Question

A. B. Rayton Ltd. is planning to purchase a new machine to replace the old one in the firm's processing plant. It is estimates

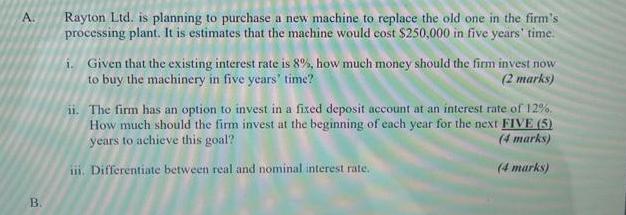

A. B. Rayton Ltd. is planning to purchase a new machine to replace the old one in the firm's processing plant. It is estimates that the machine would cost $250,000 in five years' time. i. Given that the existing interest rate is 8%, how much money should the firm invest now to buy the machinery in five years' time? (2 marks) ii. The firm has an option to invest in a fixed deposit account at an interest rate of 12%. How much should the firm invest at the beginning of each year for the next FIVE (5) years to achieve this goal? (4 marks) iii. Differentiate between real and nominal interest rate. (4 marks)

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

i Calculate the present value of the machines cost in five years time PV FV 1 rn Where PV is the pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F. Brigham, Phillip R. Daves

11th edition

978-1111530266

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App