Answered step by step

Verified Expert Solution

Question

1 Approved Answer

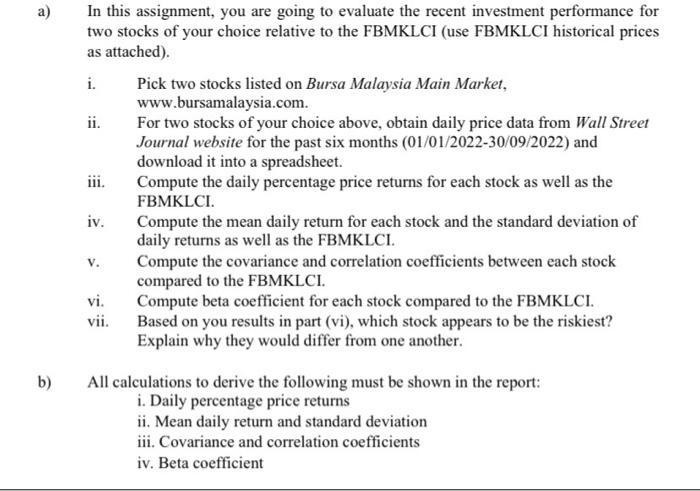

a) b) In this assignment, you are going to evaluate the recent investment performance for two stocks of your choice relative to the FBMKLCI

a) b) In this assignment, you are going to evaluate the recent investment performance for two stocks of your choice relative to the FBMKLCI (use FBMKLCI historical prices as attached). i. ii. iii. iv. V. vi. vii. Pick two stocks listed on Bursa Malaysia Main Market, www.bursamalaysia.com. For two stocks of your choice above, obtain daily price data from Wall Street Journal website for the past six months (01/01/2022-30/09/2022) and download it into a spreadsheet. Compute the daily percentage price returns for each stock as well as the FBMKLCI. Compute the mean daily return for each stock and the standard deviation of daily returns as well as the FBMKLCI. Compute the covariance and correlation coefficients between each stock compared to the FBMKLCI. Compute beta coefficient for each stock compared to the FBMKLCI. Based on you results in part (vi), which stock appears to be the riskiest? Explain why they would differ from one another. All calculations to derive the following must be shown in the report: i. Daily percentage price returns ii. Mean daily return and standard deviation iii. Covariance and correlation coefficients iv. Beta coefficient

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Long term assets Life insurance companies invest mainly their pooled funds in long term asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started