Answered step by step

Verified Expert Solution

Question

1 Approved Answer

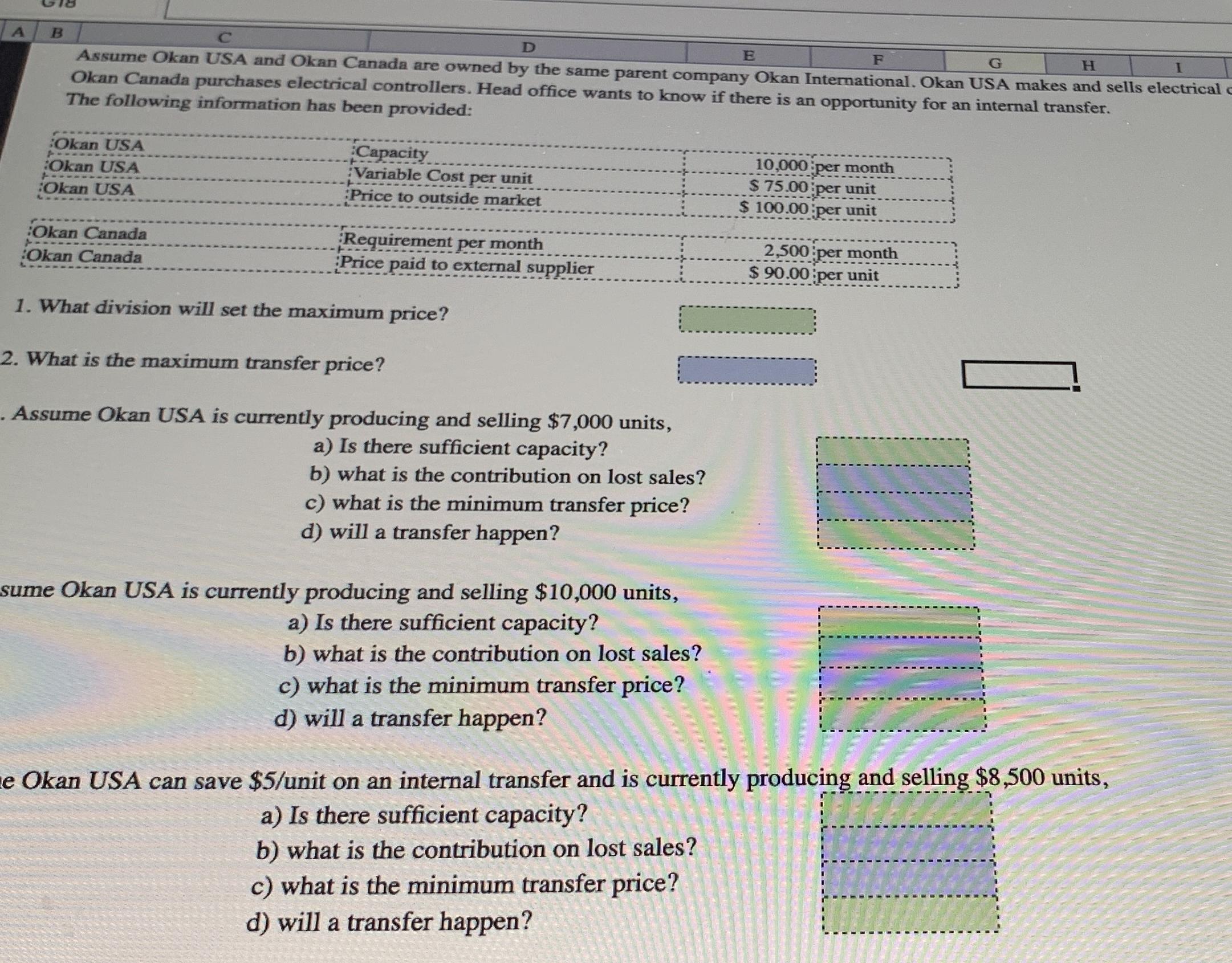

A B D E F G H Assume Okan USA and Okan Canada are owned by the same parent company Okan International. Okan USA

A B D E F G H Assume Okan USA and Okan Canada are owned by the same parent company Okan International. Okan USA makes and sells electrical Okan Canada purchases electrical controllers. Head office wants to know if there is an opportunity for an internal transfer. The following information has been provided: Okan USA Okan USA Okan USA Okan Canada Okan Canada Capacity Variable Cost p t per unit Price to outside market Requirement per month Price paid to external supplier 10,000 per month $75.00 per unit $100.00 per unit 2,500 per month $90.00 per unit 1. What division will set the maximum price? 2. What is the maximum transfer price? . Assume Okan USA is currently producing and selling $7,000 units, a) Is there sufficient capacity? b) what is the contribution on lost sales? c) what is the minimum transfer price? d) will a transfer happen? sume Okan USA is currently producing and selling $10,000 units, a) Is there sufficient capacity? b) what is the contribution on lost sales? c) what is the minimum transfer price? d) will a transfer happen? e Okan USA can save $5/unit on an internal transfer and is currently producing and selling $8,500 units, a) Is there sufficient capacity? b) what is the contribution on lost sales? c) what is the minimum transfer price? d) will a transfer happen?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started