Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) (b) Primark Corporation (PC here after) operates in retailing industry, a summary of its financial information on 31st Dec 2020 is in the

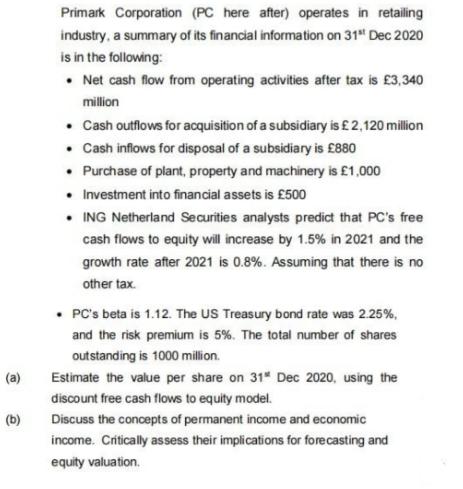

(a) (b) Primark Corporation (PC here after) operates in retailing industry, a summary of its financial information on 31st Dec 2020 is in the following: Net cash flow from operating activities after tax is 3,340 million Cash outflows for acquisition of a subsidiary is 2,120 million Cash inflows for disposal of a subsidiary is 880 Purchase of plant, property and machinery is 1,000 Investment into financial assets is 500 . ING Netherland Securities analysts predict that PC's free cash flows to equity will increase by 1.5% in 2021 and the growth rate after 2021 is 0.8%. Assuming that there is no other tax. PC's beta is 1.12. The US Treasury bond rate was 2.25%, and the risk premium is 5%. The total number of shares outstanding is 1000 million. Estimate the value per share on 31 Dec 2020, using the discount free cash flows to equity model. Discuss the concepts of permanent income and economic income. Critically assess their implications for forecasting and equity valuation.

Step by Step Solution

★★★★★

3.58 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

a To estimate the value per share on 31 Dec 2020 using the discount free cash flows to equity model we need to calculate the free cash flows to equity FCFE for each year and discount them to the prese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started