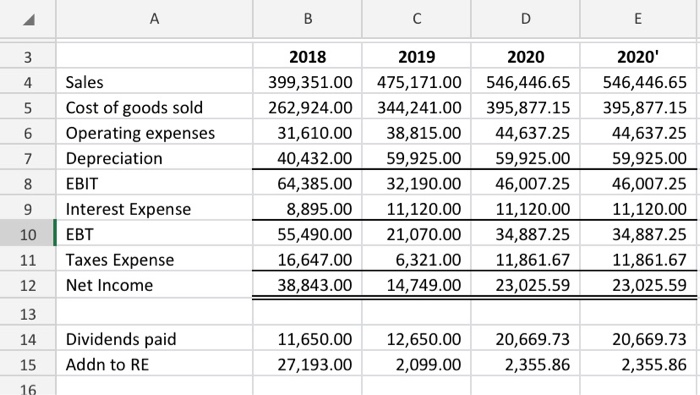

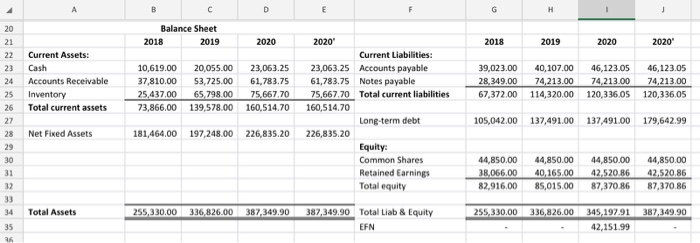

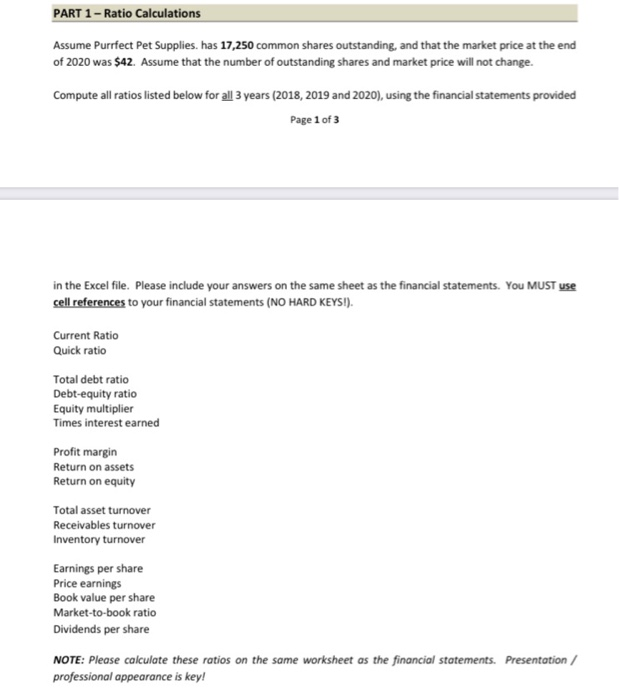

A B D E 3 4 un 6 7 2018 2019 2020 399,351.00 475,171.00 546,446.65 262,924.00 344,241.00 395,877.15 31,610.00 38,815.00 44,637.25 40,432.00 59,925.00 59,925.00 64,385.00 32,190.00 46,007.25 8,895.00 11,120.00 11,120.00 55,490.00 21,070.00 34,887.25 16,647.00 6,321.00 11,861.67 38,843.00 14,749.00 23,025.59 Sales Cost of goods sold Operating expenses Depreciation EBIT Interest Expense EBT Taxes Expense Net Income 2020 546,446.65 395,877.15 44,637.25 59,925.00 46,00 7.25 11,120.00 34,887.25 11,861.67 23,025.59 8 9 10 11 12 13 14 15 Dividends paid Add to RE 11,650.00 27,193.00 12,650.00 2,099.00 20,669.73 2,355.86 20,669.73 2,355.86 16 B D E G H Balance Sheet 2018 2019 2020 2018 2019 2020 2020 Current Assets: Cash Accounts Receivable Inventory Total current assets 10,619.00 37,810.00 25,437,00 73,866.00 20,055.00 53,725.00 65,798.00 139,578,00 23,063.25 61,783.75 75,667.70 160,514.70 39,023.00 28,349.00 67,372.00 40, 107.00 74,213.00 114,320.00 46,123.05 74,213.00 120,336,05 46,123.05 74,213.00 120,336,05 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 2020 Current Liabilities: 23,063.25 Accounts payable 61,783.75 Notes payable 75,667.70 Total current liabilities 160,514.70 Long-term debt 226,835.20 Equity Common Shares Retained Earnings Total equity 105,042,00 137,491.00 137,491.00 179,642.99 Net Fixed Assets 181,464.00 197,248.00 226,835.20 44,850.00 38,066,00 82,916,00 44,850.00 40,165.00 85,015.00 44,850.00 42,520.86 87,370.86 44,850.00 42.520.86 87,370.86 Total Assets 255,330,00 336,826.00 387,349.90 255,330,00 336,826.00 387,349.90 387,349.90 Total Liab & Equity EFN 345,197.91 42,151.99 35 PART 1 - Ratio Calculations Assume Purrfect Pet Supplies, has 17,250 common shares outstanding, and that the market price at the end of 2020 was $42. Assume that the number of outstanding shares and market price will not change. Compute all ratios listed below for all 3 years (2018, 2019 and 2020), using the financial statements provided Page 1 of 3 in the Excel file. Please include your answers on the same sheet as the financial statements. You MUST use cell references to your financial statements (NO HARD KEYS!). Current Ratio Quick ratio Total debt ratio Debt-equity ratio Equity multiplier Times interest earned Profit margin Return on assets Return on equity Total asset turnover Receivables turnover Inventory turnover Earnings per share Price earnings Book value per share Market-to-book ratio Dividends per share NOTE: Please calculate these ratios on the same worksheet as the financial statements. Presentation / professional appearance is key