Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A B Find the net present value (NPV) for the following series of future cash flows, assuming the companys cost of capital is 8.68 percent.

A

B

Find the net present value (NPV) for the following series of future cash flows, assuming the companys cost of capital is 8.68 percent. The initial outlay is $366,084.

Year 1: 123,123

Year 2: 127,679

Year 3: 124,965

Year 4: 136,808

Year 5: 143,320

Round the answer to two decimal places.

Your Answer:

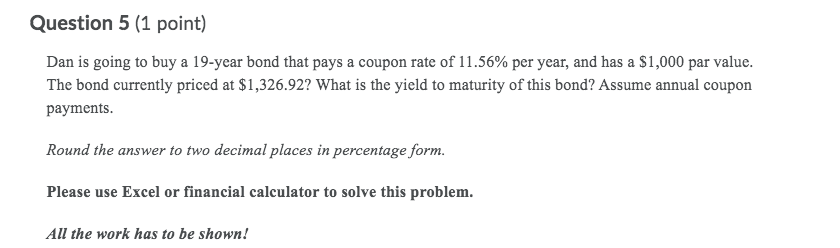

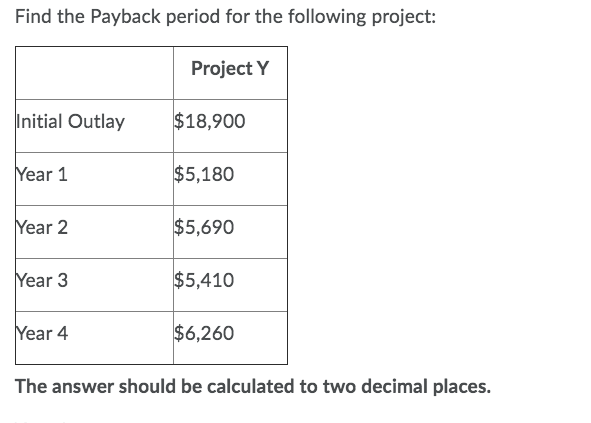

Question 5 (1 point) Dan is going to buy a 19-year bond that pays a coupon rate of 11.56% per year, and has a $1,000 par value. The bond currently priced at $1,326.92? What is the yield to maturity of this bond? Assume annual coupon payments. Round the answer to two decimal places in percentage form. Please use Excel or financial calculator to solve this problem. All the work has to be shown! Find the Payback period for the following project: Project Y Initial Outlay $18,900 Year 1 $5,180 Year 2 $5,690 Year 3 $5,410 Year 4 $6,260 The answer should be calculated to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started