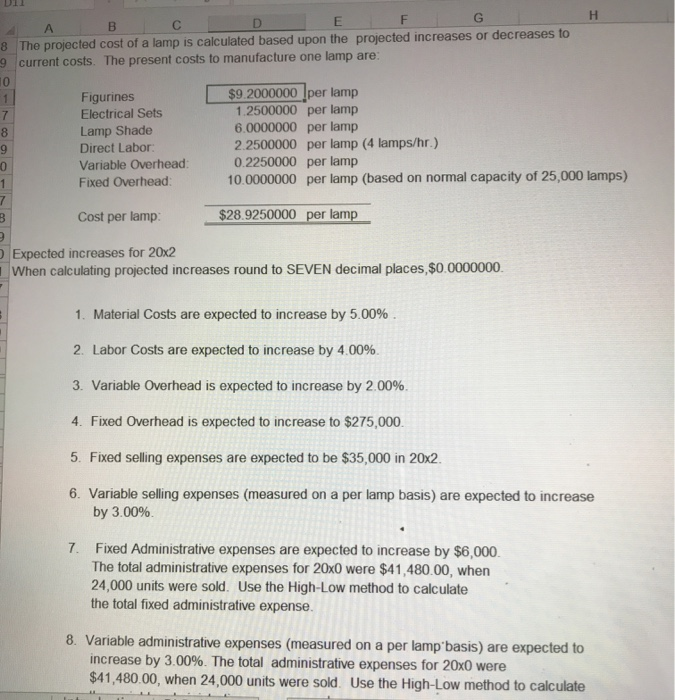

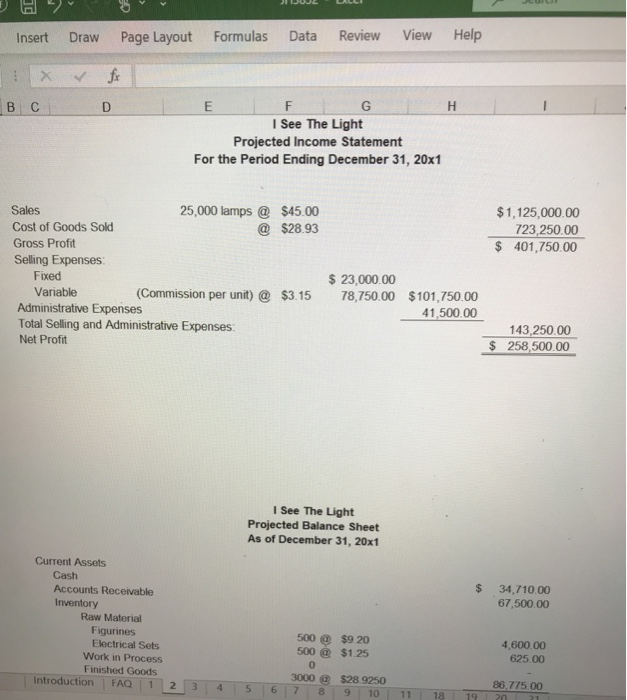

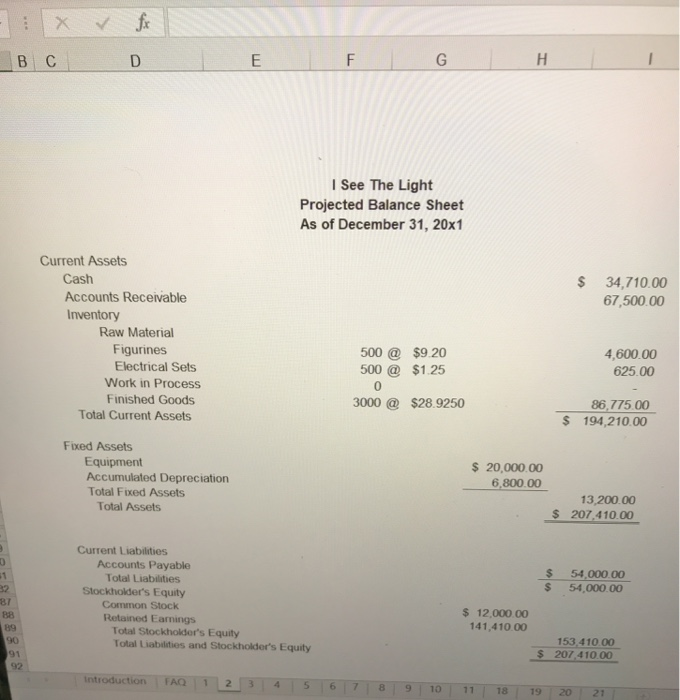

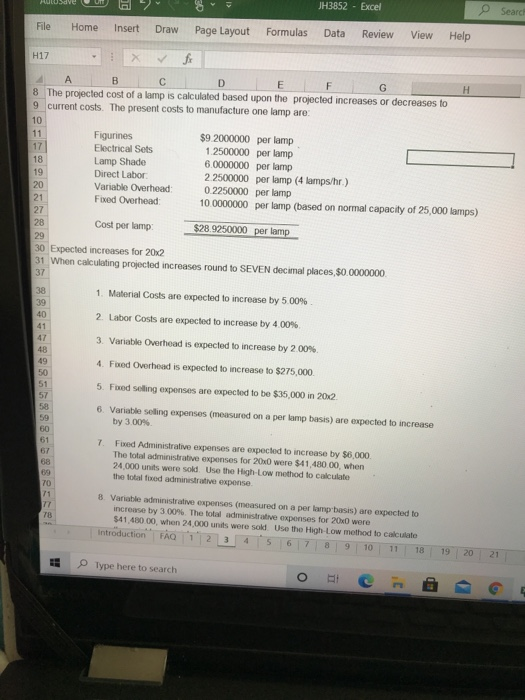

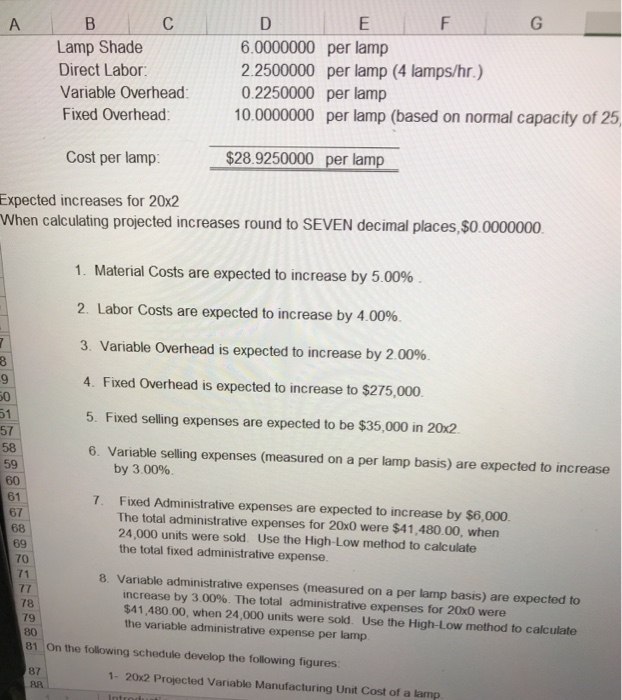

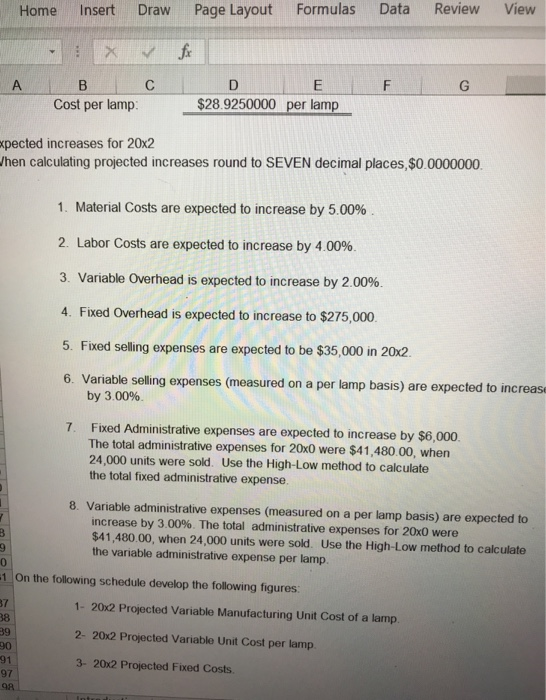

A B D E F H 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 10 1 Figurines $92000000 per lamp Electrical Sets 1.2500000 per lamp 8 Lamp Shade 6.0000000 per lamp 9 Direct Labor 2.2500000 per lamp (4 lamps/hr.) 0 Variable Overhead 0.2250000 per lamp 1 Fixed Overhead 10.0000000 per lamp (based on normal capacity of 25,000 lamps) 7 3 Cost per lamp $28.9250000 per lamp Expected increases for 20x2 When calculating projected increases round to SEVEN decimal places,$0.0000000 1. Material Costs are expected to increase by 5.00% 2. Labor Costs are expected to increase by 4.00%. 3. Variable Overhead is expected to increase by 2.00%. 4. Fixed Overhead is expected to increase to $275,000 5. Fixed selling expenses are expected to be $35,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 7. Fixed Administrative expenses are expected to increase by $6,000 The total administrative expenses for 20x0 were $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 20x0 were $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate Anave JH3852 - Excel Search & Page Layout Fle Home Insert Draw Formulas Data Review View Help 011 A D E G H 27 28 Cost per lamp $28 250000 per og 59 61 67 30 Expected increases for 2012 31 When calling proced increases round to SEVEN decimal places 500000000 37 1. Material Costs are expected to increase by 5.00% 39 40 2 Labor Costs are expected to increase by 400% 41 47 3 Vanable Overhead is expected to increase by 2.00% 41 49 4 Ford Overhead is expected to increase to $275,000 51 5 Fred Seing expenses are expected to be $35.000 in 2012 6 Variable sing expenses (measured on a perlump basis) are expected to increase by 30% 7 Food Administrative expenses are expected to increase by $6.000 The total administrative expenses for 2010 were $11.40000when 24,000 units were sold Use the High-Low method to calculate the total danse expense 70 8 Variable administrative expenses nesured on a perintas) are expected to increase by 300%. The total adesive expenses for 2010 were 541,43000, when 2,000 unts were sold Use the High Low method to calculate the write administrative expense per me ar on the following schedule develop the following figures 37 1- 2012 Procled Variable Manufacturing Unit Cost of almo 2- 2012 Projected wristle Unit Cost perform 91 3.2012 Propected Fred Costs Introduction FAQ 1 2 3 4 10 7 92 Type here to search BP Lenovo Esc 2 # 3 $ 4 % 5 6 7 Tab Q W E R T Y 10 Insert Draw Page Layout Formulas Data Review View Help X D E F G H I See The Light Projected Income Statement For the Period Ending December 31, 20x1 $1,125,000.00 723,250.00 $ 401,750.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $28.93 Gross Profit Selling Expenses Fixed Variable (Commission per unit) @ $3.15 Administrative Expenses Total Selling and Administrative Expenses Net Profit $ 23,000.00 78,750.00 $ 101,750.00 41,500.00 143,250.00 $ 258,500.00 I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Introduction FAQ 500 @ $9 20 500 @ $1.25 0 3000 @ $28 9250 8 9 10 4,600.00 625.00 2 3 5 86,775 00 20 11 18 19 x & fi D E F G H I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets 500 @ $9.20 500 @ $1.25 0 3000 @ $28.9250 4,600.00 625.00 86,775.00 $ 194,210.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 13,200.00 $ 207.410.00 0 31 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 87 BB $ 12,000.00 141.410.00 89 90 91 92 153.410.00 $ 207 410.00 Introduction FAO 4 5 6 7 8 10 11 18 19 20 21 JH3852 - Excel e Search File Home Insert Draw Page Layout Formulas Data Review View Help H17 fr A B D E F G H 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 10 11 Figurines $92000000 per lamp 17 Electrical Sets 12500000 per lamp 18 Lamp Shade 6 0000000 per lamp 19 Direct Labor 2 2500000 per lamp (4 lamps/hr) 20 Variable Overhead 0 2250000 per lamp 21 Fixed Overhead 10 0000000 per lamp (based on normal capacity of 25,000 lamps) 27 28 Cost per lamp $28.9250000 per lamp 29 30 Expected increases for 2012 31 When calculating projected increases round to SEVEN decimal places $0.0000000 37 1. Material Costs are expected to increase by 5.00% 38 39 40 41 47 48 49 50 51 57 2. Labor Costs are expected to increase by 4.00% 3. Variable Overhead is expected to increase by 2.00% 4. Foxed Overhead is expected to increase to $275,000 5. Fixed selling expenses are expected to be $35,000 in 2012. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 59 60 61 68 70 71 7 Fred Administrative expenses are expected to increase by $6,000 The total administrative expenses for 200 were $41,480 00, when 24.000 units were sold Use the High-Low method to calculate the total food administrative expense 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 300%. The total administrative expenses for 200 were $41.480 00, when 24.000 units were sold Use the High-Low method to calculate Introduction 5 2 9 10 11 18 78 FAO 19 20 21 Type here to search o B Lamp Shade Direct Labor Variable Overhead: Fixed Overhead: D E F G 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25 Cost per lamp $28.9250000 per lamp Expected increases for 20x2 When calculating projected increases round to SEVEN decimal places $0.0000000 1. Material Costs are expected to increase by 5.00% 2. Labor Costs are expected to increase by 4.00%. 3. Variable Overhead is expected to increase by 2.00% 8 9 4. Fixed Overhead is expected to increase to $275,000 50 51 5. Fixed selling expenses are expected to be $35,000 in 20x2 57 58 6. Variable selling expenses (measured on a per lamp basis) are expected to increase 59 by 3.00% 60 61 7. Fixed Administrative expenses are expected to increase by $6,000. 67 The total administrative expenses for 20x0 were $41,480.00, when 68 24,000 units were sold. Use the High-Low method to calculate 69 the total fixed administrative expense. 70 71 8. Variable administrative expenses (measured on a per lamp basis) are expected to 77 increase by 3.00%. The total administrative expenses for 20x0 were 78 $41.480.00, when 24,000 units were sold. Use the High-Low method to calculate 79 the variable administrative expense per lamp 80 81 On the following schedule develop the following figures: 87 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp 88 Introde Home Insert Draw Page Layout Formulas Data Review View A F G B Cost per lamp D E $28.9250000 per lamp expected increases for 20x2 Jhen calculating projected increases round to SEVEN decimal places $0.0000000 1. Material Costs are expected to increase by 5.00% 2. Labor Costs are expected to increase by 4.00%. 3. Variable Overhead is expected to increase by 2.00% 4. Fixed Overhead is expected to increase to $275,000 5. Fixed selling expenses are expected to be $35,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 7 Fixed Administrative expenses are expected to increase by $6,000 The total administrative expenses for 20x0 were $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 20x0 were 8 $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp 0 1 On the following schedule develop the following figures 37 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 38 39 2- 20x2 Projected Variable Unit Cost per lamp 90 91 3- 20x2 Projected Fixed Costs. 97 98 A B D E F H 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 10 1 Figurines $92000000 per lamp Electrical Sets 1.2500000 per lamp 8 Lamp Shade 6.0000000 per lamp 9 Direct Labor 2.2500000 per lamp (4 lamps/hr.) 0 Variable Overhead 0.2250000 per lamp 1 Fixed Overhead 10.0000000 per lamp (based on normal capacity of 25,000 lamps) 7 3 Cost per lamp $28.9250000 per lamp Expected increases for 20x2 When calculating projected increases round to SEVEN decimal places,$0.0000000 1. Material Costs are expected to increase by 5.00% 2. Labor Costs are expected to increase by 4.00%. 3. Variable Overhead is expected to increase by 2.00%. 4. Fixed Overhead is expected to increase to $275,000 5. Fixed selling expenses are expected to be $35,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 7. Fixed Administrative expenses are expected to increase by $6,000 The total administrative expenses for 20x0 were $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 20x0 were $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate Anave JH3852 - Excel Search & Page Layout Fle Home Insert Draw Formulas Data Review View Help 011 A D E G H 27 28 Cost per lamp $28 250000 per og 59 61 67 30 Expected increases for 2012 31 When calling proced increases round to SEVEN decimal places 500000000 37 1. Material Costs are expected to increase by 5.00% 39 40 2 Labor Costs are expected to increase by 400% 41 47 3 Vanable Overhead is expected to increase by 2.00% 41 49 4 Ford Overhead is expected to increase to $275,000 51 5 Fred Seing expenses are expected to be $35.000 in 2012 6 Variable sing expenses (measured on a perlump basis) are expected to increase by 30% 7 Food Administrative expenses are expected to increase by $6.000 The total administrative expenses for 2010 were $11.40000when 24,000 units were sold Use the High-Low method to calculate the total danse expense 70 8 Variable administrative expenses nesured on a perintas) are expected to increase by 300%. The total adesive expenses for 2010 were 541,43000, when 2,000 unts were sold Use the High Low method to calculate the write administrative expense per me ar on the following schedule develop the following figures 37 1- 2012 Procled Variable Manufacturing Unit Cost of almo 2- 2012 Projected wristle Unit Cost perform 91 3.2012 Propected Fred Costs Introduction FAQ 1 2 3 4 10 7 92 Type here to search BP Lenovo Esc 2 # 3 $ 4 % 5 6 7 Tab Q W E R T Y 10 Insert Draw Page Layout Formulas Data Review View Help X D E F G H I See The Light Projected Income Statement For the Period Ending December 31, 20x1 $1,125,000.00 723,250.00 $ 401,750.00 Sales 25,000 lamps @ $45.00 Cost of Goods Sold @ $28.93 Gross Profit Selling Expenses Fixed Variable (Commission per unit) @ $3.15 Administrative Expenses Total Selling and Administrative Expenses Net Profit $ 23,000.00 78,750.00 $ 101,750.00 41,500.00 143,250.00 $ 258,500.00 I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Introduction FAQ 500 @ $9 20 500 @ $1.25 0 3000 @ $28 9250 8 9 10 4,600.00 625.00 2 3 5 86,775 00 20 11 18 19 x & fi D E F G H I See The Light Projected Balance Sheet As of December 31, 20x1 $ 34,710.00 67,500.00 Current Assets Cash Accounts Receivable Inventory Raw Material Figurines Electrical Sets Work in Process Finished Goods Total Current Assets 500 @ $9.20 500 @ $1.25 0 3000 @ $28.9250 4,600.00 625.00 86,775.00 $ 194,210.00 Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets $ 20,000.00 6,800.00 13,200.00 $ 207.410.00 0 31 $ $ 54,000.00 54,000.00 Current Liabilities Accounts Payable Total Liabilities Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 87 BB $ 12,000.00 141.410.00 89 90 91 92 153.410.00 $ 207 410.00 Introduction FAO 4 5 6 7 8 10 11 18 19 20 21 JH3852 - Excel e Search File Home Insert Draw Page Layout Formulas Data Review View Help H17 fr A B D E F G H 8 The projected cost of a lamp is calculated based upon the projected increases or decreases to 9 current costs. The present costs to manufacture one lamp are: 10 11 Figurines $92000000 per lamp 17 Electrical Sets 12500000 per lamp 18 Lamp Shade 6 0000000 per lamp 19 Direct Labor 2 2500000 per lamp (4 lamps/hr) 20 Variable Overhead 0 2250000 per lamp 21 Fixed Overhead 10 0000000 per lamp (based on normal capacity of 25,000 lamps) 27 28 Cost per lamp $28.9250000 per lamp 29 30 Expected increases for 2012 31 When calculating projected increases round to SEVEN decimal places $0.0000000 37 1. Material Costs are expected to increase by 5.00% 38 39 40 41 47 48 49 50 51 57 2. Labor Costs are expected to increase by 4.00% 3. Variable Overhead is expected to increase by 2.00% 4. Foxed Overhead is expected to increase to $275,000 5. Fixed selling expenses are expected to be $35,000 in 2012. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 59 60 61 68 70 71 7 Fred Administrative expenses are expected to increase by $6,000 The total administrative expenses for 200 were $41,480 00, when 24.000 units were sold Use the High-Low method to calculate the total food administrative expense 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 300%. The total administrative expenses for 200 were $41.480 00, when 24.000 units were sold Use the High-Low method to calculate Introduction 5 2 9 10 11 18 78 FAO 19 20 21 Type here to search o B Lamp Shade Direct Labor Variable Overhead: Fixed Overhead: D E F G 6.0000000 per lamp 2.2500000 per lamp (4 lamps/hr.) 0.2250000 per lamp 10.0000000 per lamp (based on normal capacity of 25 Cost per lamp $28.9250000 per lamp Expected increases for 20x2 When calculating projected increases round to SEVEN decimal places $0.0000000 1. Material Costs are expected to increase by 5.00% 2. Labor Costs are expected to increase by 4.00%. 3. Variable Overhead is expected to increase by 2.00% 8 9 4. Fixed Overhead is expected to increase to $275,000 50 51 5. Fixed selling expenses are expected to be $35,000 in 20x2 57 58 6. Variable selling expenses (measured on a per lamp basis) are expected to increase 59 by 3.00% 60 61 7. Fixed Administrative expenses are expected to increase by $6,000. 67 The total administrative expenses for 20x0 were $41,480.00, when 68 24,000 units were sold. Use the High-Low method to calculate 69 the total fixed administrative expense. 70 71 8. Variable administrative expenses (measured on a per lamp basis) are expected to 77 increase by 3.00%. The total administrative expenses for 20x0 were 78 $41.480.00, when 24,000 units were sold. Use the High-Low method to calculate 79 the variable administrative expense per lamp 80 81 On the following schedule develop the following figures: 87 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp 88 Introde Home Insert Draw Page Layout Formulas Data Review View A F G B Cost per lamp D E $28.9250000 per lamp expected increases for 20x2 Jhen calculating projected increases round to SEVEN decimal places $0.0000000 1. Material Costs are expected to increase by 5.00% 2. Labor Costs are expected to increase by 4.00%. 3. Variable Overhead is expected to increase by 2.00% 4. Fixed Overhead is expected to increase to $275,000 5. Fixed selling expenses are expected to be $35,000 in 20x2. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.00% 7 Fixed Administrative expenses are expected to increase by $6,000 The total administrative expenses for 20x0 were $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate the total fixed administrative expense. 8. Variable administrative expenses (measured on a per lamp basis) are expected to increase by 3.00%. The total administrative expenses for 20x0 were 8 $41,480.00, when 24,000 units were sold. Use the High-Low method to calculate the variable administrative expense per lamp 0 1 On the following schedule develop the following figures 37 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 38 39 2- 20x2 Projected Variable Unit Cost per lamp 90 91 3- 20x2 Projected Fixed Costs. 97 98