Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) (b) In a liberalised economy, market forces of demand and supply dictate the interest rates and exchange rates in the market. With reference

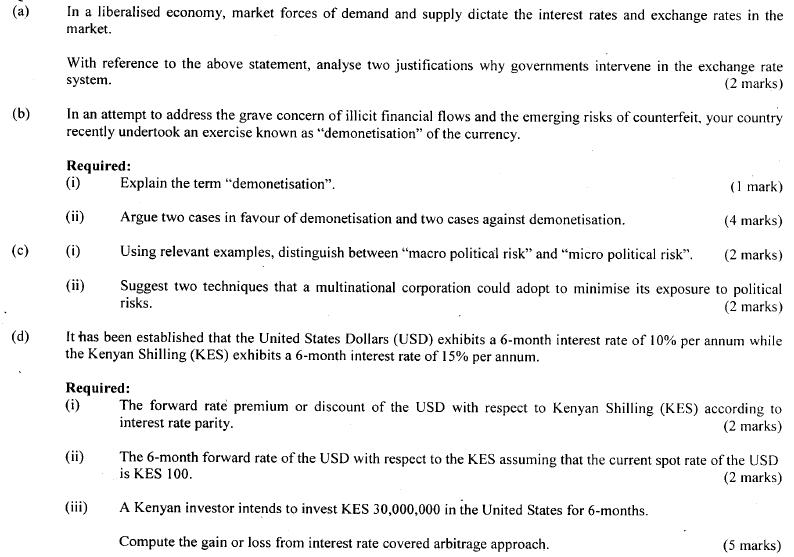

(a) (b) In a liberalised economy, market forces of demand and supply dictate the interest rates and exchange rates in the market. With reference to the above statement, analyse two justifications why governments intervene in the exchange rate system. (2 marks) In an attempt to address the grave concern of illicit financial flows and the emerging risks of counterfeit, your country recently undertook an exercise known as "demonetisation" of the currency. Required: (i) Explain the term "demonetisation". (1 mark) (ii) Argue two cases in favour of demonetisation and two cases against demonetisation. (4 marks) (c) (i) Using relevant examples, distinguish between "macro political risk" and "micro political risk". (2 marks) (ii) (d) risks. Suggest two techniques that a multinational corporation could adopt to minimise its exposure to political (2 marks) It has been established that the United States Dollars (USD) exhibits a 6-month interest rate of 10% per annum while the Kenyan Shilling (KES) exhibits a 6-month interest rate of 15% per annum. Required: (i) The forward rate premium or discount of the USD with respect to Kenyan Shilling (KES) according to interest rate parity. (2 marks) (ii) The 6-month forward rate of the USD with respect to the KES assuming that the current spot rate of the USD is KES 100. (2 marks) (iii) A Kenyan investor intends to invest KES 30,000,000 in the United States for 6-months. Compute the gain or loss from interest rate covered arbitrage approach. (5 marks)

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each part of the question 2 Justifications for government intervention in the exchange rate system despite market forces dictating rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started