A)

B)

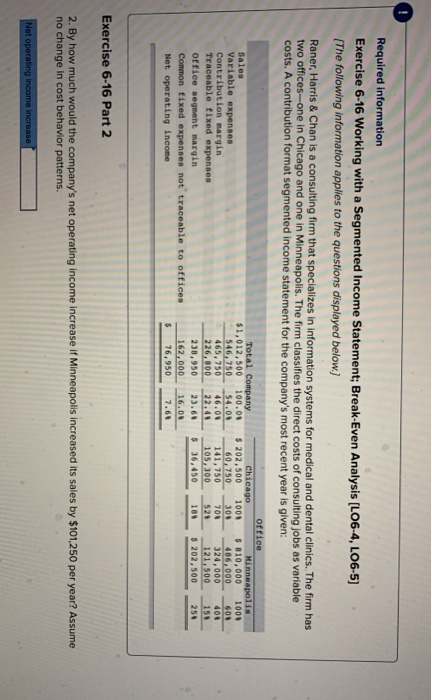

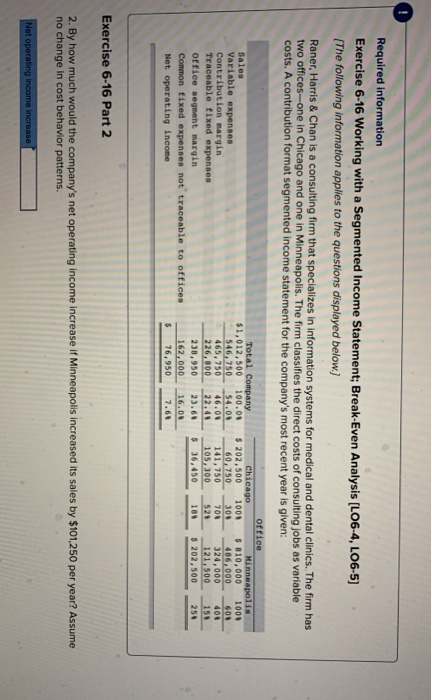

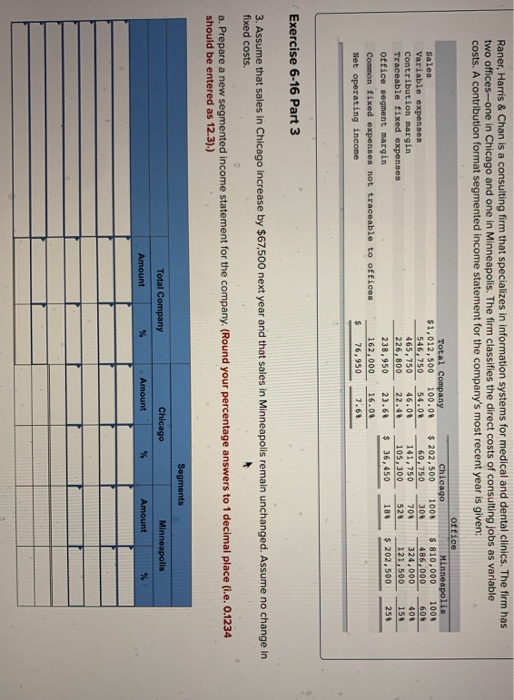

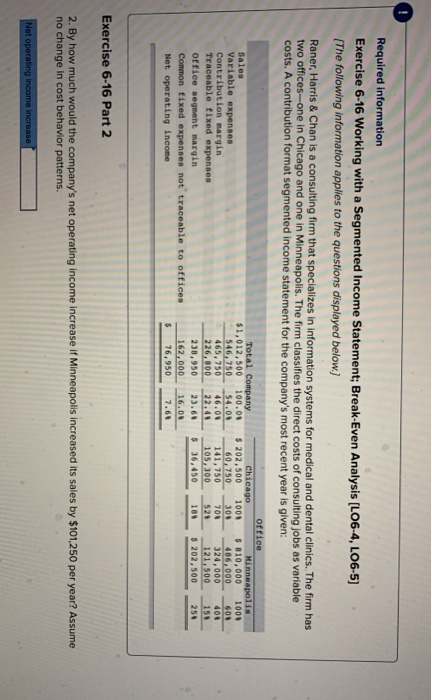

Required information Exercise 6-16 Working with a Segmented Income Statement; Break-Even Analysis (L06-4, LO6-5) [The following information applies to the questions displayed below.) Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses office segment margin Common fixed expenses not traceable to offices Net operating income 601 Total Company $1,012,500 100.00 546,750 54.00 465,750 46.00 226,800 22.45 238,950 23.61 162,000 16.00 $ 76,950 7.60 office Chicago Minneapolis $ 202,500 1000 $ 810,000 1001 60.750 300 486,000 141,750 700 324,000 408 105,300 520 121,500 150 $ 36,450 188 $ 202,500 250 Exercise 6-16 Part 2 2. By how much would the company's net operating income increase if Minneapolis increased its sales by $101,250 per year? Assume no change in cost behavior patterns. Net operating income increase Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices--one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $1,012,500 100.08 546, 750 54.00 465,750 46.00 226,800 22.40 238,950 23.60 162,000 16.00 $ 76,950 7.60 office Chicago Minneapolis $ 202,500 1000 $ 810,000 1008 60, 750 300 486,000 608 141,750 700 324,000 408 105,300 528 121,500 150 $ 36,450 184 $ 202,500 258 Exercise 6-16 Part 3 3. Assume that sales in Chicago increase by $67,500 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs. a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (i.e. 0.1234 should be entered as 12.3).) Segments Minneapolis Total Company Amount % Chicago Amount Amount