notes 24 Operating lease liabilities, noncurrent 25 Other Liabilities 26 Total Liabilities 27 28 STOCK HOLDERS EQUITY 29 Class A 30 Class B 31 Class C 32 Additional paid-in-capital 33 Accumulated other comprehensive income (loss) 34 Accumulated deficit 35 Total Equity 36 37 Total Liabilities & Equity 38 $71,908 $41,077 $554.342 S667,327 1.4% 0.8% 11.0% 13.3% $46,886 $42,179 $410,610 S499,675 1.2% 1.1% 10.2% 12.5% $1,675,169 $287,292 S64,474 $2,694,262 33.3% 5.7% 1.3% 53.6% $891,776 S303.178 $57,382 $1,752,011 22.2% 7.6% 1.4% 43.7% $1,248,010 $23,696 $231,627 $10,200,141 $21,363 (S7,891,542) $2,329,976 24.8% 0.5% 4.6% 203.0% 0.4% -157.1% 46.4% $999,304 $93,846 S224,611 $9,205,256 $573 ($6,945,930) $2,259,913 24.9% 2.3% 5.6% 229.4% 0.0% -173.1% 56.3% $5,024,238 100.0% $4,011,924 100.0% AutoSave OFF Snap inc. Common Size BS and IS Student Template Home Insert Draw Page Layout Formulas Data Review View Analytic Solver Data Mining Tell me Share X Iskoola Pota 11 VA V Percentage Conditional Formatting Insert ab 2. Format as Table v DX Delete Paste BIU MA $ % 9 8-98 Editing Cell Styles ! Format Anal Da C9 X fx A B C D E F 1 Snap Inc. 2 PERIOD ENDING: 12/31/20 Common Size % 12/31/19 Common Size % (in 000) 4 Total Revenue $2,506,626 $1,182,505 less: Cost of Revenue 47.2% 6 Gross Profit 8 OPERATING EXPENSES 9 Research and Development 10 Sales and marketing 11 General and administrative 12 Total Costs and Expenses 13 1 14 Operating Loss 15 Interest Income 16 Interest Expense 17 Other income (expense), net 18 Loss Before Income Taxes 19 Income Tax Benefit 20 Net loss 21 Net loss applicable to Class A, B & C shareholders: 22 Shares Outstanding (front page bottom of Form 10-K) 23 Fully Diluted 24 Earnings Per share-fully diluted 25 #DIV/0! #DIV/0! A B D E 12/31/19 Common Size % 12/31/20 Common Size % $545,618 $1,991,922 $744,288 S56,147 $3,337,975 10.9% 39.6% 14.8% S520,317 $1,592,488 S492,488 $38.987 $2,643,986 13.0% 39.7% 12.3% 1.0% 65.9% 1.1% 66.4% $178.709 $269,728 $105,929 $939,259 $192,638 S5,024.238 3.6% 5.4% 2.1% 18.7% 3.8% 100.0% S173,667 $275,447 $92,121 $761,153 $65,550 $4,011,924 4.3% 6.9% 2.3% 19.0% 1.6% 100.0% 1 Snap Inc. Balance Sheet 2 3 CURRENT ASSETS 4 Cash and Cash Equivalents Marketable Securities 6 Accounts Receivable 7 Prepaid expenses & other 8 Total Current Assets 9 LONG-TERM ASSETS 10 Property & Equipment 11 Operating Lease right-of-use assets 12 Intangible Assets 13 Goodwill 14 Other Assets 15 Total Assets 16 17 CURRENT LIABILITIES 18 Accounts Payable 19 Operating lease liabilities 20 Accrued expenses & other current liabilities 21 Total Current Liabilities 22 23 Convertible senior notes 24 Operating lease liabilities, noncurrent 25 Other Liabilities 26 Total Liabilities 27 28 STOCK HOLDERS EQUITY 29 Class A 30 Class B 31 Class C 32 Additional paid-in-capital 33 Accumulated other comprehensive income (loss) 34 Accumulated deficit 35 Total Equity 36 37 Total Liabilities & Equity 38 $71,908 $41,077 $554.342 S667,327 1.4% 0.8% 11.0% 13.3% $46,886 $42,179 $410,610 S499,675 1.2% 1.1% 10.2% 12.5% $1,675,169 $287,292 S64,474 $2,694,262 33.3% 5.7% 1.3% 53.6% $891,776 S303.178 $57,382 $1,752,011 22.2% 7.6% 1.4% 43.7% $1,248,010 $23,696 $231,627 $10,200,141 $21,363 (S7,891,542) $2,329,976 24.8% 0.5% 4.6% 203.0% 0.4% -157.1% 46.4% $999,304 $93,846 S224,611 $9,205,256 $573 ($6,945,930) $2,259,913 24.9% 2.3% 5.6% 229.4% 0.0% -173.1% 56.3% $5,024,238 100.0% $4,011,924 100.0% AutoSave OFF Snap inc. Common Size BS and IS Student Template Home Insert Draw Page Layout Formulas Data Review View Analytic Solver Data Mining Tell me Share X Iskoola Pota 11 VA V Percentage Conditional Formatting Insert ab 2. Format as Table v DX Delete Paste BIU MA $ % 9 8-98 Editing Cell Styles ! Format Anal Da C9 X fx A B C D E F 1 Snap Inc. 2 PERIOD ENDING: 12/31/20 Common Size % 12/31/19 Common Size % (in 000) 4 Total Revenue $2,506,626 $1,182,505 less: Cost of Revenue 47.2% 6 Gross Profit 8 OPERATING EXPENSES 9 Research and Development 10 Sales and marketing 11 General and administrative 12 Total Costs and Expenses 13 1 14 Operating Loss 15 Interest Income 16 Interest Expense 17 Other income (expense), net 18 Loss Before Income Taxes 19 Income Tax Benefit 20 Net loss 21 Net loss applicable to Class A, B & C shareholders: 22 Shares Outstanding (front page bottom of Form 10-K) 23 Fully Diluted 24 Earnings Per share-fully diluted 25 #DIV/0! #DIV/0