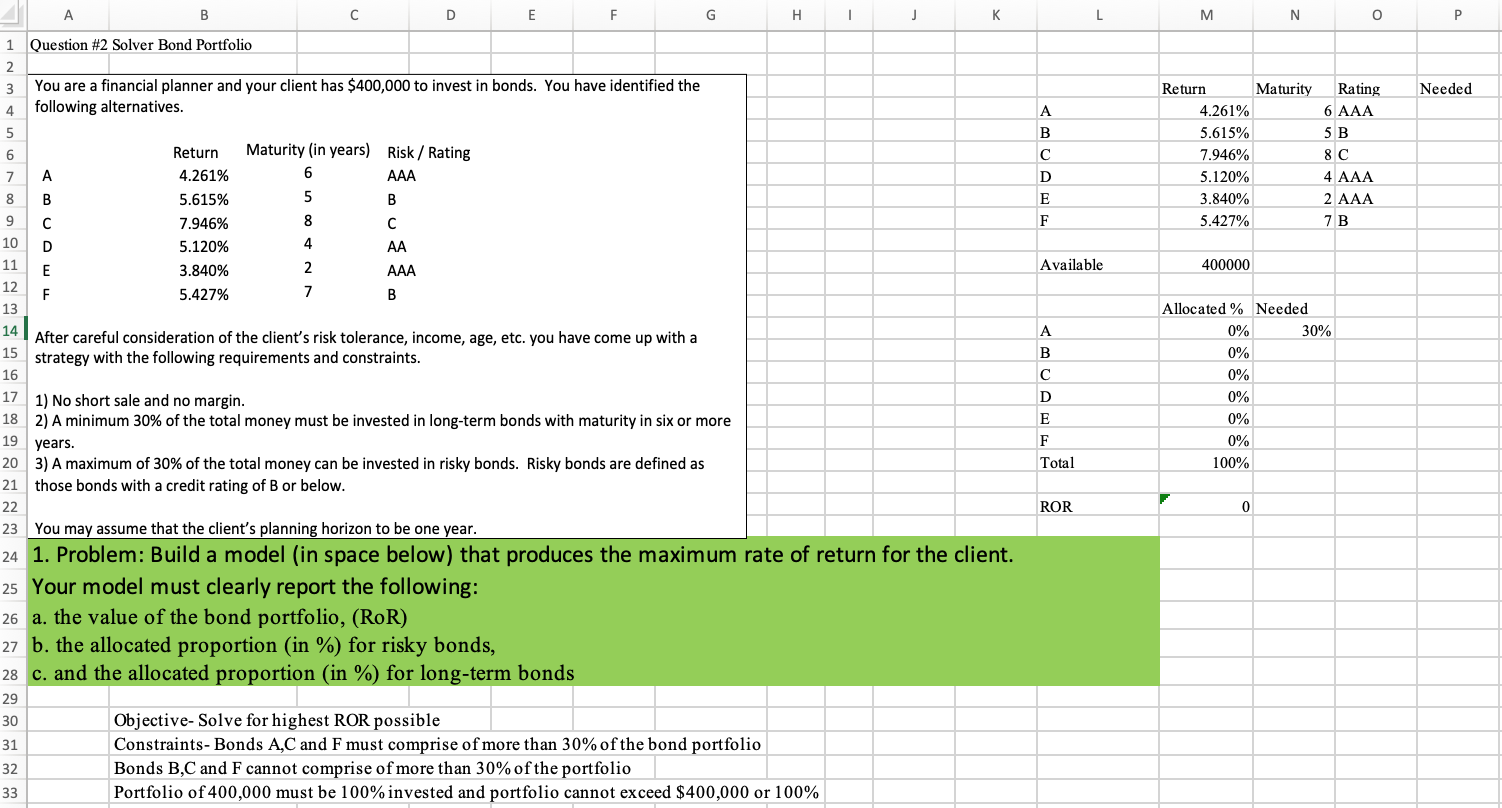

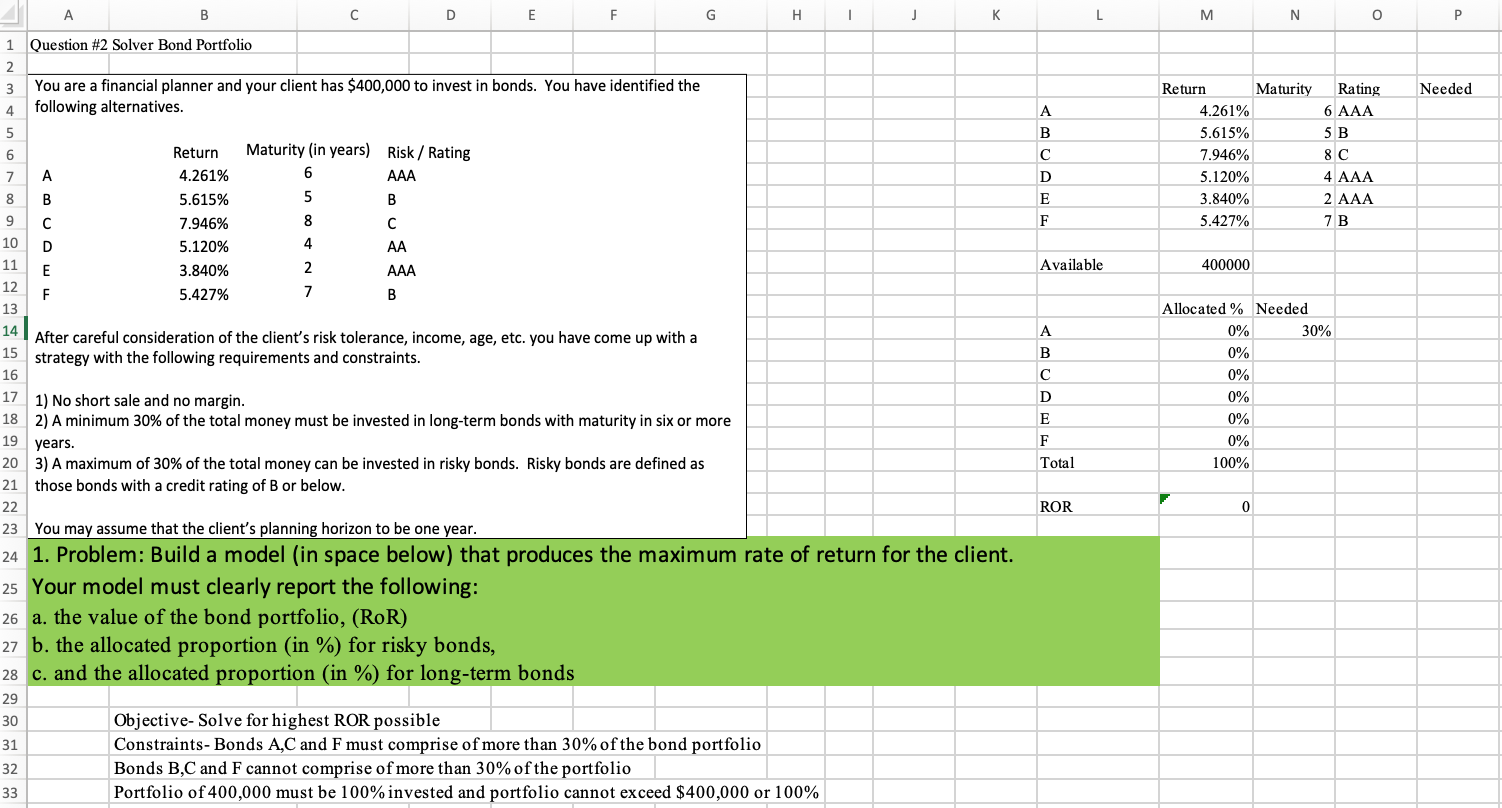

A B D E F G H 1 J K L M N o 1 Question #2 Solver Bond Portfolio 2 3 You are a financial planner and your client has $400,000 to invest in bonds. You have identified the following alternatives. Needed 4 A 5 B Return Maturity 4.261% 5.615% 7.946% 5.120% 3.840% 5.427% Rating 6 AAA 5 B 8C 4 AAA 2 AAA 7 B D E F Available 400000 6 Return Maturity (in years) Risk / Rating 7 A 4.261% 6 AAA 8 B 5.615% 5 B 9 C 7.946% 8 C 10 D 5.120% 4 AA 11 E 3.840% 2 AAA 12 F 5.427% 7 B 13 14 After careful consideration of the client's risk tolerance, income, age, etc. you have come up with a 15 strategy with the following requirements and constraints. 16 17 1) No short sale and no margin. 18 2) A minimum 30% of the total money must be invested in long-term bonds with maturity in six or more A B Allocated % Needed 0% 30% 0% 0% 0% 0% 0% 100% D 19 years. E F Total ROR 0 20 3) A maximum of 30% of the total money can be invested in risky bonds. Risky bon are ned as 21 those bonds with a credit rating of B or below. 22 23 You may assume that the client's planning horizon to be one year. 24 1. Problem: Build a model (in space below) that produces the maximum rate of return for the client. 25 Your model must clearly report the following: 26 a. the value of the bond portfolio, (RoR) 27 b. the allocated proportion (in %) for risky bonds, 28 c. and the allocated proportion (in %) for long-term bonds 29 30 Objective-Solve for highest ROR possible 31 Constraints-Bonds A,C and F must comprise of more than 30% of the bond portfolio 32 Bonds B,C and F cannot comprise of more than 30% of the portfolio 33 Portfolio of 400,000 must be 100% invested and portfolio cannot exceed $400,000 or 100% A B D E F G H 1 J K L M N o 1 Question #2 Solver Bond Portfolio 2 3 You are a financial planner and your client has $400,000 to invest in bonds. You have identified the following alternatives. Needed 4 A 5 B Return Maturity 4.261% 5.615% 7.946% 5.120% 3.840% 5.427% Rating 6 AAA 5 B 8C 4 AAA 2 AAA 7 B D E F Available 400000 6 Return Maturity (in years) Risk / Rating 7 A 4.261% 6 AAA 8 B 5.615% 5 B 9 C 7.946% 8 C 10 D 5.120% 4 AA 11 E 3.840% 2 AAA 12 F 5.427% 7 B 13 14 After careful consideration of the client's risk tolerance, income, age, etc. you have come up with a 15 strategy with the following requirements and constraints. 16 17 1) No short sale and no margin. 18 2) A minimum 30% of the total money must be invested in long-term bonds with maturity in six or more A B Allocated % Needed 0% 30% 0% 0% 0% 0% 0% 100% D 19 years. E F Total ROR 0 20 3) A maximum of 30% of the total money can be invested in risky bonds. Risky bon are ned as 21 those bonds with a credit rating of B or below. 22 23 You may assume that the client's planning horizon to be one year. 24 1. Problem: Build a model (in space below) that produces the maximum rate of return for the client. 25 Your model must clearly report the following: 26 a. the value of the bond portfolio, (RoR) 27 b. the allocated proportion (in %) for risky bonds, 28 c. and the allocated proportion (in %) for long-term bonds 29 30 Objective-Solve for highest ROR possible 31 Constraints-Bonds A,C and F must comprise of more than 30% of the bond portfolio 32 Bonds B,C and F cannot comprise of more than 30% of the portfolio 33 Portfolio of 400,000 must be 100% invested and portfolio cannot exceed $400,000 or 100%